Capturing Oil Volatility With Commodity Options and USO

Post on: 17 Апрель, 2015 No Comment

Find out how to capture oil volatility with commodity options and USO

2 Trades to Profit From the Oil Volatility Explosion

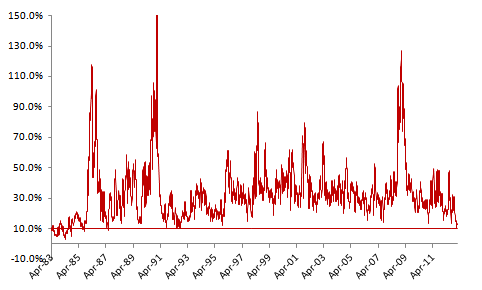

Crude oil has been declining sharply since early May, and is now re than 20% off its recent high. As you might expect, implied volatility in options on crude has exploded higher. Out-of-the-money puts expiring in June are trading with implied volatilities of 45% and higher, and the CBOE Crude Oil Volatility Index (OVX ) the Oil VIX was quoted Tuesday at 48.12.

While not quite as unusual as the volatility currently priced into equity options, these are still very high readings. OVX, for example, has not closed above 48 since July 2009.

Options traders will instinctively look for ways to sell this elevated implied volatility. While capturing historically high implied volatility is often a profitable approach, a price trend this strong should be respected, so any short volatility trade should either be long some gamma or should have a delta bias sufficient to tolerate additional downside momentum. The following complex position using Light Crude Oil (NYMEX: CL) has both of those features:

+1 CL June 71 Put

+1 CL June 67 Put

-2 CL June 62.5 Puts

-2 CL June 58 Puts

For a net debit of about $3.80

With June CL futures trading at $68.42, this position is short 412 delta, short 4 gamma, long 44 theta and short 25 vega. It will lose $3,870 if the futures contract is at $71 or above at expiration. Below $71 to about $53, the position will be profitable, with maximal profits of $9,100 attainable between $58 and $62.50 at expiration.

The greatest risk in this position is not of a trend reversal, however, because of the extra short puts, the position is exposed to both price and volatility risk in the event that oil falls quickly into the low $50s. In other words, a true collapse in the price of oil would entail nearly unlimited downside exposure.

Fortunately, the long at-the-money calls provide some initial negative delta that will give us ample opportunity to manage the position. If the price declines another 5%-10%, the short deltas will generate profits for this position, and depending on how strong the trend appears, traders can decide whether to close the trade at that time.

An ideal scenario would be one in which the price of oil continues to fall, but at a slowing pace. A gentler decline would reduce the implied volatility (and, thus, the value) of the short out-of-the-money puts, while still accruing profits to the long options.

Traders who are apprehensive about a sudden reversal to the upside could purchase some out-of-the-money calls as insurance. The CL June 74 Calls recently traded for 93 cents, and at that price would protect the position from losses, provided any price reversal occurred quickly.

Adding the long call reduces our delta exposure to -176, changes the size of the gamma to 38, flattens the position theta, and leaves us long 28 vega. The chart below displays the risk profile for this position, including both the put ratio trade and the long call hedge.

Source: thinkorswim

Those long calls will decay in value, too, so it is wise not to sit on the position for too long. Because this trade expires in June, if the position has not moved favorably within a week or so, it may be advisable to exit early instead of letting time decay eat away the value of the long legs of the position.

United States Oil Fund LP (NYSE: USO ), the most actively traded oil ETF, is at times inferior to simply trading options on crude oil futures directly. since contango (when the futures price is above the expected future spot price.) effects and other fund properties raise the possibility of tracking error. But for anyone without a futures account, a similar trade would be:

+1 USO June 33 Put

+1 USO June 31 Put

-2 USO June 29 Puts

-2 USO June 27 Puts

For a net debit of $1.84

Long calls struck at 34 or 35 would provide a suitable upside hedge. And the risk management considerations noted above apply here, too.

When implied volatility rises to recent or historical highs, the most tempting approach might be to adopt a directionally neutral, short volatility position. Traders who are willing and able to aggressively delta-hedge such positions can do well, but an alternative approach is to structure options trades in the direction of the existing trend to help reduce risk and improve the probability that the trade will succeed.

The Secret to Money-Doubling Trades They Dont Want You to Know

Professional traders Nick Atkeson and Andrew Houghton reveal their proven, time-tested strategy to finding money-doubling trades in a new report. Its the trading secret so effective they were banned from sharing it with you. Download your FREE copy here.