Become a Registered Investment Advisor

Post on: 19 Август, 2015 No Comment

Registered Investment Advisor Registration

There is more to registration than completing the ADV form!

Investment Advisor Registration Services – from Start-up to On-Going Administration — include:

- Registering investment advisors with state or federal regulatory agencies, as appropriate.

- Developing standard forms of Investment Advisory Agreements to meet requirements and provide maximum protection to the advisor.

- Identifying cost-effective sources to perform specialized services; especially legal and accounting.

- Developing procedures to ensure timely and accurate completion of required compliance and accounting functions.

- Training administrative personnel in compliance and record-keeping requirements.

- Performing Blue Sky filings for investment advisors and limited partnerships.

- Establishing relationships with brokers, including Prime Brokers.

- Facilitate opening accounts.

- Reviewing practices for compliance with regulations.

Fees:

Each RIA registration is unique and fees change upon complexity. Besides consulting fees, other costs are state and/or federal filing fees, FINRA exam study materials, and FINRA exam test fees.

The complete registration process is handled — from completion of Form ADV to responding to regulator comments, and forwarding complete files to the client once the certificate is received.

The startup cost also includes a filing to the Department of Labor in order to allow the RIA to take ERISA clients. There is no filing fee associated with this filing.

After the client is registered, services can be provided for ongoing compliance services, which are billed on an hourly basis. These services range from answering questions regarding record keeping requirements to informing clients of upcoming regulatory deadlines, and submitting the necessary documents if requested.

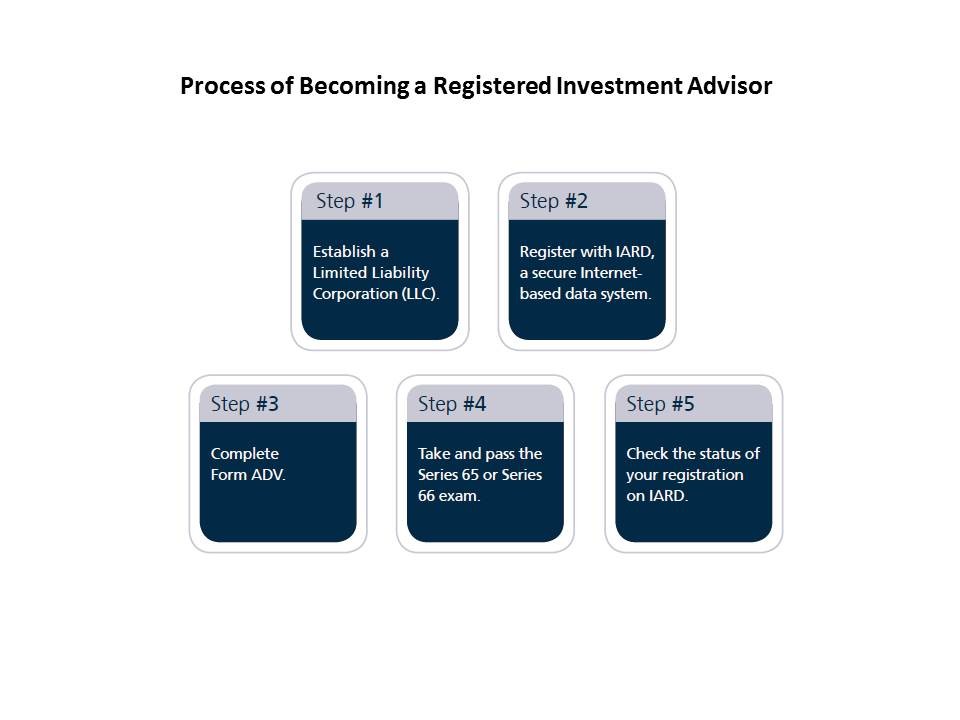

Here is the general process used to file an initial investment advisor registration:

- Phone interview with client to discuss the kind of business to be done;

- Draft of Form ADV is created, then forwarded to client for review;

- Comments regarding Form ADV are received and revisions are made to the draft;

- Final draft of Form ADV is sent, along with documents for execution;

- Execution documents are received and registration package is submitted to regulatory agency

- If comments are received from the regulatory agency, a response is prepared and submitted:

- Original certificate of registration is received, and complete files are sent to the client.

- The registration package to the regulatory agency will include any associated documents required for registration.

Exams:

Generally the state securities administrators require the Series 65 Uniform Registered Investment Advisor exam. They will accept, however, the Series 7 in combination with the Series 66 .

Some professional designations, such as the CFA. CFP. CIC, APFS, or ChFC, will waive the exam requirement.

If the Investment Advisor is going to run a Hedge Fund and trade commodity futures, a Series 3 National Commodity Futures Exam is often required.