Buy the Rumor Sell the News

Post on: 25 Апрель, 2015 No Comment

Why does a market seem to improve prior to the actual reporting of positive economic news only to fade when the news is reported? Welcome to the world of trading and investing in which market participants will often, ‘buy the rumor’ and ’sell the news.’

In fact, this phenomena is the perfect description for today’s price action.

Prior to the market open this morning, equity futures were indicating a slightly weaker opening. In fact, the equity markets did open in slightly positive territory. At 10am, we received economic data which collectively would be viewed in a VERY POSITIVE light. This data includes:

1. Institute of Supply Management Manufacturing Index rose to 52.9 vs last month’s reading of 48.9 and an expectation of 50.5. This month’s reading of above 50 is the first indication of growth in manufacturing in a year and a half. Manufacturing represents approximately 12% of our economy. All other things being equal, this report is an indication that our recession is ending or actually has ended.

In the spirit of full disclosure, the employment component of this ISM Index showed only marginal improvement. This release continues to highlight that an economic recovery will not be robust in terms of improved job prospects and overall employment.

Another somewhat disturbing component of the ISM Index entails Prices Paid. In a big surprise, this release details that Prices Paid rose to a 65 level from 55 last month and against an expectation of 57.8. The increase in prices paid will further pressure profit margins and may be an indication that an increase in inflation is closer than we may think.

Despite, the employment and price components, a return to growth in manufacturing is a critical development in bringing a semblance of stability to our economy.

2. Pending Home Sales also generated a surprisingly strong 3.2% increase vs an expectation of a 1.5% increase. Be mindful, though, that this report had generated a 3.6% increase in July. While analysts will portray this report as a positive development overall, I continue to believe that the housing sector of our economy needs to be viewed primarily through the prism of delinquencies and defaults. Unless and until those statistics start to decline, housing will not be a strong indication of our overall economic health.

3. Construction spending shows little improvement. Against an expectation of a flat reading, the report came in with a -.2% reading. Addiitonally, prior month’s report was revised down from a .3% reading to only .1%.

4. Deal activity today is focused on E-Bay’s sales of its Skype internet phone unit for $2.75 billion. That figure is a very strong valuation for this business.

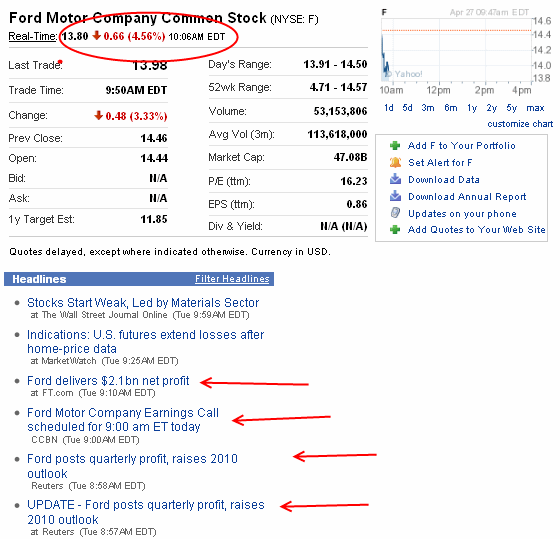

Despite this generally very positve news, in the last 45 minutes while I have been writing this commentary, the equity markets have had a major selloff and are now down more than 1.5%. WHY??

Well, let’s be mindful that the economic fundamentals have been totally disconnected from market price action and overall valuations for a protracted period.

Please check my commentary from my August 2009 Market Review in which I wrote,

While it has been foolhardy and painful to fight the Fed and the massive liquidity pumped into the system, I see some real signals in a variety of sectors that this rally is running out of steam. The markets have not truly had a meaningful correction in the last 6 months. Are we due for one? I personally think it would be very beneficial. Why? The disconnect between Wall Street and Main Street has never been greater. I do not view that gap as healthy.

Call me crazy, but I project September will have a 5-7% retraction across the major equity market averages based on reading the tea leaves as highlighted in this review.

What do you think?

One day nor merely a few hours does not a market call make, but I do think the signs we are seeing in the emerging markets and commodity markets are real warning signals that we ignore at our peril.