Book Review Dual Momentum Investing An Innovative Strategy for Higher Returns with Lower Risk

Post on: 11 Август, 2015 No Comment

I was fortunate to obtain an advance copy of Gary Antonaccis Dual Momentum Investing: An Innovative Strategy for Higher Returns with Lower Risk. which is set to release in hardcover at the end of October. I frequently cite Antonaccis momentum research and his Optimal Momentum website on Scotts Investments so I was excited to dive into the book.

The book begins with a brief history of modern finance. To summarize modern finance in a few pages is a daunting task, but overall the book does a good job of providing historical context for the development of momentum investing. The efficient market hypothesis (EMH ) is taken to task by Antonacci, laying the groundwork for Chapter 2 which explores the the history and evolution of momentum investing. It may surprise some readers that momentum investing is not a new phenomenon, and Antonacci provides several historical examples of successful momentum investors, one of the most famous being Jesse Livermore.

We are warned at the start of Chapter 3 This and the next chapter are a bit wonkish. Some readers may wish to skip them and move on to Chapter 5. This is an accurate warning, although I found value in the overview of modern finance and its relationship to dual momentum. Chapter 3 gives a history of mean-variance, the Capital Asset Pricing Model (CAPM ), the Fama/French 3 factor model and the 4 factor model. This was a much deeper history than I expected, but also a very good synopsis of modern finance. Chapter 4 provides hypotheses on potential reasons why momentum works, such as herding, anchoring, and the confirmation bias, while acknowledging that ultimately we do not have a definitive explanation for why momentum is so prevalent. Chapters 3 and 4 are very accessible for those with a background in finance or economics. However, the layperson may have difficulty with Chapter 3 and 4 and may want to skip ahead.

Chapters 5 and 6 focus on asset selection and smart beta strategies. Antonacci is skeptical of many of todays popular investment strategies and asset classes. He makes intelligent arguments against hedge funds, private equity, active mutual funds, managed futures and other alternative strategies. He is skeptical of smart beta but acknowledges there may be some room for low-cost alternatives to traditional cap-weighted index based strategies.

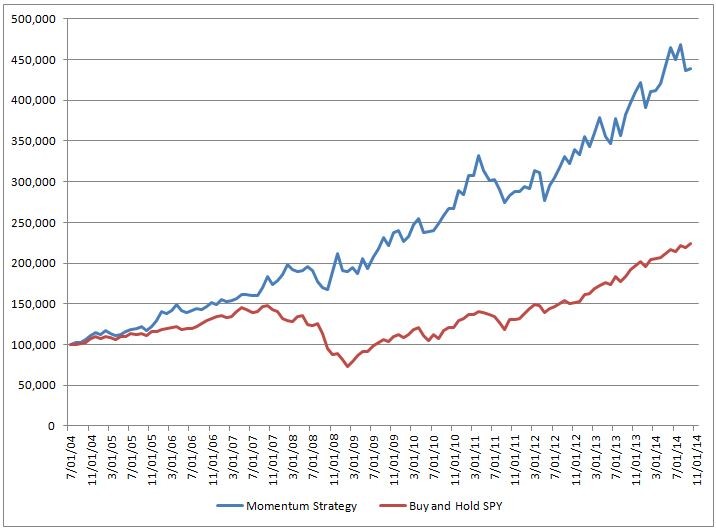

The last three chapters of the book put the Dual Momentum strategy together. In Chapter 8 the reader is presented with a simple strategy rooted in both relative and absolute momentum that can be implemented with three ETFs. Readers are warned against replacing or modifying the strategy with something new. However, Chapter 9 provides some alternative momentum strategy implementations which have historically strong results.

Dual Momentum Investing: An Innovative Strategy for Higher Returns with Lower Risk is a must-read for individual investors and financial professionals. I was struck by the volume of references and citations. Antonacci has done the heavy lifting for his readers by thoroughly researching the history and data behind momentum investing. The result is a well-researched and overwhelming argument for momentum investing. Readers are rewarded with a simple, robust strategy that anyone can implement.