Can you really master trading the markets

Post on: 9 Июнь, 2015 No Comment

by Scott on Tuesday, January 20th, 2015 | No Comments

I always get a kick when I visit a trading web site and there is a reference to the master trader who is teaching some course or strategy for trading. This reference gives the impression that the individual is profitable on every trade, makes money every day, and has mastered the markets.

In my opinion, there is no such thing as a master trader. You simply cant master the markets, because you just never know what is going to happen from day to day.

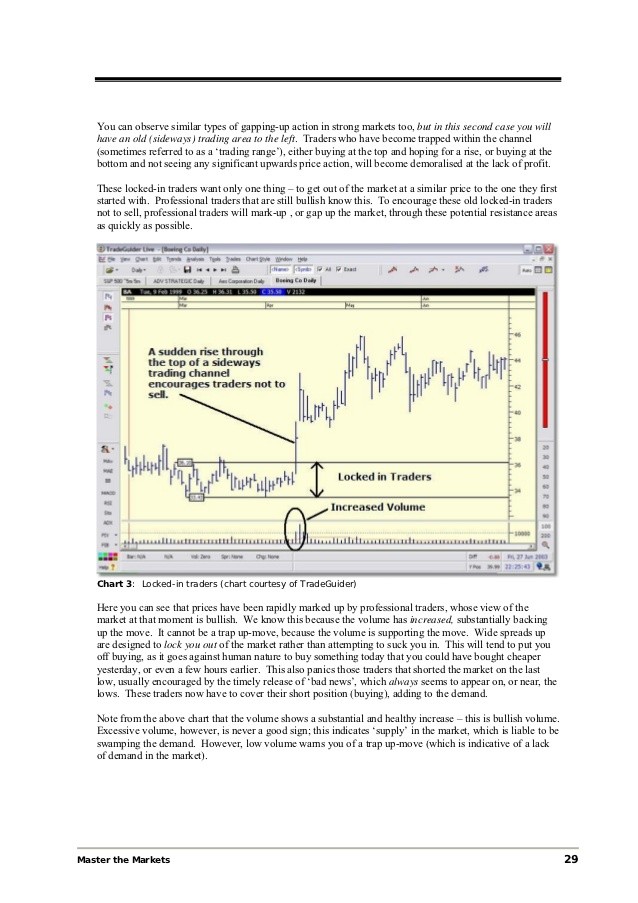

There is no system or strategy that can foresee every probability. Consider the chart below

Swiss Franc Futures

There is not a trader on earth who could foresee this move happening in the Swiss Franc last week. Within a period of MINUTES, the Swiss Franc traded 30% higher. This move not only wiped out the accounts of thousands of retail forex and futures traders, but also bankrupted several of their brokers.

Now of course, eventually, someone will say that they saw this coming and made a fortune on the move, but if they happened to be long at that time, it was simply luck, and not any particular skill that allowed them to capture the move.

Ill give you a personal example

Shortly after I first started trading futures in 1994, I learned the Turtle Trading System from former Turtle Russell Sands. If you are unfamiliar with the system, it is a medium term trend following system that employs the use of channel breakouts to enter and exit trades.

One day, even while I was trading a small account, I entered a long position in the Coffee market. I had no business trading that market because of the volatility in that market and the size of the contract. A one cent move is equivalent to $375, and at the time, coffee prices typically moved about 1.5 cents each day. Based on the risk management system employed in the Turtle Trading System, my risk per contract was over $1,000, which was nearly 10% of my account at the time.

Anyhow, my timing was perfect, because as soon as I entered the trade, the market took off. I ended up catching the entire trend that followed, and ultimately made a small fortune because I added a number of contracts along the way due to ignoring proper money management.

Coffee Futures 1994

With this trade alone, I could say that I am a master trader. Yet, nothing could be further from the truth.

It was just luck that I hit this move because all trend following systems have more losing trades than winning trades.

Most great traders also experience a losing year from time to time, no matter what strategy they employ. Yes, there are some exceptions, but even where traders are profitable every year, you will see a considerable disparity in their returns.

Consider David Tepper of Appaloosa Management. Appaloosa is one of the most sought after hedge funds in the world due to an incredible long term performance record. In 2013, it was reported that Tepper himself earned over $3 billion since the fund earned over 40% on the year.

However, 2014 proved to be a struggle for the fund, as it just barely managed to eke out a positive return for the year, while the S&P 500 returned double digits.

Probably an even better example is the case of Long Term Capital Management. This hedge fund was run by Nobel Prize winners, and it had an incredible track record for a few years. However, there was a significant flaw in the strategy employed in that there was too much leverage being employed in markets that were too illiquid. One day, the fund collapsed and even the Federal Reserve was forced to step in to avoid a financial catastrophe that could affect the world economy. You can read about Long Term here .

So, keep this in mindyou will never master the markets. The best that you can do is learn how to master yourself, and even this will prove to be a difficult task over the long run. Mastering yourself simply means you are able to emotionally deal with everything the markets can throw at you.

If you can come close to mastering yourself, then you will have the ability to become a successful trader over the long run.

By the way, Id love to hear any of your comments on any of my posts here!