Calendar Spreads_2

Post on: 20 Июль, 2015 No Comment

The intra-commodity spread in commodities

An intra-commodity spread is the purchase of a futures contract and the simultaneous sale of another futures contract for a different month in the same commodity on the same futures exchange. Intra-commodity spreads are synonymous with calendar or time spreads .

In another article this month, Backwardation and Contango- Two terms that describes market structure ; we looked at how future market prices in nearby versus deferred contracts can offer insight into supply and demand fundamentals in commodity markets. Calendar spreads are the tools that many professional commodity traders utilize to express their price opinions. In fact, for many professionals, these spreads are the trades of choice.

Calendar or time-spreads are volatile

The supply and demand equation for many commodities results in their moving from shortages to surpluses and vice versa. Supply shortages create deficit markets where demand outstrips supplies. Supply surpluses or gluts exist when ample quantities can satisfy present demand with unused inventories left over.

Calendar spreads can be more volatile than outright, active front month futures or cash commodity prices. This particularly holds true for agricultural and soft commodities where production cycles are year-to-year or season-to-season. Crops, livestock or certain other goods are often susceptible to rot; they may deteriorate over time or be subject to diseases and fungus that decreases available supplies. In energy, geopolitical events may affect the futures curve. which is a term that defines the difference in prices between nearby and deferred contracts.

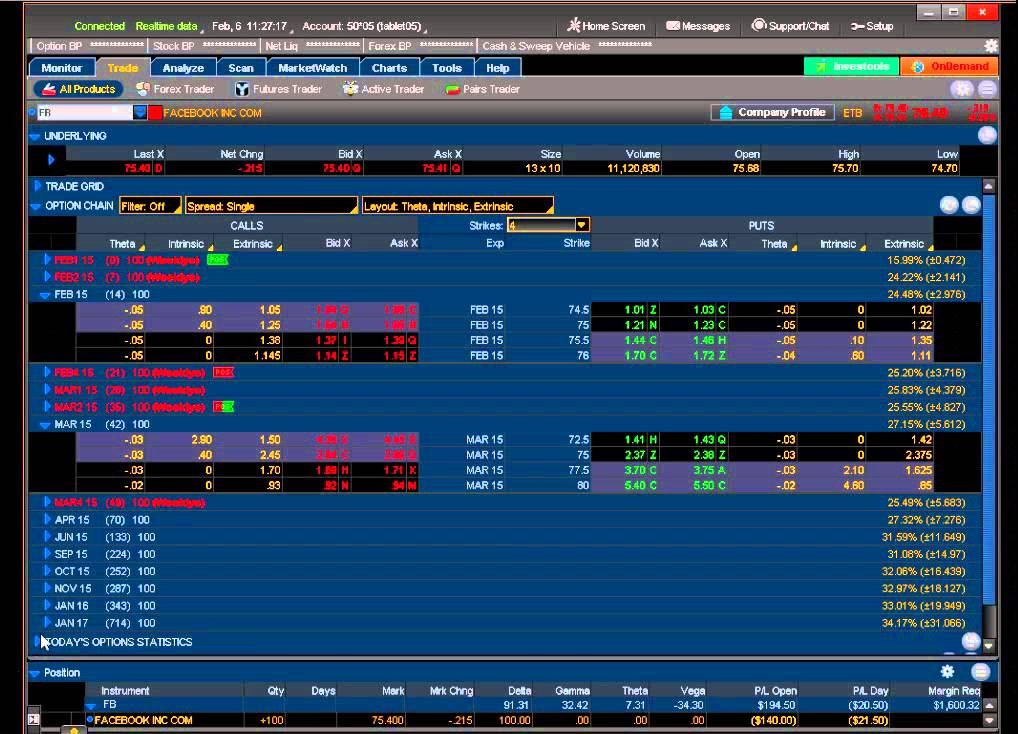

The chart illustrates how a crude oil spread (November 2014 versus December 2017) was more volatile than the outright price of crude oil during the period from June 2014 through the beginning of October 2014. The price of crude oil dropped 12.5% but the calendar spread dropped by 62%.

In metals, production problems or sudden demand can affect the fundamental equation for precious, non-ferrous and other metal commodities. The price volatility of a commodity is multidimensional. The financial press and news networks tend to focus only on front month or cash prices. However, calendar spreads provide a real time view of market supply and demand fundamentals. In the case of the crude oil spread, the backwardation moving from $16.68 in June to $6.37 in October indicates that the potential for a supply shock or shortage decreased during the period.

Calendar Spreads and fundamentals

Calendar spreads reflect the oversupply or deficit characteristics of a market. During periods of oversupply, deferred contracts tend to increase in value relative to nearby contracts. At times of deficit, nearby prices tend to increase in value relative to deferred contracts. As such, calendar or time spreads can be the best non-biased source for monitoring supply and demand fundamentals of a commodity market on a real time basis.

If a trader believes that a market will move toward backwardation for the reason of increasing demand or a supply problem, that trader will go long calendar spreads. If a trader believes that a market will move toward contango for the reason of decreasing demand or increasing supplies the trader will go short calendar spreads. The long or short refers to the position in the nearby futures contract.

Oil- A case study in calendar spreads

In 1990, Iraq invaded Kuwait. The nearby price of crude oil was around the $20 level before the invasion and the market was in contango (nearby prices were below deferred prices). On that fateful night, August 2, 1990. the price of crude oil soared- from $20 to $40 a barrel in a number of hours as Iraqi troops poured over the Kuwaiti border. At the same time, long-term crude oil prices (deferred futures) actually remained the same or fell. The market, by virtue of price action, was telling us that the issue between the two countries would not affect deferred contract prices on those future dates. Therefore the calendar spreads in the crude oil market actually went up, in some cases, more than the front month price which appreciated by 100%. The reason this occurred was that nearby supply worries consumed the oil market as Iraq and Kuwait, both significant producers, went to war.

Many professional traders who made significant profits during this period were not long outright crude oil. Many of the most successful traders were long crude oil calendar spreads. This is just one example of many where calendar spreads were not only more volatile than outright prices but also where traders employed them to express a market view and take advantage of a market event.

The bottom line on calendar spreads.

Calendar spreads are intra-commodity spreads that highlight supply and demand characteristics in each commodity market. Movements in these spreads often spotlight changes in a market’s fundamentals. Exchanges offer daily data and closing prices for all contracts that trade. Watch those contracts for changes in the differentials the information gleaned will provide insight into potential future market volatility and price direction.