Butterfly spread (Business) Definition Online Encyclopedia

Post on: 4 Апрель, 2015 No Comment

N posisie wat deur n lang posisie in n gesprek met trefprys K1, n lang posisie in n gesprek met trefprys K3, en n kort posisie in twee oproepe met trefprys K2, K3 geskep is waar K2 K1 en K2 0: 5 (K1 K3).

butterfly spread

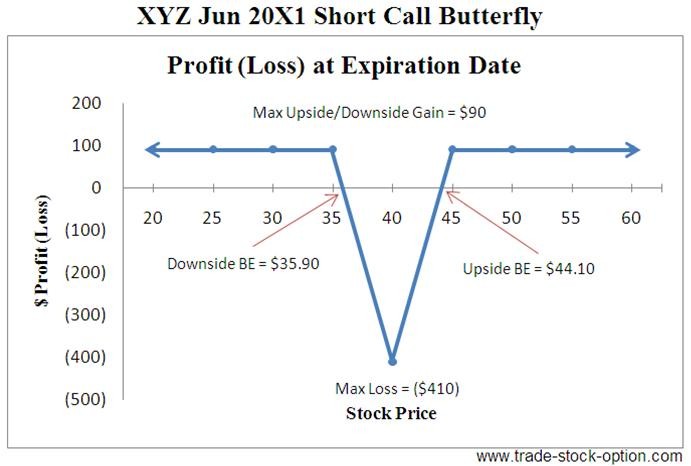

Complex options strategy that involves selling two calls and buying two calls on the same or different markets, with several maturity dates; one option has a higher exercise price. and the other a lower price.

Butterfly Spread s

A complex neutral options strategy which involves selling at the money options and buying out of the money options.

BUTTERFLY SPREAD — Applies to derivative products. Complex option strategy that involves buying a call.

RUT Butterfly Spread Book at 10:24 EST, December 26, with RUT at 1167.58:

Newbies who would like a review of the butterfly trade can find a quick explanation at the beginning of last week’s article.

See also: Butterfly Spread. Long, Short, Straddle. Strangle, Strike Price

Mentioned in

Iron Condor

Financial browser?

[Harvey] butterfly spread A three-legged spread in futures or options. In the option spread. the options have the same expiration date but differ in strike prices. For example, a butterfly spread in soybean call options might consist of two short calls at a $6.

A nonparallel shift in the yield curve involving the height of the curve.

Butterfly spread.

There are a number of complicated strategies, given fancy names such as the "butterfly spread ," the "straddle ," etc. but they all serve the same purpose.

Interest Rates And Your Bond Investments

Advanced Option Trading: The Modified Butterfly Spread

Advanced Bond Concepts

Bond Basics Tutorial.

See also: Derivatives, In the Money, Out of the Money. At the Money, Option Holder. Option Writer, Option Premium. Omega. Barrier Option, Trigger Option, Look Forward Option, Straddle. Strangle, Butterfly Spread. Binary Option, Combined Option.

An options strategy, similar to a butterfly spread. involving four strike prices that has both limited risk and limited profit potential. A. (Read more)

Confederation Of British Industry.

Stocks and bonds: (1) difference between the bid and offer price.