Avoid Contango With These Five Commodity ETFs

Post on: 11 Апрель, 2015 No Comment

The rapid development of exchange traded products has brought with it increased diversity in the investing space. Markets segments that were once nearly impossible for the average Joe to reach have now become as easy to buy as a share of ExxonMobil. Some of these elusive market segments include emerging markets, high yield fixed income, and commodities, the latter of which is one of the most popular and fastest growing segments of the exchange traded world.

It used to be that investors had to own a futures account, which can be very complex and risky, in order to invest in commodities. With these accounts being so difficult for the average trader to use, exchange traded products stepped in to act as a vehicle for buyers interested in achieving commodity exposure but with minimal risks regarding margin and leverage. Now, traders can gain exposure to various futures contracts, or even physical commodities. through the exchange-traded structure, cracking this corner of the market wide open. But as commodity ETFs have had a meteoric rise to popularity, they have had their fair share of backlash as well [see also How Contango Impacts ETFs ].

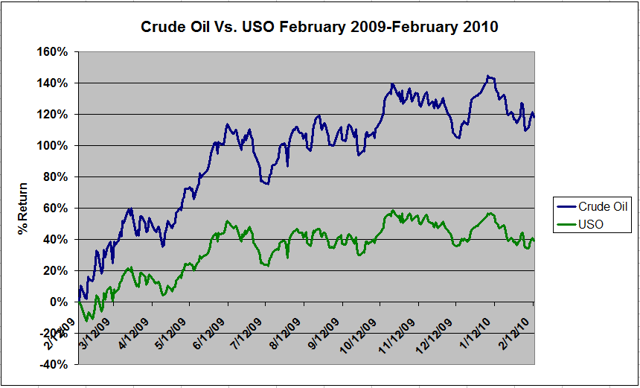

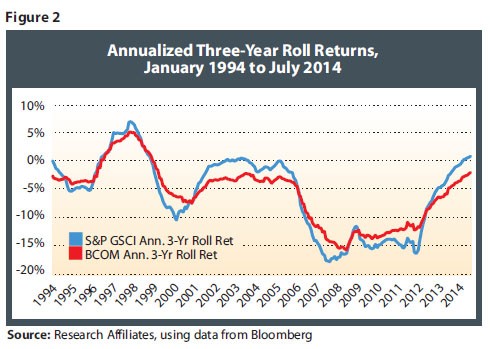

The biggest issue with numerous futures -based funds is contango. When futures markets are contangoed–near month futures are cheaper than those expiring further into the future–the roll process can mean selling low and buying high, thereby creating some significant headwinds for investors. Exchange traded commodity products are powerful tools, but can lead to undesirable outcomes if used by those who do not fully understand them. The most important thing to remember about these products is that they should be thought of as a futures contract first and an ETP second. As a result, investors must realize that the contango is little more than the storage costs for a commodity by a different name, eating into returns in order to pay for these often significant costs. While contango can can damage the value of long positions, there is an opposing force in the futures world that many investors use to generate strong returns known as backwardation [see also Commodity ETF Investing: Four Strategies For Fighting Contango ].

This process is simply the opposite of contango, whereby near month futures are more expensive than those expiring further into the future, creating a downward sloping curve for future prices over time. In this case, the roll process of an exchange traded product would mean selling high and buying low, giving investors a powerful strategy to work with as their products roll over from month to month. A long position in a backwardated ETF, if monitored closely, could lead to strong gains for a portfolio, assuming of course, that the backwardation continues unabated. Below, we outline several ETFs that currently have backwardated futures contracts, potentially allowing investors to take advantage of this downward sloping futures curve. With that being said, investors shouldnt take this a buy list as the backwardation could disappear at any time leaving some investors in the lurch. Instead, investors should take a closer look at these commodities to see if the fundamentals, as well as the backwardation characteristics, make for a compelling investment case for client portfolio.

iPath Dow Jones-UBS Cotton Total Return Sub-IndexSM ETN (BAL )

This product tracks a single-commodity sub-index currently consisting of one futures contract on the commodity of cotton. In 2010, BAL was among the top gaining ETPs as cotton prices soared due to various snags in emerging market production. Now, its futures contracts are backwardated all the way through December of 2012, creating a unique opportunity for traders looking to utilize this downward sloping curve. The current July 2011 contract is trading at $1.5339, which will continue to drop all the way to the December 2012 contract, which is trading for $0.990 Investors should take note that cotton prices have recently hit a historic high, and may be due for a correction that could drag down this product, backwardation and all [see also Seven Best ETF Performers Of Q1 (And Five Of The Worst) ].

United States Brent Oil Fund (BNO )

This ETF measures the daily changes in the spot price of Brent Crude oil. one of the most popular oil benchmarks in the world. This North Sea oil product is currently backwardated for the next two years, leaving plenty of room for BNO to make gains based on the end of the month roll and re-buy that futures based products are subject to. So far in 2011, it would appear that BNO has taken advantage of its backwardation as well as significant geopolitical issues as it has already returned 33% since the beginning of the year.

Corn Fund (CORN )

Teucrium s CORN ETF is the only fund that exclusively offers exposure to corn futures. This important grains futures are currently in backwardation through the end of 2012. This relatively new fund, introduced mid-way through 2010, has had an impressive run. It has gained over 75% since inception, with 14% coming in 2011 alone. Investors looking to buy into the backwardation strategy should give this fund a closer look, as corn is an extremely important global commodity that makes its way into a variety of everyday products. [see Talking Commodity ETFs With Sal Gilbertie Of Teucrium ].

United States Gasoline Fund (UGA )

With crude oil spikes leading to hefty increases at the pump, the world has a watchful eye on all things gasoline, including this ETF. UGAs main contract is on RBOB Gasoline (Reformulated gasoline Blendstock for Oxygen Blending), which is simply the fuel that consumers use for their cars, lawn mowers, etc. For the time being, these futures are backwardated through January of next year, leaving plenty of time for investors to make a profit off of the futures curve should it remain out of contango. This ETF was enjoying steady gains long before the crisis in Libya struck, though that did help push this fund up to its current level of a 31% gain on the year.

United States Oil Fund (USO )

USO is one of the most popular commodity funds on the market, exchanging hands over 13 million times a day. The fund hold futures contracts on light, sweet crude oil (WTI), which will be hitting a period of backwardation starting with the October 2011 contract. This contract is currently selling for $113.70, and will continue to drop until the March 2016 contract, which is selling for $105.53. This represents an approximate 7% drop in price over that time period. USO is up roughly 15% on the year, though these gains also are tied to surging geopolitical worries and inflation concerns, not just backwardation [see also USO vs. BNO: Explaining The Big Gaps In Oil ETF Performance ].

[For more ETF ideas sign up for our free ETF newsletter .]

Disclosure: No positions at time of writing.