Are Consumer Confidence Indices Useful As Leading Indicators

Post on: 30 Июль, 2015 No Comment

Consumer confidence fell to its lowest level in more than two years, the Conference Board reports. Thats a discouraging sign for the economy. No ones really surprised, given the various ills weighing on the economy, although some analysts doubt that such measures are all that valuable. Consumer confidence usually is not a good indicator of spending, Edward Meir, MF Global senior commodities analyst, tells AP. People may say they dont feel great but they still spend.

Quantifying how consumers think is a fuzzy art under the best of circumstances, but that doesnt stop anyone from trying. There are several confidence measures to consider. A popular alternative to the Conference Boards index is the Thomson Reuters/University of Michigan survey, which has also slumped recently, falling to its lowest level in August since November 2008. Yet another reason for caution.

How much stock should we put in such measures for gauging the future? Consumer confidence benchmarks surely deserve routine monitoring, but the standard caveat applies: Any one predictor is subject to failure at times, and so we need a diversified mix of factors to minimize the potential for error. That said, consumer confidence metrics are a valuable addition to the mix. There are no silver bullets here and so when used in isolation they should be taken with a grain of salt. But theres also a danger if we ignore these metrics because they can tap into a different stream of intelligence about the business cycle. Indeed, there are times when ignoring a slump in consumer confidence has been misguided, to say the least.

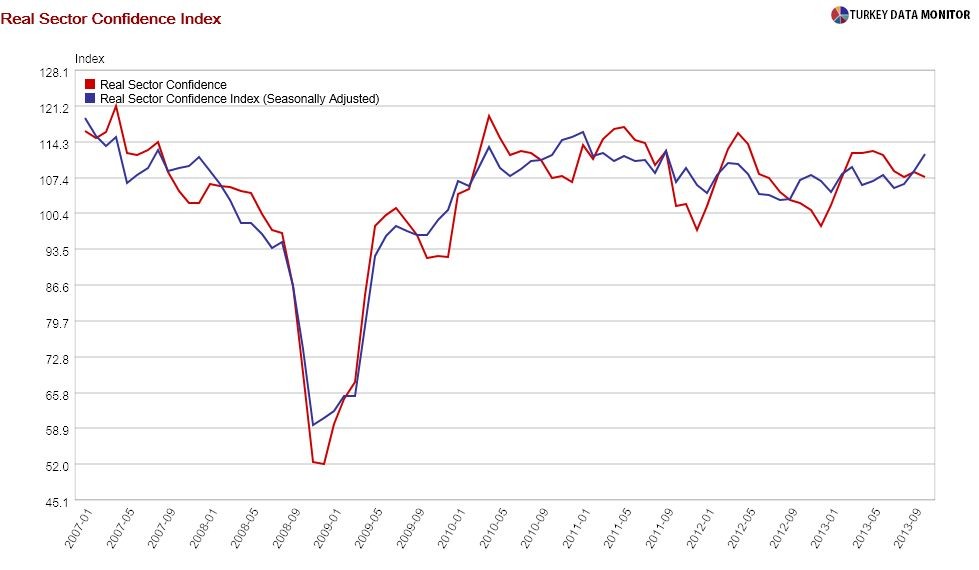

A recent study from the European Central Bank, for example, tells us to take these numbers seriously:

…the results show that the consumer confidence index can be in certain circumstances a good predictor of consumption [in the U.S. and Europe]. In particular, out-of-sample evidence shows that the contribution of confidence in explaining consumption expenditures increases when household survey indicators feature large changes, so that confidence indicators can have some increasing predictive power during such episodes.

Consumer Confidence as a Predictor of Consumption Spending: Evidence for the United States and the Euro Area

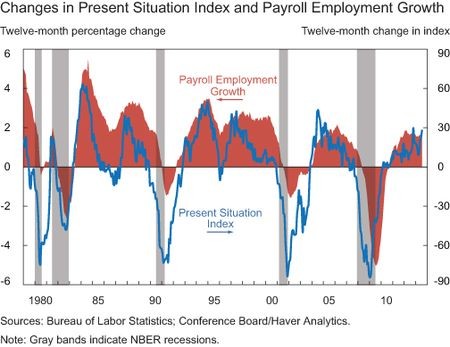

One of the studys charts compares the historical fluctuations in the University of Michigan Consumer Sentiment Index with real (inflation-adjusted) consumption in the U.S. noting that the correlation between the two series is rather high. Its far from perfect, but the point is that its not random either.

The ECB study isnt the first time that researchers have found a productive link between consumer confidence indices and economic activity. A paper from 1994, for instance, found a relationship between confidence measures and economic activity (Does Consumer Sentiment Forecast Household Spending? If So, Why? ). There also seems to be a connection, as you might expect, between consumer confidence and the stock market. As research from a 2003 issue of The Journal of Portfolio Management advised:

Consumer confidence rises with high stock returns, but high consumer confidence is followed by low stock returns. Sentiments of individual investors about the stock market improve with consumer confidence about the economy, as if individuals were unaware that stock prices are a leading indicator of the economy.

Consumer Confidence and Stock Returns

A 2005 study presents evidence that both consumer confidence and stock prices have an important role in the United States business cycle, especially at times when a cluster of large shocks to either of them occurs (The Influence of Consumer Confidence and Stock Prices on the United States Business Cycle).

Its true that some economists cast aspersions on the idea that consumer confidence indices are helpful for looking ahead. Clearly, theres room for debate, as there is with any one indicator. But to the extent that we try to peel away some of the futures uncertainty, adding consumer confidence gauges to a broad mix of variables is almost certainly worthwhile. Thats hardly a guarantee, but no other factor can offer assurances either. Instead, this is a game of minimizing the potential for misleading forecasts. More often than not, using consumer confidence metrics in connection with other indicators, such as the 12-month change in the stock market, initial jobless claims, the yield curve, etc. sheds light on the state of the economy. But caveats abound, including the argument that not all consumer confidence benchmarks are created equal.

Technically, consumer confidence is considered a lagging indicator, or so a number of dismal scientists opine. In that case, these benchmarks are telling us whats happened. But understanding the past can sometimes help with anticipating the future. In fact, some references to these measures are labeled as leading indicators, as in The Economist Guide to Economic Indicators , for instance. Whatever category you prefer for consumer confidence metrics, just dont ignore them.