Candlestick Charting Explained Timeless Techniques for Trading stocks and Sutures eBook Gregory L

Post on: 16 Апрель, 2015 No Comment

Free Kindle Reading App Anybody can read Kindle books—even without a Kindle device—with the FREE Kindle app for smartphones, tablets and computers.

To get the free app, enter your email address or mobile phone number.

Formats

Book Description

Customers Who Bought This Item Also Bought

Editorial Reviews

From the Back Cover

The classic Japanese candlestick reference, updated with all-new insights and tools to improve your predictive accuracy

Candlestick Charting Explained takes the subjectivity out of Japanese candlestick analysis by providing you with standardized, straightforward coverage of 89 powerful candlestick patterns. Inside you will learn what they indicate about current trader behavior and how you can use each to instantly improve your market knowledge and analytical precision.

In this revised and expanded third edition, candlestick expert Greg Morris updates his influential guidebook with valuable new material and patterns to give you:

- Thorough coverage of candlestick patterns to allow instant analysis of investor attitude and probable market direction

- Methods for integrating candlesticks with traditional Western charting analysis for enhanced signal verification

- Completely new section by Ryan Litchfield dedicated to Trading with Candlesticks

- Current insights into trader psychology, and how it impacts interactions between buyers and sellers

Its in-depth exploration of traditional as well as all-new candlestick charts, Candlestick Charting Explained will show you how to make candlestick charting a logical, understandable, and profitable component of your current trading program.

Empower your trading with Japanese candlestick charting

Japanese candlestick charts dramatically improve your understanding of short-term (less than a week) market sentiment, making you a much more informed and focused trader of stocks, futures, and indices. The bestselling Candlestick Charting Explained focuses on the patterns themselves and highlights the key facts you need to know to apply each pattern to your trading. For each of 89 distinctive candle patterns, its standardized format provides you with:

- Commentary —Description of pattern and significance of its name, insights into unique features, and other concise explanation

- Rules of Recognition —Simple rules for quick, accurate identification along with precise, day-by-day descriptions of pattern development

- Scenarios and Psychology Behind the Pattern —Trading scenarios that could have led to the pattern’s development, with general discussion of the psychology of each

- day’s action

- Pattern Flexibility— Situations that change the pattern’s effectiveness with explanations of allowable deviations from the classic pattern

- Pattern Breakdown —Instructions for reducing the pattern to a single candle line and whether or not outside confirmation is suggested or unnecessary

- Related Patterns —Patterns that have similar formations, could be considered variations, or are a part of this pattern

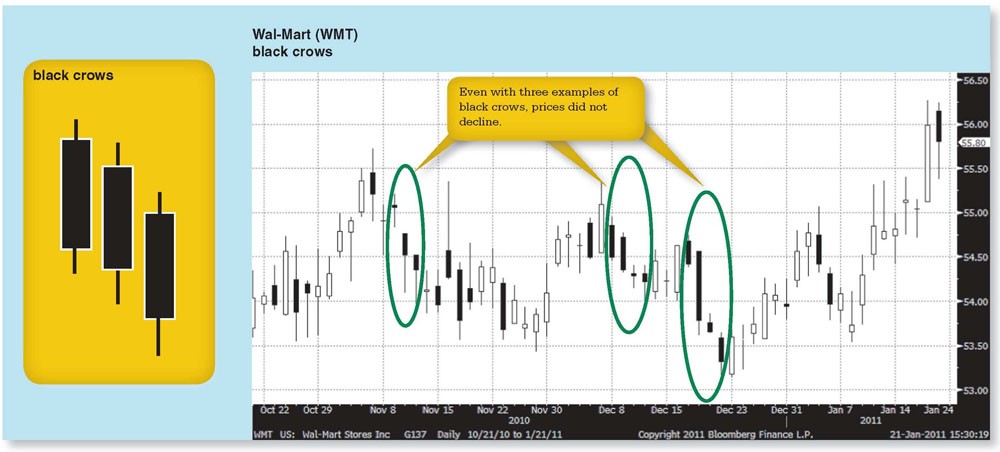

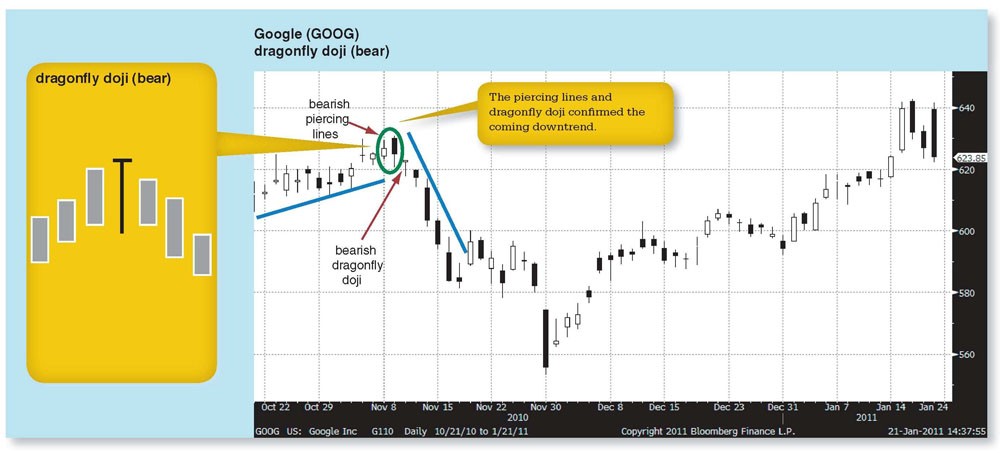

- Example— A graphic example of the pattern to both aid in recognition and eliminate costly confusion in pattern identification

Additional information and insights present different interpretations of candlesticks based on intraday instead of end-of-day events and action, improving signal reliability. The author’s unique candle pattern filtering concept, instrumental in answering the how question, is updated to utilize today’s larger universe of stock data. An all-new chapter provides practical application and perspective traders need to view candles in the context of today’s computer-driven marketplace.

For millions of traders, candlesticks have become a key tool in creating and verifying trading signals. Candlestick Charting Explained is the only book you need to start integrating their proven versatility and effectiveness into your technical trading program.

About the Author

Gregory L. Morris is a portfolio manager for PMFM, Inc. managing the PMFM Core Advantage Portfolio Trust mutual fund. One of the world’s leading experts on candlestick charting, Morris is a consultant and the former CEO of MurphyMorris.com, which he and a partner founded and later sold to StockCharts.com. He is the author of The Complete Guide to Market Breadth Indicators. along with numerous articles for professional publications, and has spoken to thousands of traders and investors at industry conferences around the world.