Can synthetic ETFs continue to compete FTSE Global Markets

Post on: 29 Июнь, 2015 No Comment

Can synthetic ETFs continue to compete?

www.ftseglobalmarkets.com/media/k2/items/cache/bcf12a472243d7c5b8cc804b4a1e72a8_XL.jpg

The sovereign debt crisis has become a gigantic stress test for synthetic exchange-traded funds (ETFs) that may well determine whether they can compete against physical ETFs or will survive only as niche products used in markets where physical replication is impractical. Synthetic ETFs make up about half the market in Europe, though only a handful exist in the United States where current regulations limit the ability of registered investment companies to replicate index performance using derivatives. Market participants have long debated the relative merits of physical and synthetic ETFs, but now investors are voting with their feet. Neil O’Hara reports.

At first glance, a physical ETF, which owns the components of the index it seeks to track, is a less risky investment than a synthetic ETF, which delivers the return on the benchmark index through total return swaps. Appearances can be deceptive, however. Most physical ETFs offset part of their expenses through securities lending, a bilateral transaction that introduces the same collateralised counterparty credit risk a swap entails. If the counterparty defaults, a physical ETF must sell the collateral and use the proceeds to replace the securities lent out, just as a synthetic ETF would use collateral to replace its swap exposure.

Except for commodity ETFs that own the underlying asset rather than futures contracts or swaps—the precious metal ETFs, for example—and a few early US ETFs such as the SPDR, the original ETF that tracks the Standard & Poor’s 500 index, physical ETFs do lend the securities they own. “The early ETFs were unit investment trusts, which have no investment discretion,” says Townsend Lansing, head of regulator affairs at ETF Securities in London. “The physical replicating ETF structures evolved to permit securities lending. Both synthetic ETFs and physical ETFs that engage in securities lending have similar counterparty credit risk.” For the vast majority of ETFs, the debate over the relative credit risk of physical versus synthetic vehicles is moot, at least in theory.

ETF Securities is an independent sponsor of about 150 ETFs with $28.3bn under management. It specialises in commodity ETFs, typically structured as debt instruments backed by collateral, which is held by an independent trustee to buttress investor protection. The products mimic the legal framework of UCITS even though they do not qualify under rules that preclude UCITS funds from holding commodities.

20GM%20Issue%2057/thumbnails/thumb_Townsend%20Lansing.JPG /% Townsend Lansing, head of regulator affairs at ETF Securities. The credit risk in a collateralised ETF product is the difference between the collateral value and the market price of the underlying asset after the counterparty fails, not the entire principal amount. Townsend says investors have three primary concerns: the quality of the collateral, how closely the collateral is correlated to the underlying asset, and how fast the fund can take possession of the collateral. “Those three issues apply equally to a physical ETF that does securities lending and an ETF using swaps,” he says.

Investors today enjoy greater transparency about the collateral backing a synthetic ETF than for the securities lending collateral in a physical ETF. In response to concerns that arose after Lehman Brothers failed, the leading synthetic ETF sponsors began to post on their websites daily updates about the collateral supporting the swaps in each product. Credit Suisse even posts the serial numbers and identifying marks for the individual bars held in its precious metals ETFs.

Physical ETFs may even have greater credit exposure than their synthetic siblings, depending on the collateral guidelines applied to their securities lending programmes. The prospectus for a physical ETF discloses that the fund may engage in securities lending, but sponsors neither identify the counterparties to whom they lend nor give any information about the collateral received. In addition, the broker dealers who borrow the securities and lend them on to hedge fund clients often re-hypothecate the collateral they receive, which ratchets up broker dealer leverage and the credit risk associated with securities lending.

UCITS restricts the maximum residual credit exposure to the sponsor of a synthetic ETF sponsor to 10% of fund net assets, but the leading sponsors have adopted lower thresholds: a 5% target for db-X-trackers and zero at Lyxor. Simon Klein, head of ETFs Europe at Lyxor, notes that synthetic ETF products survived a trial by fire during the 2008 financial crisis, too. “All the swaps were settled,” he says. “There was no problem in ETFs.”

Lyxor manages $38.6bn in ETFs, all of which are synthetic. Created under French law, Lyxor ETFs must hold at least 75% of the collateral in European assets, although in practice the proportion is usually higher—in early November, it was 90% European, 6% UK and 4% US. Unlike some of its competitors, Lyxor holds the collateral in the ETF itself rather than in a pledged account at a third party, a structure that should enable Lyxor to act more quickly if disaster strikes. “It is a similar risk, but with a pledged account the manager has to move the collateral into the fund. It is already there in our structure,”says Klein.

Credit risk is a bigger concern for investors in exchange-traded notes (ETNs), which offer the return on a benchmark just like an ETF. Legally they are quite distinct, however: ETNs are unsecured obligations of the issuer, typically a major bank or securities house. Most ETNs enjoy collateral protection, but the issuer has considerable discretion over the type of collateral and may retain possession of it. “Some ETNs have ring-fenced collateral,” says Phil Mackintosh, global head of portfolio strategy and ETF research at Credit Suisse. “You have to look at notes products case by case.”

Investors do not appear to distinguish between sponsors affiliated with major securities houses, which use a single swaps counterparty—Deutsche Bank for db-X-tracker ETFs, Société Générale for Lyxor ETFs—and independent sponsors such as ETF Securities, which have multiple counterparties and could cut their exposure to a particular firm if its creditworthiness came into question. Synthetic ETF sponsors now follow risk management practices long used in the securities lending market, including daily mark to market valuations and adjustment of the collateral amount. “Most ETFs are run by managers who are conscious of the risks and try to minimize the exposure,” says Mackintosh. “The credit risk in synthetic ETFs is not as high as people think.”

Another critical risk in any ETF is tracking error, the extent to which fund returns differ from those on the benchmark it purports to mimic. Synthetic ETFs have the edge here. A total return swap delivers the exact return on the index, which limits tracking error to fund expenses plus the cost of index replication through swaps, including adjustments to the principal amount as fund assets wax or wane. A physical ETF bears similar costs, although the market impact of trading securities rather than adjusting the swap principal amount is higher, particularly in less liquid securities. A physical ETF may incur tax costs related to the dividends it receives, too.

In addition, physical ETFs do not hold every security in the underlying reference index. A broad benchmark may have so many components, including some in countries where foreign ownership restrictions prevent an ETF from owning the correct weighting in each stock that it would be impractical to rebalance the fund whenever assets fluctuate or the index components change. For example, the MSCI World Index, which has about 1,600 components, goes through a major revision every year that sometimes adds or removes as many as 300 names. Physical ETF sponsors use “optimised sampling”, whereby the fund typically owns only the largest and most liquid index components, which cuts trading costs but raises tracking error.

The error can be significant. Lyxor’s Klein says the largest physical emerging markets ETF in the US underperformed by more than 6% in 2009 and outperformed by the same amount the following year. “An ETF cannot hold Indian stocks,” he says. “It has to use sampling to replicate the index performance. The physical structure can be very inefficient in many instances; emerging markets, for example.”

The synthetic ETF structure enables investors to access asset classes they could not easily hold in physical form, such as commodities, currencies or hedge funds. Mackintosh at Credit Suisse points out that some US ETFs now offer “factor exposure” to portfolio characteristics. For example, a volatility ETF may go long technology or airlines, which exhibit high volatility, and sell short consumer staples or other industries less susceptible to market swings. “Some funds are long-short baskets from which the manager extracts some attribute other than beta,” Mackintosh explains. “It is hard to do that in a physical ETF. If it is not a swap- or note-based product the ETF has to manage loans.”

US Securities and Exchange Commission (SEC) rules preclude most synthetic ETFs in the United States except for some grandfathered leveraged and inverse products, which are among the most controversial ETFs on the market. They work as advertised on an intraday basis, but rebalance every day and make no claim to track the reference index over longer periods. They are trading chips designed for professional investors—but also available to retail investors who may not understand the risks. Inverse ETFs carry extra credit risk, too. If a counterparty fails, most markets will go down, inflating the defaulted swap value to the ETF—and the risk that collateral may not cover the full replacement cost of the swap.

Critics of synthetic ETFs argue that in specialised niches the fund could outgrow liquidity in the underlying assets. In practice, the creation and redemption mechanism embedded in every ETF ties the liquidity of the fund to liquidity in whatever index it tracks. “People have to hedge, even in a swaps-backed ETF,” says Lansing at ETF Securities. “The real concern is on the other side, if you get a run on the fund—but that can happen with any investment, not just an ETF.”

Investor preferences between synthetic and physical ETFs depend on cultural factors and perceptions as well as hard analysis. For example, an endowment fund must disclose its investments to the university administration and donors in its annual report. Whenever derivatives are blamed for an unforeseen event, the portfolio manager can expect faculty and donors to carp at the risks the fund is taking if it trades these instruments.

20GM%20Issue%2057/thumbnails/thumb_PKLittle2011%20001.jpg /% Patricia Little, a senior research analyst at Mercer. “An endowment doesn’t want to lose donors by having assets in the fund that will upset people,” says Patricia Little, a senior research analyst at Mercer, an investment consulting firm. “Why worry about something if you don’t have to and it doesn’t have a significant cost?” Portfolio managers may prefer physical ETFs rather than take flak from key constituents who believe synthetic ETFs are too risky.

The credit risk in either swaps-based ETFs or physical ETFs that lend their securities only comes home to roost if a counterparty goes bust, of course. Memories of the Lehman Brothers collapse are still raw, however, and the demise of MF Global is a timely reminder that, although rare, bankruptcies do occur among financial firms—and with little or no warning. “Counterparty failure has a low probability, but it doesn’t creep up,” says Little. “It hits you smack in the face. Given current financial uncertainties, why should investors take that risk?”

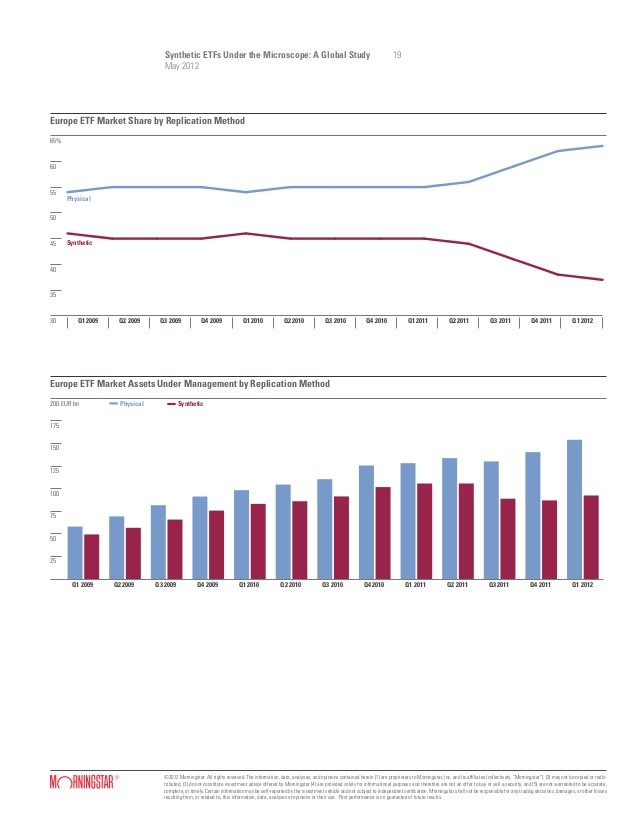

According to figures compiled by Deutsche Bank, investors have pulled money from synthetic ETFs and switched into physical products as the eurozone debt crisis intensified in recent months. Lyxor has suffered the largest outflows—€5.6bn year to date—amid concerns about the exposure of French banks, including Société Générale, to Greece and other troubled Eurozone countries. Synthetic ETFs today face a tougher test than in 2008 that could determine whether they will play a leading role in the future or merely a bit part.