Are ETFs With The Biggest Price Upside Potential From MarketMaker Forecasts The Best

Post on: 14 Июль, 2015 No Comment

Summary

- We looked at over 450 widely-held ETFs where Market-Makers [MMs] have been helping big-money fund managers adjust their portfolio holdings.

- Often (usually) the size of their trade orders require MMs to take part of the other side of the trade, putting MM firm capital at risk.

- MMs always hedge such risk exposures when taken. What they will pay for protection, and the way the hedge is done, tells just how far they think prices could run.

- Here are the 50 ETFs with the biggest upsides, and the actual market experiences, good and bad, in the next 3 months following prior forecasts like those of today.

- We ranked them, considering odds of a winning buy, worst-case interim price drawdown, how long it took to get to a forecast sell target, and annual rates of gain.

Which are the best ETF bets today?

Good portfolio strategy says the biggest promises often incur the biggest risks on the way to the profit capture. Or may never reach their sell targets.

So just screening for the best upside prospects is never enough. And finding those big potentials can’t be done just by looking for the most volatile issues, statistically. Price volatility, as measured by standard deviation, produces a symmetrical result. What goes up that way also comes down. Equally.

Some fatally-flawed academic investment theories, like CAPM, the Capital Asset Pricing Model, use standard deviation of returns as a measure of risk, not return. By the way, that doesn’t work very well, and after some 30 years of delusion and commercial misdirection by pension fund consultants and others, it is grudgingly being abandoned.

Instead, some are turning to Behavioral Analysis of looking at the way humans, including investors, perceive the world around them, and behave accordingly. Finally there is recognition that investing, particularly stock investing, is a (very serious) game, with all outcomes dependent on the actions of other players in the game.

Unfortunately, the early attempts in this field have taken the venal tack of looking for mistakes in perception that seem to be habitually encountered. The plot is to try to take advantage of such errors for profit at the expense of the misdirected. It’s a pretty shallow approach, but not unexpected, given the source of earlier theoretical attempts at investing legerdemain.

Instead, we look for what successful folks involved with investments do right, not wrong. We judge success by what their actions produce in the way of compensations. The folks who are making volume markets for big-money investment portfolio managers typically get paid in salary and bonuses over a million dollars a year. To many, that sounds like success. What do they do?

Why market-makers make the big bucks

They don’t take risks, they avoid them. But their jobs of helping clients get million-dollar trade-ticket orders filled promptly and quietly, hundreds of times a market day, usually require that the MM firm’s capital gets put at risk. It becomes the stub end of the other side of the client’s order that the market itself won’t provide.

Thus the client gets his order filled, the MM firm earns a trade spread between what the other investors will take for their shares and what the fund client agrees to pay for the whole block, assuming it is a buy order (which it isn’t always). But that leaves the MM exposed to the risk that the client is right, and the stock goes up. The MM firm is short the shares needed to fully fill the buy trade, and it would cost the MM firm’s principal account as a capital loss, easily more than they might make on the trade spread.

That would be intolerable for the MM firm, so before the client’s buy is agreed to, at any price, a hedging transaction is arranged to protect against such an event. That involves making some guess as to how much protection may be needed. Hundreds of such decisions are needed every day in many MM firms. Decisions that must be reached in minutes for fill or kill orders. Or reached before the market’s end-of-day close for most others.

On the spot decisions are what win trades from valued fund clients, over other MM competitors eager to profit from the same client’s trade opportunity. So all major MM firms have for decades maintained worldwide information-gathering systems, staffed 24×7 year-round by research staffs evaluating how stock price prospects may be changing.

That background input supports the momentary knowledge of what the range of protections are going to cost in various derivative instrument markets that can provide the necessary protection. To keep the game realistic, the sellers of the protection are the proprietary trade desks of other MM firms, whose information support systems tend to be equally able and resourced.

What buyers and sellers of the needed expected protection embed as a cost into the share price of the entire block trade may determine whether that trade gets done. There is lots of motivation to make it happen; that’s how everyone involved gets paid, and if the fund portfolio manager is right on his buy, his reputation (and probably his bonus) benefits.

What we — and you — get from the activity

The benefit for us is credibility of the forecasts, to begin with. A history of how well the forecasts have proven out in time lets us choose investments that best suit our preferences of trade-offs between returns and risks. Chosen from many alternatives each day, with changes coming tomorrow.

Because the MMs are continually being asked to help with stock position changes in volume, with both buys and sells involved, they need to anticipate both upside and downside prospects. Their hedges contain expectations in both directions, ones that are usually not equal, or in statistical terms, symmetric. Asymmetry is what turned CAPM into CrAPM.

But MMs, no matter whether buyers or sellers of protection, are human, make mistakes, get surprises, sometimes turn out to be wrong. How often that happens and how bad are the results, are things that can be observed historically, along with the results of the good guesses. No guarantees here, but there is a past record that provides perspective. And perspective can aid our choices.

Back to the best ETF alternatives

A first screen of the 450 ETFs eliminated about 100 by our quality controls on the forecasts themselves. Another 250 had upsides of less than the minimum we consider needed to undertake any exposure to equity price change risks.

Then we tested the remaining 100 or so for how well their adequate upside forecasts had actually performed, following a Time-Efficient Risk Management Discipline [TERMD], commonly applied to all candidates.

This discipline uses the top of the MM price range forecast as a sell target. The first end-of-day market close price encountered following the forecast that equals or exceeds the target closes out the position. If that has not happened in 3 months (63 market days), the holding is closed out regardless of its gain or loss compared to its end-of-day cost the first market day after the forecast. This is a test that is simple, judgment-free, followable, and auditable.

It also turns out to be a portfolio management style that has many advantages, particularly in wealth building situations.

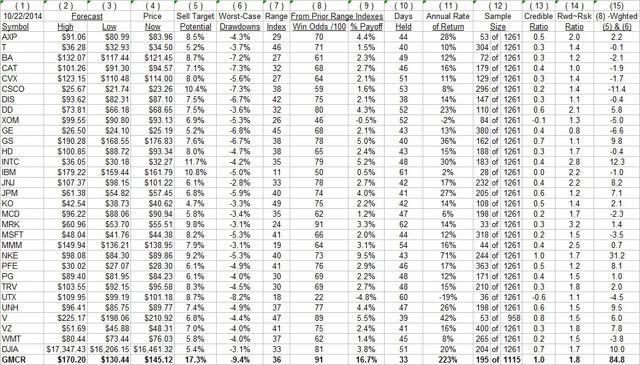

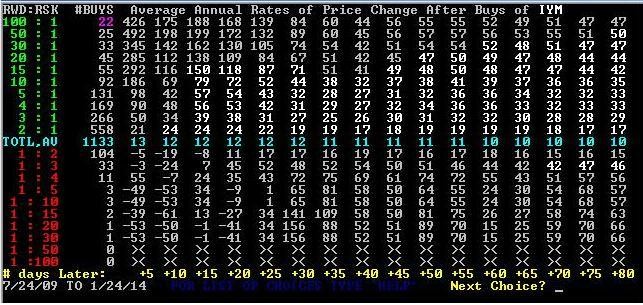

Figure 1 shows its impacts on the best-ranked 50 of the candidates in terms of comparing forecast gain opportunities against actual worst-case price drawdowns.

Figure 1

(used with permission)

Numbered ETF symbols are located on this Risk

Reward map at the intersection of forecast upside price change possibilities (on the green horizontal scale) and the average worst-case price drawdowns from prior forecast TERMD experiences (on the vertical red scale). Good buys are down and to the right, the not so, up and left.

Best choice, based only on this tradeoff, appears to be ProShares Short VIX Short Term Futures ETF (NYSEARCA:SVXY ) at [18], discussed recently in this SA article. But several other portfolio considerations may alter an investor’s preferences. They are provided in the details of the table in Figure 2.

Figure 2

Columns 2,3,4 show the forecasts implied in MM hedging on 10/29/14, with (5) spelling out the upside from (4) to (2). All the other data reflects similar prior forecast results from TERMD management discipline. (12) indicates the number of such experiences out of the past 5 years of 1261 market days or the life of the ETF. The blue summary rows average the ETF subsets and the same measures for our whole population with acceptable forecasts on the day. The SPDR S&P 500 Trust ETF ( SPY) is present as a market proxy indicator.

Portfolio Strategy considerations

Risk vs. Reward is a basic to all investing, but it is not the only one, and how each R is appraised can be the basis for a variety of discussions. We have strong opinions on many of these fronts, derived from over 50 years of professional activity in many aspects of the investment business. But we recognize that while our views are important to us, they do reflect our circumstances usually. The surroundings of many investors often produce differing emphasis. Thank God for that, because it helps to make markets more liquid, more flexible, and more functional.

An ultra conservative investment portfolio’s mission may call it to be a stable and reliable source of cash in emergency, while the investor’s current expenditure needs and future plans are provided for by other means. The job in this case is to stay liquid under all circumstances, with minimal attention to growth or income. In present political interference with money markets, such a portfolio is chained to short-term U.S. Government debt obligations of no more than a year or two, a dismal outlook for capital employment.

At the other extreme, are many previously middle-class (formerly) working folks, who now have futures crushed by layoffs largely motivated by corporate budget demands in a fearful, contracting business environment. The operating economics of advancing information technology may have endangered their continued and future employment.

As they examine pension funds converted from originally dependable corporate defined benefit plans to now defined contribution marketing opportunities for mutual fund management organizations, some 80% of them find balances that haven’t even kept up with major market price indexes — which have just recently got back to where they were 8-10 years ago.

The clock doesn’t stop for any of us, nor for our offspring’s needs to confront a more demanding, complex, and competitive productive environment, nor for the continuing needs of our survivors. For those investors of the previous two paragraphs, trying to meet the challenge requires major changes in investment strategy, away from concern with piddling dividends, to finding the best possible tradeoffs to build wealth through capital gains at the least cost of inevitable pieces of loss bound to be encountered in the process. Time becomes an essential, crucial part of the equation.

While there are hopefully many personal investing assignments between these two extremes, it is with the more desperate needs that we are intent on serving. There we find the most satisfaction in providing assistance, and the analysis in Figure 2 reveals much of what ought to be of help.

True risk is not uncertainty, but in the actual loss of capital. Investing is inherently an activity of alternative selection decisions under uncertainty. On the positive side is an appraisal of the odds for success (and its complement, the likelihood of loss). On the negative side is an appraisal of the scope of possible loss (contrasted with the likely size of gain that is possible.) All are unknowable with certainty, but must be guessed at.

We hope that players in this second most serious game (next to war) will demonstrate by what they earn, their skills of playing well. Which is why we look to the market-making community for guidance. Fortunately, their true expectations cannot be disguised in a well-informed, competitive market that provides their self-protective actions.

Since these actions get repeated dozens of times a day we have an extensive history of daily forecasts that tell where the best guessers have made their best guesses, across the array of possible balances between upside and downside possibilities. All told by the subsequent market actions. Odds of success, costs of failures (losses).

Take care in contrasting forecast gains (5) with actual gains from like forecasts (9) net of losses. When the Win Odds (8) are factored in, it is apparent that many worst-case price drawdowns are subsequently recovered and turned into profitable outcomes. Thus true risk of actual loss and the threat of loss are often quite different things. For many investors, when the threat gets bad enough they may convert threat into reality and take a loss that could be corrected with patience and toughness.

But knowing the odds for recovery depends on knowing how long patience must be extended. That is a decision with different answers for many investors. Our TERMD discipline sets a 3-month limit to any holding to make the measurement finite. It could just as well be 6 months. Wherever it is set will affect the ultimate average of net AROR gains across the portfolio’s experience since different investment selections may have different sensitivities. Our approach is to set one limit and not try to over-tune the discipline.

Please study the differences presented in the details between the investment candidates in Figure 2. Recognize that their relative attractiveness, to whatever combination of appeals, will be somewhat different tomorrow, and considerably different a month or six months from now as situations and investor perceptions change.

Conclusion

The purpose of this article is not to pick a best investment right now, although it might be used that way. Instead, we hope it will get individual investors thinking about how choices may be made among alternatives, while we all are faced with continually changing uncertainties. Further SA articles will explore the subject in other dimensions.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.