Bob Jensen s Introduction to FAS 133 FAS 138 and IAS 39 on Accounting for Derivative Financial

Post on: 14 Июнь, 2015 No Comment

rjensen/000overview/mp3/133summ.htm

www.trinity.edu/rjensen/acct5341/speakers/133glosf.htm#T utorials

www.cs.trinity.edu/

rjensen/video/acct5341/fas133/WindowsMedia/

000FAS133introduction.wmv

010FAS133Helpers.wmv

020FAS133futures.wmv

Interest Rate Swap Valuation, Forward Rate Derivation, and Yield Curves

for FAS 133 and IAS 39 on Accounting for Derivative Financial Instruments

May 2002 SPE Document from the FASB (It is free in draft form)

The FASB staff has prepared a new updated edition of Accounting for Derivative Instruments and Hedging Activities. This essential aid to implementation presents Statement 133 as amended by Statements 137 and 138. Also, it includes the results of the Derivatives Implementation Group (DIG), as cleared by the FASB through December 10, 2001, with cross-references between the issues and the paragraphs of the Statement.

�The staff at the FASB has prepared this publication to bring together in one document the current guidance on accounting for derivatives,� said Kevin Stoklosa, FASB project manager. �To put it simply, it�s a �one-stop-shop� approach that we hope our readers will find easier to use.�

Accounting for Derivative Instruments and Hedging Activities �DC133-2

Prices: $30.00 each copy for Members of the Financial Accounting Foundation, the Accounting Research Association (ARA) of the AICPA, and academics; $37.50 each copy for others.

International Orders: A 50% surcharge will be applied to orders that are shipped overseas, except for shipments made to U.S. possessions, Canada, and Mexico. Please remit in local currency at the current exchange rate.

To order:

The earliest records of transactions that had features of derivative securities occur around 2000 BC in the Middle East. (Page 338)

Geoffrey Poitras, The Early History of Financial Economics 1478-1776 (Chelten, UK: Edward Elgar)

During the Greek and Roman civilizations, transactions involving elements of derivative securities contracts had evolved considerably from the sale for consignment process. Markets had been formalized to the point of having a fixed time and place for trading together with common barter rules and currency systems. These early markets did exhibit a practice of contracting for future delivery. ( Page 338)

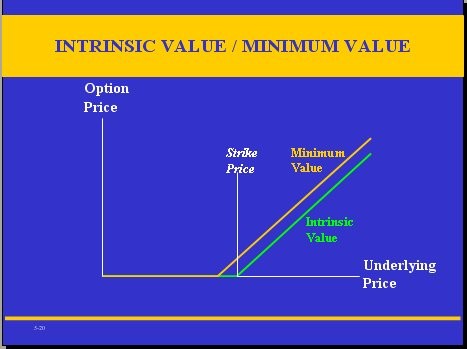

Like forward contracts, the use of options contracts or privileges has a long history. (Page 339)

The heuristics of an options transaction involves the payment of a premium to acquire a right to complete a specific trade at a later date. These types of transactions appear not only in early commercial activity but also in other areas. For example, an interesting ancient reference to (sic) options-like transactions can be found in Genesis 29 of the Bible where Laban offers Jacob an option to marry his youngest daughter Rachel in exchange for seven years labour. (Page 339)

What is surprising is that it took over 4000 years (Until FAS 133 in June of 1998) to finally requiring the booking of derivatives into the ledger. However, Laban’s contract falls outside the scope of FAS 133 if Rachel cannot readily be converted into cash.

www.trinity.edu/rjensen/acct5341/speakers/133flow.htm.

Or the relative link is133flow.htm.

www.iasc.org.uk/news/cen8_142.htm