Calendar spreads

Post on: 20 Июль, 2015 No Comment

Intro To Spread Trading The Common Spreads

While most people think of trend following when they think managed futures, the asset class has expanded to include a wider variety of strategies. One such strategy is spread trading, which is an attempt to turn a profit off of the difference between the prices of two contracts (not to be confused with spread betting, which is how UK traders are able to sell short). A trader can buy the spread (which means selling the cheaper contract and buying the more expensive contract) hoping that the gap between the two contracts will widen. Or, a trader can sell the spread (buy the cheaper contract and sell the more expensive contract) hoping that the gap between the contracts will narrow.

For instance, lets say the May contract for corn is trading at $6.00, while the July contract is trading at $5.50. If you buy May and sell July (buying the spread), you will profit if the price difference expands. If you sell May and buy July (selling the spread), you will profit if the price difference narrows. The advantage of a spread trade is that the general direction of the market doesn’t matter to the trader; whether the markets traded are increasing or decreasing in value, all that matters is that the spread is growing or shrinking. While such a trade can be placed in a variety of manners, there are several traditional spreads that are used frequently across the industry:

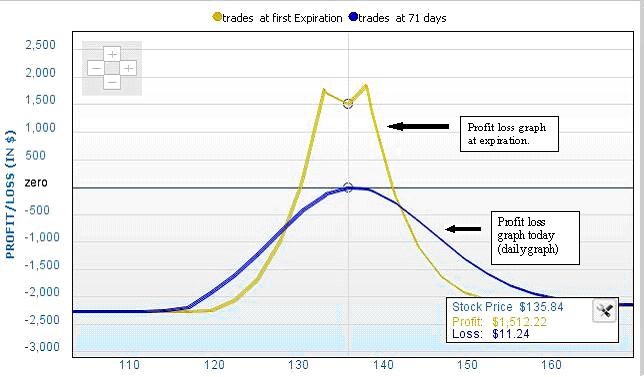

- The Calendar Spread The above scenario is an example of a calendar spread, the most common type of spread trade in use. The idea here is to try to take advantage of the price differences for one months contract over another within the same market. This is also called an “intra-market” spread, to distinguish it from “inter-market” spreads that trade contracts in different markets.

- The Inter-Exchange Spread This strategy tries to profit from imbalances between similar commodities traded on different exchanges, such as Kansas City Wheat versus Chicago Wheat, or West Texas Intermediate Crude versus Brent Crude.

- The Crack Spread No, not related to the drug. The crack spread refers to a spread trade between crude oil and one of its byproducts, like heating oil or gasoline. Its name is derived from the idea of cracking the crude oil to get useable products out of it.

- The Crush Spread Similar to the Crack spread, this trade revolves around soybeans and their byproducts. Traders will buy or sell soybean futures and either soybean meal or oil.

- The NOB Spread Spread trading isn’t just for commodities, as the NOB spread tries to take advantage of the difference between 10-year Treasury notes and 30-year Treasury bonds (Notes Over Bonds).

- The FAB Spread Like the NOB spread, FAB trades involve bonds with different maturities, in this case seeking to capitalize on the difference between 5-year treasury bonds and longer-term bonds (Five Against Bonds).

- The TED Spread The TED spread looks for profit in the difference in interest rates between three-month US T-bills and three-month Eurodollar deposits, which are time deposits in banks outside the US, but still denominated in US dollars.

Now the idea with these and more complex spreads is technically risk management the hope is that losses on one side of the trade are offset by larger gains on the other side. Several CTAs we follow at Attain engage in spread trading such as Emil van Essen and Rosetta. However, there is always the risk that the spreads go in the opposite direction that youd like them to and in a big way. For this reason, though spread trading programs can benefit your portfolio, they wont be right for everyone.

The Evolution of EVE

We profiled the popular spread trader Emil Van Essen earlier this year in our newsletter; but, of course, the exciting stuff always happens after we highlight someone. And along those lines Emil van Essen (EVE) recently announced that they will begin trading intra-commodity spreads (spreads between markets, like buying Corn, selling Wheat) in the Emil van Essen Spread Trading Low Minimum program effective immediately. The popular spread trading program has traditionally focused on trading inter-commodity spreads (spreads between different contract months of the same commodity, like buying December Corn and selling March Corn), which look to take advantage of inefficiencies in pricing across contract months of the same commodity as well as the roll yield that comes from investors moving from once contract to another at expiration. This new strategy will allow EVE to take advantage of mispricing in markets that are highly correlated (Corn and Wheat) but still trade on their own metrics.

According to Emil’s long time top lieutenant Bryan Kiernan, the addition of intra-commodity spreads is the culmination of ongoing research into the firm’s existing spread models. Specifically, it is the result of a six-month long research project that showed adding intra-commodity spread exposure added diversification, lowered volatility, and increased rate of return in their models. (PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS)

EVE will be very conservative with initial trading allocations to this new component of their strategy, and will only apply 5% of client assets to intra-commodity trading. Slowly incorporating new ideas is always a good idea in our opinion, and we are happy to see EVE taking a more conservative approach in this regard. Margins are estimated to be 1% to 2% per spread, while portfolio margin use will remain similar to current levels with a soft cap around 20% of equity, which is also good news.

The downside is that intra-commodity spreads can be, by definition, riskier than their inter-commodity counterparts. There is always the possibility that a world event (drought, supply disruption) could have a larger impact on one market more than the other. Risk management is the key to success for any managed futures program and leads us to our key point; as long as EVE is able to manage the risk across the “intra” markets as well as they have with inter-commodity spreads, then adding the new markets is a good idea. However, one bad loss due to a disruption in the oil pipeline in the North Sea or a drought in Russia could upend years of hard work that has seen Emil van Essen steadily increase assets in the managed futures space.

Of course, Emil made his name by being one of the first managers to trade spreads in a managed futures program, so it is not surprising that he continues to look for new opportunities in the market. His pedigree speaks for itself and, in our opinion, deserves the benefit of the doubt. We look forward to watching this new evolution in the program play out.