Beginner s Guide To ETFs And Currency Risk Yahoo She Philippines

Post on: 9 Май, 2015 No Comment

The recent rise in volatility in the euro currency reminds us that when invested in ETFs, we can be exposed to currency risk. In this article, we will explain that risk and identify the different ways to manage it.

What Is ETF Currency Risk?

Lets recall the basic idea behind the ETF industry. ETFs give investors access to markets and companies that are otherwise hard to reach. By purchasing an ETF share, the investor owns a piece of a fund that buys shares in companies in which the investor is interested.

An ETF that invests overseas will generally own shares in the foreign territory and, in general, these will be held in the foreign currency. Therefore, by buying such ETFs, you are exposed to movements in the foreign exchange rate between the currency that your ETF is listed in and the currencies in which the ETFs assets are held.

How might this risk affect your investment? Imagine that the price of the overseas shares does not change over the next six months. You might expect that your ETFs value will also be unchanged. However, because of the currency risk, this is not necessarily true. If the exchange rate changes between the currency your ETF is listed in and the foreign currency changes, then your ETF can change in value, even though the value of the underlying assets has not changed.

As the ETF holder, you are generally long the overseas currency via your ETF. If the overseas currency strengthens, the holdings of your ETF are worth more in the ETFs listed currency, and therefore, the ETF will be more valuable.

Dealing with ETF Currency Risk

So what are your options in dealing with ETF currency risk?

Do Nothing

You might decide you are prepared to take the rough with the smooth. If you own many ETFs invested in various countries then you might argue that your portfolio is diversified and that it may all balance out. A health warning here is that if your ETFs are listed in U.S. dollars, remember that the U.S. dollar is generally viewed as the worlds reserve currency of choice. This means that, at times in the past, the U.S. dollar has strengthened or weakened in value against many other currencies simultaneously, thus diversification may not always be as effective as hoped.

Another viewpoint is that you are presumably investing in the overseas companies via the ETF because you expect those companies to succeed. It could be argued that economically successful countries will tend to have stronger currencies. In other words, you may think that the ETF currency risk discussed above will generally work in your favor, given your expectation about those companies and countries. This is very much a value judgment, but it is an approach taken by many investors.

Hedge Your Currency Risk

If you want to mitigate the currency risk either partially or fully, you can hedge your position. There are several ways to do this. One way is to find an ETF provider that offers this as part of the funds specification. Another is to hedge yourself using FX futures contracts or even FX ETPs. You will probably need to use Short FX ETPsn because they are generally listed in terms of the domestic currency (which you need to sell).

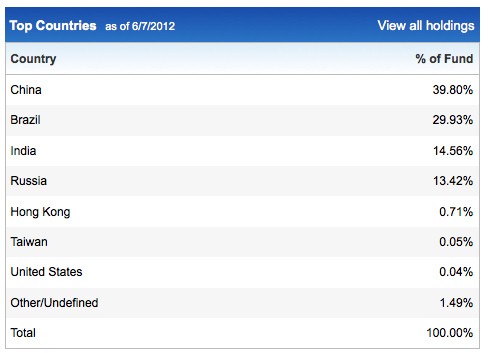

Remember, for ETFs that are invested in companies in multiple currencies, you will need to hedge each currency separately in the correct ratio. This might be onerous or costly. You could instead just hedge partially or just hedge the larger currency exposures in the fund.

Hedge the Right Way!

This cannot be stressed enough and FX trading is notorious for this simple pitfall. If you hedge the wrong way, you do not eliminate your risk, you double it! One great tip to make sure you are hedging the right way is to backtest. Check the price of your ETF and the underlying shares from a year ago (for example) and check the relevant FX rates at that time. Now see how they have changed since. If the ETFs price has fallen by 20% but the underlying shares or index have only fallen by 10%, would your FX hedge be able to make up for the other 10%?

The Bottom Line

ETFs that invest overseas can offer the investor a relatively low-cost vehicle to broaden their investment horizons. However, there can be a currency risk that should be understood. There are several options in order to deal with this risk (including doing nothing and viewing this risk as part of the opportunity). The first step is always to understand the risks, before deciding the strategy to fulfill your investment goals.

More From Investopedia