Automated Trading System for Futures Forex and ETF s

Post on: 12 Июнь, 2015 No Comment

Top 10 Trading Systems for 2015

*All systems can be leased for $50/month for up to 2 contracts. Additional leases are required for additional contracts.

Leases are month to month and automatically billed through Paypal.

Leases can be cancelled at anytime within your Paypal account or by emailing us .

Annual leases are also available at a discount for up to two contracts/lease. Email us for more details.

Trading System Portfolios

Trading system portfolios are developed by combining different trading systems that use different methods in order to seek reduced risk through diversity. Multi-market, multi-method trading systems that trade trend and counter trend approaches provide opportunities to profit in every type of market environment. Experience in the markets and understanding each systems response to certain market conditions will allow for a determination of which systems will work best in current market environments.

The Nine System Portfolio is our recommend day trading portfolio for the futures. This Portfolio day trades four different markets: E-mini S&P, Euro Currency, Crude Oil, and Soybeans.

The Nine System Portfolio is selective it it’s trades, seeking to capture long term day trades and to maximize average trade profit. There are four systems traded on the E-mini S&P, two trend, and two counter trend, two systems traded on the Euro Currency, one trend and one countertrend, two systems traded on Crude Oil, one trend and one counter trend, and one trend trading system for Soybeans.

The Nine System Portfolio is available in all three platforms, Tradestation, MultiCharts, and NinjaTrader.

Money Management Algorithms

Money management can be the third dimension of a trading plan. Many times, this one factor can be the biggest factor in overall returns. Traditionally money management refers to the percentage of a portfolio or investment capital to allocate to each trade and how to vary the allocation percentages based on market conditions and the trading performance of your current trading system or strategy. Some of our latest money management research and strategies include systematic equity curve management strategies such as letting the basic system trade in simulation mode so that it will continue to generate an equity curve. The money management algorithm will only allocate real trades when the trend of the equity curve is up. Another example of one of our systematic money management algorithms is to stop trading at a pre-defined draw down and then to start again once there has been a run up of a predetermined amount from the equity curve lows.

Note that the second equity curve also requires the moving average of the equity curve to be in an uptrend. To accomplish these equity curve management strategies successfully we use DLL’s to generate the trades in one window, and then pass the information from the trading to a second window that has a strategy that uses the original rules in addition to the equity curve management rules.

Providing Rule Based Strategies for Stocks, Futures, and FOREX

Trading the markets is a challenge that we enjoy facing with research and trading system development of trend and counter trend trading systems. We specialize in futures but our strategies work on Forex, ETF’s, and stocks as well. Some strategies date back to December 2000 while some of our newest strategies were developed in the past year. Cobra, another favorite was developed in 2005.

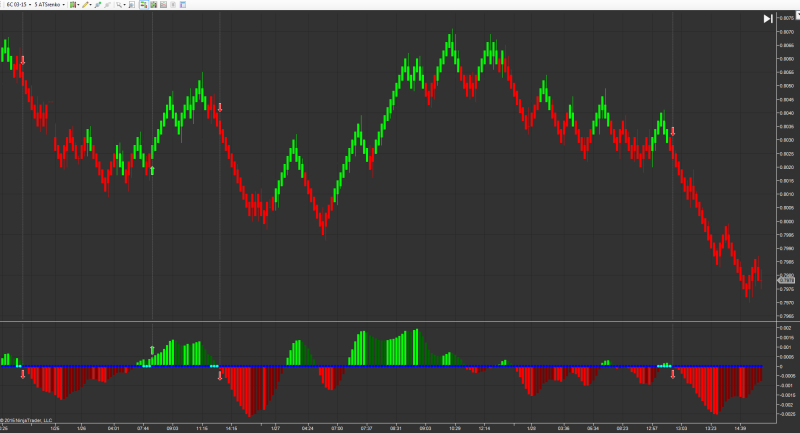

Most of our analysis starts with either the E-mini S&P futures or the Euro Currency and then is applied to other markets to see how it works. The system that works over the broadest range of markets is the Cobra, our flagship trend following day-trade strategy. Cobra CT is our counter trend version of Cobra.

Counter trend strategies are popular with traders as the perception of finding a turning point provides a lower risk approach. This is not always true. In strong trends, there are inflection points, or prices where the market moves away from so strongly, that the likely hood of returning to the prices the market just left has a very low probability. In this case a trend that accelerates can also provide a low risk entry point when entering a trade near that inflection point.