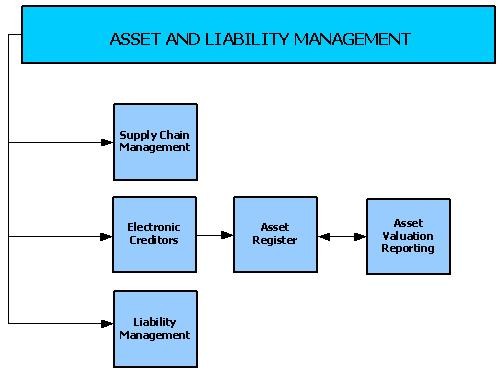

Asset Liability Management

Post on: 16 Март, 2015 No Comment

Asset liability management (ALM), the management of assets with a view to the liabilities, is one of the key responsibilities of an institutional investor. This issue is relevant not only for pension plans, pension funds and contractual trust arrangements, but also for foundations, banks, insurance companies and family offices.

Based on your specific liability structure, we derive an optimal investment policy consisting of a strategic asset allocation tailored to your risk management situation. Upon client request, we implement this investment policy and then continue to support you with regular updates, advising you on adhoc issues as they occur.

If required, we derive an index for your liabilities as a customized benchmark, which illustrates the economic development of your liabilities and serves as a reference for the performance of your investment.

Within our integrated ALM approach, we can perform robust portfolio optimization, as well as scenario simulations using dynamic risk management strategies that flexibly respond to market developments.

The integrated analysis of assets and liabilities gives our clients a higher transparency on the potential impact of their investment strategy on their individual economical, regulatory and accounting goals. A decision-making process based on an unbiased view also helps with communication – both with internal and external supervisory boards.

We have many years of experience with numerous investors from various industries and their specific regulatory environments (such as VAG, Basel III, Solvency II), as well as their different accounting standards (for example HGB, IFRS, US-GAAP).

Our integrated and dynamic ALM approach allows for a forward-looking simulation of a wide range of investment and risk management strategies with regards to your economic, regulatory and/or accounting objectives.

This analysis can be done both at the aggregate or collective basis as well as the level of individual investors or plan participants.

Our services

(Integrated) ALM study

Liability matching / liability benchmarks

DC investment / glide path advisory

Your benefits

Our powerful ALM platform provides you with a realistic assessment of your overall investment situation.

Improved transparency on the possible effects of an investment strategy on the likelihood of meeting your individual economic, regulatory or accounting objectives.

You benefit from many years of experience with numerous investors from various industries and their specific regulatory framework.

We have experience on a wide range of questions in the areas of defined benefits and defined contribution – both in a national and international context.