Book Review One Up On Wall Street by Peter Lynch

Post on: 17 Июнь, 2015 No Comment

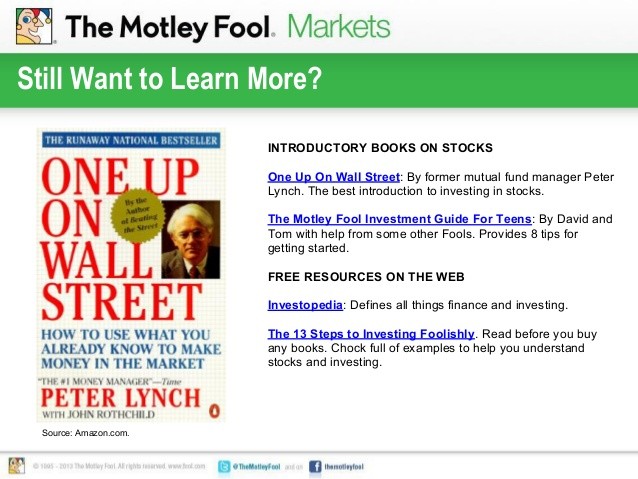

With the S&P 500 index down roughly 7.5% for the month, it’s a perfect time to take a break from all the (investing) fuss and re-evaluate our fundamentals. The best way to do that would be to pick up your favorite investing book and brush up on the basics. One of my favorites is the timeless classic, One Up On Wall Street. How To Use What You Already Know To Make Money In The Market by Peter Lynch. As the title suggests, this book proves that successful investing can be achieved by almost anyone, given the right tools and mindset. I’d like to give a quick review on this must-have, bestseller book on investing, so that you too, can benefit from it.

About The Author

Peter Lynch was the vice chairman of Fidelity Management & Research Company, the investment advisor arm of Fidelity Investments. Under his leadership, Fidelity Magellan Fund became the best performing fund in the world from May 1977 to May 1990. He grew the fund from $18 million in assets to $14 billion during his 13-year leadership for an annual average return of 29%. Needless to say, this guy has achieved a demigod/legend/icon status in the investing world.

This book is solid in terms of content and writing style. Lynch has a knack for telling his story with a twist of humor and common sense. He writes in a casual tone that anybody can relate to, and he can make seemingly complex ideas easier to understand. Below are some chapter highlights that I want to share:

Preparing To Invest

Peter Lynch starts this chapter with probably the best (and most honest) advice any investment professional can give to anyone new to investing. That is to “only invest in what you can afford to lose without that loss having an effect on your daily life in the foreseeable future.” To me, that shows his sincerity and maturity both in character and profession. While other less-ethical investment “professionals” (ahem, Goldman Sachs) only care about screwing their clients and ripping their eyeballs out. Lynch advises to put your financial safety as priority number one. He also advises people to stop listening to so-called professional investors (AKA smart money) because they too, like most of us, can make bad calls and decisions. He emphasized that “dumb money (AKA investing public) is only dumb when it listens to the smart money”.

He says that ordinary people like you and me are in a better position for discovering great companies as opposed to Wall Street analysts. This is because we are closer to a company’s products or services, and can easily judge if they are superior (thus, will sell well) or not. He said “you can pick spectacular performers from your place of business, your neighbourhood shopping mall, long before Wall Street discovers them.” Just look at the obvious clues like long lines of people crowding a store, or businesses opening more and more stores, etc.

Picking Winners

This chapter teaches Lynch’s process on how to look for companies that can become potential “tenbaggers” (AKA ten times return on investment). He emphasizes the importance of earnings and gives a checklist of financial ratios that influence his investment decisions. This includes the PEG ratio that was popularized thanks to this book.

The Long Term View

In this chapter, Lynch teaches (1) how to design your own portfolio (2) the best time to buy and sell different kinds of companies (3) the silliest (and most dangerous) things people say about stock prices and (4) the evils of Options. Futures. and Shorting (what can I say? He’s old-fashioned like Warren Buffet).

As I have said before, this is a solid investment book that every serious investor should have. The principles it teaches are based on (not so) common sense and will stand the test of time, bull markets or not. So do yourself a favor, log-off Facebook (FB ) for a day and read this book. I promise it will be time well spent.