Bond Funds for a Rising InterestRate Environment

Post on: 1 Май, 2015 No Comment

June 11, 2013

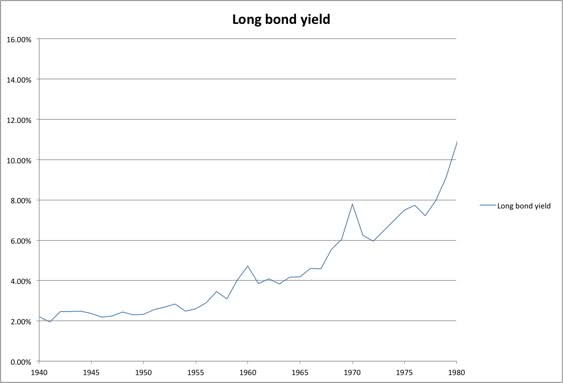

Interest rates rose sharply in May, but no one knows whether they are near the top of a trading range or if they are starting a sustained upward climb. Most bonds are negatively affected by rising interest-rates since bond prices fall when interest rates rise, but not all areas of the bond market are equally affected by interest rates.

Below, we look at four kinds of bond funds that have historically held up in rising-rate environments:

Short- and Ultra Short-Term Bond Funds

The shorter the average duration of a bond fund, the less the fund’s NAV will fluctuate with interest rates. Funds with durations of three years and less remain fairly stable when interest rates rise, and they offer a relatively safe haven during volatile times in the bond market. The trade-off for stability is that these funds offer very low yields. Examples include Pimco Low-Duration (PLDDX) and Weitz Short/Intermediate Term Income (WSHNX).

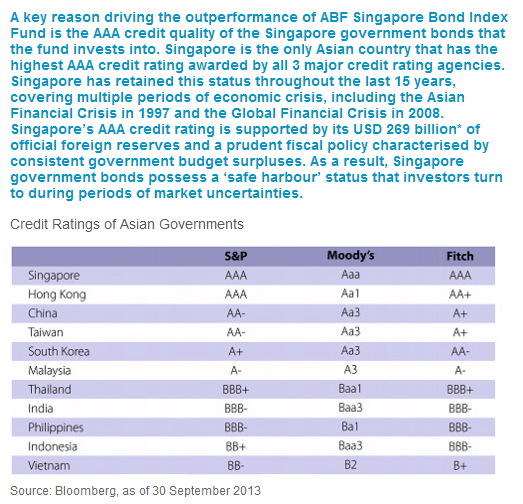

High-Yield Bond Funds

Bonds of lower credit quality issuers have had a strong run lately and credit spreads (the difference between BBB yields and 10 year US Treasury yields) are now “normal.” The added yield these funds offer may yet be attractive if overall rates remain flat, and yields could cushion the impact of small increases in interest rates. We use high-yield bond funds with care because there are risks here. These funds would suffer for example, if default rates rise or if interest rates jump dramatically. Examples include Fidelity High Income (SPHIX) and Wells Fargo Advantage Short Term High Yield (STHBX).

Floating-Rate Funds

These funds invest in bank loans, which reset interest rates based on increases or decreases in a benchmark (usually the LIBOR rate). This potentially insulates these funds from the negative impact of rising rates and allows them to benefit from higher yields as rates rise. There are risks, of course, and we use these funds gingerly. Companies that use bank loans for financing tend to have lower credit quality and the market for these loans can lack liquidity. Floating-rate funds may be dicier than most individual investors may like and they suffered badly in 2008 when lending dried up during the credit crisis, but they can be useful within a professionally managed portfolio. Examples include Fidelity Floating Rate (FFRHX) and PIMCO Floating Rate (PFIDX).

Inverse Bond Funds

These are funds that go up when the bond market is falling and drop in value when the bond market gains. Using derivative instruments, such as futures contracts, interest rate swaps, and options, they essentially “short” the bond market. Not for the faint of heart, they can prove to be volatile. Betting against a particular market is a fairly sophisticated strategy that may not be appropriate for all investors. And some of these funds add to their risk level through leverage. But they do provide investors with options; they can be used to make a bet on the downward direction of bonds, or as a hedging device for a bond portfolio. Examples include ProFunds Rising Rate Opportunities (RRPIX) and Rydex Inverse Government Long Bond (RYJUX).

Of course, the key to using these bond funds is to have a strategy that determines when to own these funds and when to move on to better performers. Our Flexible Income strategy is one such strategy: it leads us to invest in potentially riskier funds like high yields and floating rate funds only when these funds are outperforming less risky funds like short-term and intermediate-term bond funds. In more challenging periods in the bond market, our strategy can be 100% allocated to more stable short-term bond funds. Our strategy also limits our exposure to potentially riskier areas of the bond market, like high yields, so we can participate in the greater returns of these funds without sharply increasing the volatility of our portfolios.

Our Flexible Income strategy also has another tool in its rising-interest-rate toolbox: low volatility equity funds. which we consider to be bond fund alternatives. These funds have a history of low volatility returns like most bond funds, but because these funds are balanced funds that have exposure to both stocks and bonds, they aren’t as affected by interest rate fluctuations.