Balter Liquid Alternatives Files for Second Alternative Mutual Fund

Post on: 23 Июнь, 2015 No Comment

Less than a year after launching its first fund, a multi-manager long/short equity fund. Balter Liquid Alternatives has filed for its second alternative mutual fund. The companys second fund, the Balter Discretionary Global Macro Fund, will be seeded by converting an existing separately managed account (SMA) into the fund. By doing so, Balter will be able to use the track record of the SMA to market the new fund. The SMA has a track record dating back to 2008, which will give the new fund nearly seven years of performance out of the gate.

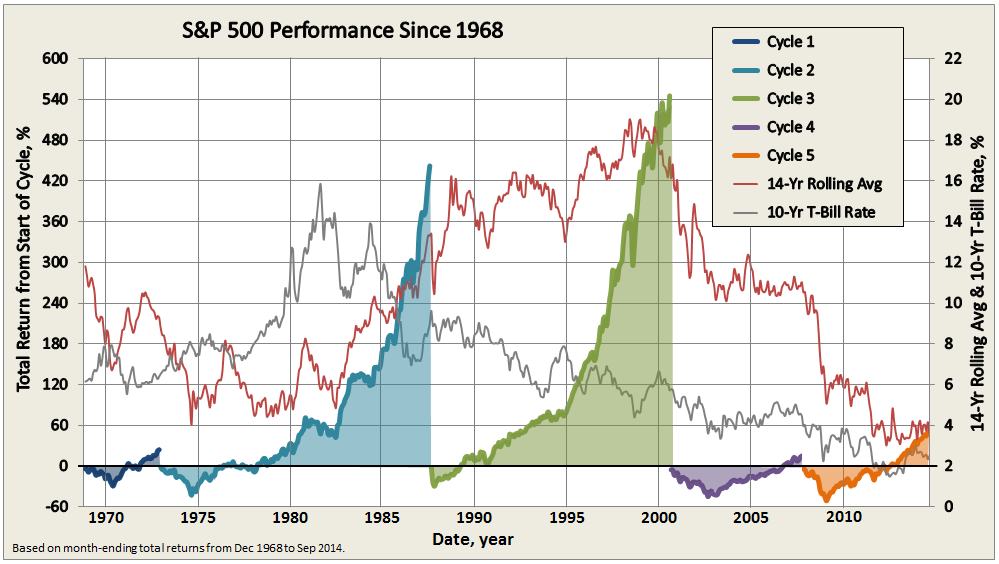

Annual performance on the global macro SMA, which has an inception date of 4/30/08 and as represented in the funds registration filing. is shown in the chart below:

The fund will be sub-advised by Willowbridge Associates Inc. and managed by two portfolio managers: Philip L. Yang and Frank C. Marrapodi. Yang is the founder of Willowbridge and established the firm after having worked at Caxton Associates as Director of Research, and later as Director of Commodity Trading. Marrapodi is the Director of Global Macro Trading at Willowbridge and has previous trading experience with Moore Capital Management, Salomon Brothers and Citigroup. Willowbridge is based in Plainsboro, New Jersey and was founded in 1988.

Investment Approach

Key points regarding the investment approach, from the prospectus, are as follows:

- The Fund employs a “global macro” investment strategy which seeks to achieve positive absolute returns in most market environments by creating a portfolio of investments diversified among investment styles, strategies and asset classes that are not expected to have returns that are correlated with each other or with the broad equity or fixed income markets.

- The global macro strategy employed by the Fund is expected to make extensive use of derivative instruments, which are generally financial contracts whose value depends upon, or is derived from, the value of an underlying asset, reference rate, or index. [Editors Note: this is very common for global macro and managed futures strategies and allows the managers of these strategies to efficiently move capital as opportunities in the markets evolve.]

- The Fund may invest up to 25% of its total assets in a wholly-owned and controlled Cayman subsidiary (the “Subsidiary”). [Editors Note: this is not unusual, and is used to gain exposure to commodity markets without violating Internal Revenue Code relating to regulated investment companies.]

Key Fund Facts

- The fund will carry over the track record of an existing separately managed account that has an inception date of 4/30/08.

- Advisor: Balter Liquid Alternatives, LLC

- Sub-advisor: Willowbridge Associates Inc.

- The prospectus allows for the addition of additional sub-advisors

- Inception date is scheduled for 12/31/14

- Management fee of 1.70%, which includes any fees from the Subsidiary

- Expense ratio of 1.89% for Institutional Class shares, and 2.19% for Investor Class

Generally speaking, this looks like a competitively priced global macro fund from an experienced manager, and with a solid track record in the SMA account. We look forward to learning more about this fund and seeing it launch at year end.