Challenges in Analyzing PIMCO Total Return

Post on: 5 Апрель, 2015 No Comment

February 5, 2014 1 Comment

Is a given hedge fund manager generating alpha? Can that alpha be captured through more liquid alternative vehicles? How can an investor truly reveal a portfolio’s net factor exposures when traditional assets are often being intermingled with credit default swaps, options, futures and leverage? These questions continue to stymie investors – even though answers may be available right under their noses. MPI’s patented “Dynamic Style Analysis” (DSA) model has revolutionized the foundations first laid by Nobel laureate Bill Sharpe, moving beyond his groundbreaking returns-based style analysis (RBSA) to reveal exposures in complex funds that are not well explained by traditional RBSA. Just as RBSA was created to fill in the gaps that result from holdings-based analysis, DSA now serves to provide additional transparency beyond RBSA in a world of increasingly complex investment vehicles.

Extracting exposures in liquid alternatives may seem complex, but our clients have used MPI’s DSA technology for the past decade to provide transparency and risk analysis while meeting compliance standards and staying true to their investment policies.

These clients know that complex problems require powerful tools, and together we have worked to address the issues that will come to an investor’s door time and time again. Using DSA technology, investors gain transparency despite the presence of derivatives and other fund positions providing only point-in-time or lagged information; navigate investment flexibility where multi-manager offerings create unintended netting and style overlap; remain in compliance with investment policies while seeking to increase allocation to products that do not offer position-level transparency; and design and rebalance portfolios to achieve optimal blends of assets that run the full spectrum of liquidity.

DSA moves beyond the ability to provide net exposures created by portfolios that combine traditional and complex alternative assets. The results of DSA analysis may be used in forward-looking simulations and assessing how funds may behave in different market scenarios. Likewise, DSA may reveal how a manager reacted to previous market events. Lastly, DSA can even provide transparency on funds with very short performance histories.

The Case of PIMCO Total Return

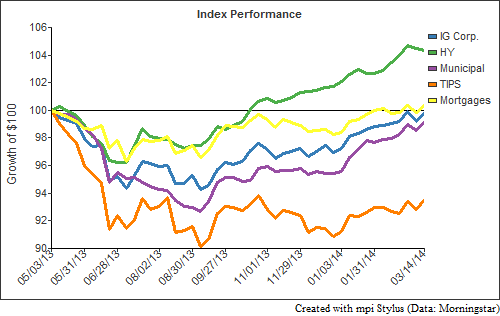

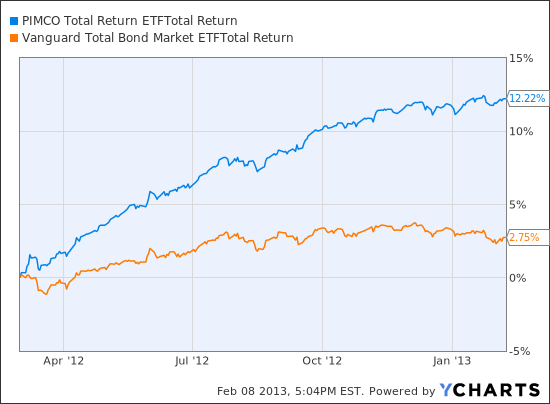

To demonstrate the benefits of our model with liquid alternatives, we analyzed the PIMCO Total Return fund using a set of broad Merrill Lynch fixed income indices (Exhibit 1). In this chart, you can see the resulting exposures at any point in time by looking at each vertical slice, while the short cash position shows the fund’s implied leverage. We were able to deduce that these factors accurately mimic the portfolios returns over the selected time horizon (Exhibit 2). This is shown below with the green line representing PIMCO TR and the yellow line representing the return of the style portfolio of exposures shown on the graph in Exhibit 1. Also shown in Exhibit 2 is the R2 of 96.82 and our proprietary Predicted R2 validation statistic which was 95.12 indicating a very good fit.

Exhibit 1

Exhibit 2

Out of Sample Test

Our next test was to test the predictive ability of our factor exposures by running an out-of-sample test. To do this, we took the factor exposures from the end of March 2013 and using a simple buy-and-hold strategy attempted to project the fund’s return (Exhibit 3). Our model was able to predict a good portion of the magnitude and direction of the funds movement during this volatile period of “Taper Talk” and shows how our factor exposures can be used for risk management

Exhibit 3

Common Style

A report at the beginning of the year in Bloomberg revealed that most PIMCO funds invest based on a uniform firm outlook on everything from the global economy to interest rates, but can be altered following economic data releases or new statements from the Federal Reserve. Our proprietary “Common Style” analysis below, which provides the degree of overlap in returns-based exposures between multiple investment vehicles, confirms these common bets. This type of analysis across fixed income managers, whether from a single fund family or from multiple providers, provides investors with essential information on diversification within a portfolio or lineup (Exhibit 4).

As investors are increasingly eyeing liquid alternatives, they need to use the same techniques that sophisticated investors use to analyze hedge funds. MPI’s Dynamic Style Analysis can effectively provide them with answers to their questions. Investors can better assess the way in which managers created their net exposures, receive adequate transparency into these vehicles, employ sound risk management procedures, ensure compliance with investment guidelines and finally, achieve optimal portfolio rebalancing from both an asset class and liquidity perspective.

Furthermore, investors also need to look at a firm’s macro views when allocating within a fund family or constructing portfolios from multiple management companies to further avoid potential risks. In testing our approach on PIMCO, it became evident that a number of their funds had common exposures, including highly similar ones to the same fixed-income factors. Specifically, the highest overlaps were between PIMCO All Asset All Authority and PIMCO High Yield and between PIMCO Total Return and the PIMCO Low Duration.