Best Agriculture ETF TAGs v v Yahoo Finance Canada

Post on: 4 Апрель, 2015 No Comment

The Teucrium Agricultural Fund (TAGS — News ) launched on March 28 and shortly thereafter, on April 13, the U.S. Agricultural Index Fund (USAG — News ) joined the fray.

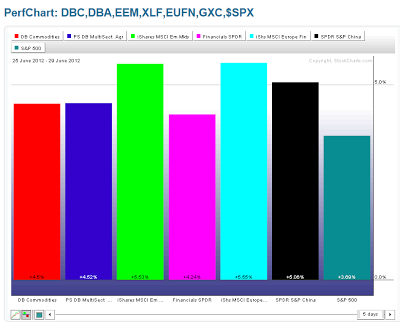

TAGS and USAG compete with the $2 billion powerhouse, the PowerShares DB Agriculture ETF (DBA — News ), along with six less popular ETNs.

With so many options that claim to do the same thing, how can you choose the right ETF for you?

Here at IndexUniverse, we like to compare ETFs on three dimensions:expenses, liquidity and exposure (check out ETF Analytics for more details on our methodology and what we’ve been working on). How do these funds stack up?

For simplicity’s sake, I’ll exclude the ETNs and only look at TAGS, USAG and DBA.

Expenses

Generally, expenses include explicit costs like expense ratios, along with implicit costs like tracking error. With such new funds, however, tracking analysis is impossible to calculate in a meaningful way, so we’re limited to expense ratios.

DBA is the clear winner here, with an expense ratio of 1.01 percent. In comparison, USAG charges approximately 1.21 percent and TAGS charges approximately 1.6 percent. It should be noted, however, that the latter two cost estimates are derived from prospectus analyses and may overstate the expense ratios if the funds reach higher asset levels.

Liquidity

In a competition between a $2 billion ETF and two very new ETFs, it’s fairly obvious that the large and established ETF will be more liquid. Any investor who is concerned primarily with liquidity should go straight to DBA and wait and see whether USAG and TAGS are able to attract significant volume.

Right now, though, USAG and TAGS are trading at wide bid/ask spreads and don’t trade very often. That’s not to say that USAG and TAGS can’t be traded right now, however:The underlying liquidity of both funds is strong, and investors working with a market maker in size should be able to tap into that effectively. Just be careful, and don’t even think about going in with a market order.

Exposure

The exposure comparison is what can make USAG or TAGS worth their higher price tags and trading headaches. After all, if DBA doesn’t provide the exposure that you want, it doesn’t really matter that it’s cheaper and easier to trade—after all, SPY is even cheaper and easier to trade, and no one looking for ags exposure is going to buy that.

USAG takes a quasi-active stance:It rebalances every month to highlight the commodities it projects to outperform. USAG initially weights each of its 14 commodities based on “overall economic importance.” It then overweights the four with the greatest backwardation—or the least contango—and the three with the greatest 12-month price momentum by 2 percent each, and then underweights the remaining seven commodities by 2 percent.

Meanwhile, DBA is a passive index that rebalances once a year. It holds 11 agricultural commodities that are assigned weights based on the Deutsche Bank index committee’s idea of economic importance, which is generally, but not always, close to USAG’s.

Finally, TAGS holds an equally weighted portfolio of soybeans, sugar, corn and wheat.

The resulting ETFs end up looking fairly different (The weights below are target weights based on the underlying indexes.)

With only 4 commodities, TAGS’ exposure is much more concentrated, making it a good option for investors who are bullish on soybeans, sugar, corn and wheat and who don’t care much about the other ags. TAGS’ main selling point is that it rebalances daily to maintain equal exposure to each of its commodities.

USAG and DBA are more comparable portfolios, since each aims to capture a broad swath of agricultural commodities. USAG holds a couple of extras—namely, soybean meal, soybean oil and canola—which diversifies its portfolio a little more. However, soybean meal and soybean oil movements tend to be highly correlated with soybean movements, so the added diversification benefit is questionable (although in theory, soybean derivatives could be less sensitive to seasonal effects). To compensate for its missing commodities, DBA weights cocoa, Kansas wheat, and coffee more heavily.

All three ETFs attempt to mitigate contango in some way. USAG and DBA select futures contracts with the highest degree of backwardation or the least degree of contango, and roll exposure over a five-day period to avoid moving the market. In comparison, the ETFs that TAGs holds (it is an ETF-of-ETFs) each maintain exposure to three contracts of different expirations (CORN, for example, holds the second and third contracts along with the December contract following the third contract).

It’s too early to say which of the three will do the most to mitigate the impact of contango on their portfolios, although it’s good that they are all conscious of the issue.

In the end, the choices are clear. Investors who want focused exposure to the big four commodities—sugar, corn, wheat and soybeans—should go with TAGS. Investors who want a passive commodities index providing broad-based exposure should stick with DBA, since it only rebalances once per year. Investors who like the idea of a more active approach that overweights the most attractive commodities every month (as determined by SummerHaven) should swallow USAG’s higher price tag.

We’ll check back in and see how performance is in a few months.

More From IndexUniverse.com