Candlestick Secrets

Post on: 16 Апрель, 2015 No Comment

Stock, Futures, and Option Traders.

Introducing an Amazing New Course

That Teaches You How to Master the Art of Candlestick Charting ( in The Shortest Possible Time ) and Allows You To Make Bigger Trading Profits. With a Greater Degree of Accuracy and Less Risk!

Let me explain,

Over 9 months ago, I set out to write and create the most comprehensive manual and learning program for mastering the art of Candlestick Charting on the market, but I soon realized that this was going to be a monumental task.

So much so, that I wound up hiring an expert to help write the book with me. I found a real pro, who’s himself an expert in the art of Candlestick Charting.

He’s the ‘real deal’ and has studied Candlesticks for years (in the land where they were invented — Japan).

And the resulting product is been nothing less than extra-ordinary!

But before I tell you about the package, I’d like to tell you a story about an.

Amazing Discovery By a 17th Century

Japanese Rice Farmer From Sakata

That Will Revolutionize How World Markets

Are Traded Forever, and Will Make Financial

Fortunes For Those Lucky Enough

To Be Privy To His Secrets.

T here is a Japanese saying “consult the market about the market” which means that when observing the market, we should pay close attention to the market movement itself, rather than observing the international affairs and economic policies that may or may not affect the market.

More than 200 years ago, the Japanese were using a unique style of technical analysis in the rice market that evolved into the candlestick technique currently used in Japan and elsewhere.

If you’ve been trading for any length of time (or even if you’re a newbie) you’re probably somewhat familiar with Candlestick charting.

But you may not know just how effective it really is!

With it’s origins stemming from the rice markets in Japan several hundred years ago, Candlecharting has been used for centuries in Japan for making huge profits in the rice futures markets.

In fact, Candlecharting or ‘Candlestick charting’ was developed by an unknown (but brilliant) rice farmer named Munehisa Honma around the year 1750.

Although he was the youngest son at a time when Japanese tradition favored succession by the eldest son, he inherited his family’s business on the merit of his extraordinary trading skills.

Using candlestick charts, he was able to predict price moves to the degree that he conducted his trades directly from his home which was a previously unheard of practice in Japan.

He managed this by paying men to convey his selling or buying instructions by waving a series of flags from the tops of buildings all the way from Sakata to Osaka!

And He Soon Became One of The

Wealthiest Rice Farmers in All of Japan!

H onma’s achievements were due in part to the fact that he applied candlestick charting in an innovative, new way.

He discovered that although there was a link between price and the supply and demand of rice, the markets were strongly influenced by the emotions of the traders.

Just as today, he then understood that when emotions played into the equation, a vast difference between the value and the price of rice occurred. His findings later became known as the Sakata Rules.

These principles are the basis for the candlestick chart analysis which is used to measure market emotions towards a stock. This difference between value and price is as applicable to stocks today as it was to rice in Japan centuries ago.

And while it’s been only relatively recently (over the last decade) that Candlesticks have become popular among Western traders, they have taken over by storm!

The simple fact is that they work.

Candlestick patterns are extremely effective when interpreted properly, and some patterns are up to a 90% accurate in predicting which way a stock is going.

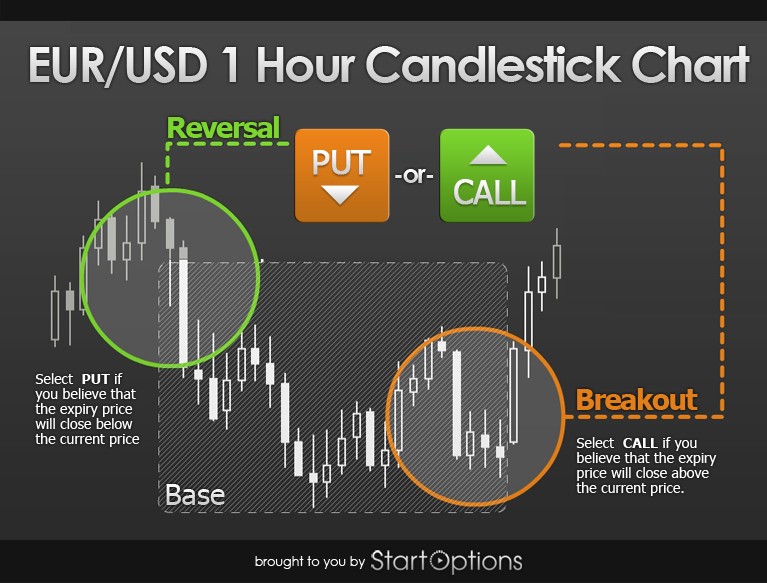

However, there are many different Candlestick patterns, both for predicting Bullish and Bearish moves, continuations, and reversals.

The trick is to know the difference.

Here’s How You Can Discover the Amazing

Secrets of Japanese Candle-Charting.

B ut best of all.

I’ve hired a professional writer and researcher to create this amazing ebook and online learning package that teaches you everything there is to know about Candlestick charting.

Even then, it’s was a monster job getting the whole thing edited, reviewed, charts created, flash cards made, and even an interactive web based ‘library’ of candlestick patterns and descriptions produced for you to learn and review online.

And the bottom line is. this is simply the best Candlesticks learning system available anywhere!

It’s by far the fastest way to learn all the important and effective Candlestick patterns that you’ve always wanted to learn, from the comfort of your own home!

Plus, you’ll be able to use these new skills and strategies immediately in your trading, for boosting your profits and minimizing your risks.

It’s no secret that mountains of professionals rely primarily on Candlesticks as their preferred charting method.

Candlestick charting is considered by experts to be much more effective than traditional ‘Western’ bar charts, both for gauging the ‘emotion’ of the markets and also for predicting future price action, based on proven high probability patterns.

Using Candlesticks in YOUR Trading Can

Help You Identify These High Probability Opportunities

But Only if You Know

Which Patterns to Look For !

B ack to the purpose of this letter.

As I mentioned above, I searched for and found a real ‘expert’ in Candlestick charting.

At first he wasn’t remotely interested in creating a book based on his secrets, but after some heavy-duty arm twisting (and offering him thousands of dollars), I finally was able to persuade him to write an all-encompassing reference manual on candlestick charting.

And all I have to say is. It’s awesome!

It’s 82 pages of real nuts-and-bolts information about Candlestick charting and really understand and interpret the many different Candlecharting patterns, both Bearish and Bullish.

The reference manual and ebook is filled with over 100 different diagrams and charts of unique candle patterns, how they should be interpreted, and when!

Here are some of the topics that are covered in the book:

Candlestick charting history. Discover the ancient origins of this incredible technique, and how it was originally used to trade the rice markets. (P.6)

The significance of Candlestick charting and why it is popular among traders today. (P. 9)

The philosophy of candle pattern recognition (P.12)

Candlestick charting — Types and positioning. Here we outline all the major patterns like the Doji, Star, Harami, Reversal Signals, Dark Clouds, Piercing Lines, Engulfing Patterns, Morning, Evening, and Doji Stars (P. 20-24)

Construction of Candlesticks. — reading the candle chart. (P. 25)

Detecting the ‘Right’ Candlestick signals. Here we outline in detail size, shape, location, visual insight, reversals, and the macro environment. (P.27)

Pattern Analysis — Bullish and Bearish pattern examples examined (P. 32-40)

Reliability of Pattern Recognition — Bullish and Bearish trends and the various degrees of reliability for each pattern. (P. 48-51).

Using Candlestick Patterns in Stock Analysis. Here we reveal which stocks work best with Candlesticks and how certain ‘Candles’ can light the way.

Interpreting Candlestick Patterns. Here we look at in detail the difference between Bullish, Bearish, and Engulfing Bearish patterns. (P. 59-63)

Special section on the Doji. Tweezing patterns and Extended pattern groups.

Techniques: Simple steps for better returns. (P. 71)

What Candlesticks Don’t Reveal.

FAQ’s — What is their origin? What makes a ‘Candle?’ Why should a trader use Candlesticks? What are Candle reversal patterns? Are they effective?