Arbitrage Strategies and Price Relationships

Post on: 21 Июнь, 2015 No Comment

Long underlying + short call

* Using the same strike price and expiration date

These are not new strategies. We have discussed them before, and you will see them covered in many intermediate or advanced option trading books. The point here is not to suggest new trades you should consider doing, but rather to use them to put things in perspective and show how the underlying, options, and their prices are related.

Synthetics are used in arbitrage because all basic option strategies have a synthetic equivalent. And if the risks and rewards are the same (across the same strike prices) then a synthetic position should be priced the same as the actual position. That is, at the same strike prices, a synthetic call should cost the same as an actual call. If this condition is violated, an opportunity for arbitrage exists. The arbitrage strategies we will be using in this article are:

Box Spreads

Jelly Rolls.

Most option traders will probably never use these arbitrage strategies. But even if you don’t trade these opportunities, understanding the mechanics of arbitrage and the relationships will make you a better trader and give you a new way of looking at options. Let’s begin by looking at the first two, conversions and reversals, since these two strategies clearly show the relationship between the price of the underlying and the price of the put and call options.

page 2

The Conversion Strategy

The price of the put and call options across the same strike prices can not get very far out of line from the fair value dictated by the underlying price. As long as the risk and reward is the same, a synthetic call should cost the same as an actual call option. If it is not, then an arbitrage opportunity exists. You can buy the cheap one and sell the expensive one for a risk-free return. This is what the conversion strategy does. A conversion involves:

Buying 100 shares of the underlying stock

Buying a put option; and

Selling a call option (at the same strike price as the put).

The long stock (in the same amount specified in the options contract, 100 shares in the case of most stock options) plus the long put creates a long synthetic call. This is then offset by the actual short call option. This is a no-risk position. The potential return is simply based on the traded prices of all components.

Another way to look at the conversion strategy is to group the option positions together and compare them to the underlying position. Combining the long put and short call create a synthetic short position in the underlying. The put makes money when the market drops and the call loses money when the market rises, so having the two option positions is just like being short the underlying. The conversion is completed, then, by buying the underlying, offsetting the synthetic short.

No matter how you look at it, you can see how puts, calls and the underlying asset are closely related. One value cannot move too far away from the other. The Graphic Analysis for most arbitrage strategies looks quite boring: A single horizontal line.

In this case, the calls and puts for XYZ Corporation are fairly valued. There is no reason to try this one at home, because if you put this trade on, in 29 days you would just be guaranteed to lose $16 no matter what the price of the underlying stock. However, if you found a case where the line was substantially above zero than the horizontal line would become quite exciting. If you could then actually execute the trade at those prices, it would mean you found a mispriced conversion, meaning a guaranteed profit with no risk!

page 3

The Reversal Strategy

The reversal strategy is just the opposite of the conversion. That is, you sell the underlying short and place a synthetic long position. The actual transactions needed would be:

Short 100 shares of the underlying stock

Buy a call option; and

Sell a put option (at the same strike price as the call).

Looking back at the table of synthetic relationships, you can see that it can again be grouped a different way. The short underlying position plus the long call is a synthetic long put option, which is then offset by the actual short put option.

Again, there is no risk in this position. The only reason to do it is if you can buy the synthetic put for less than the bid price of the put you need to short. This is just another example of the buy low, sell high theme that runs throughout the investing world, except that no time lapse is involved. You get to buy low and sell high at the same time.

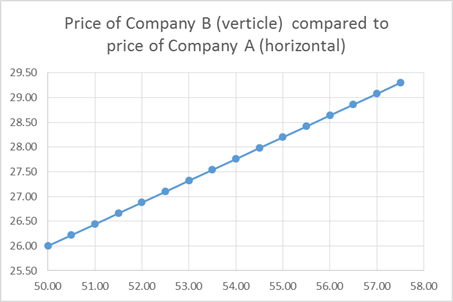

It is easy to get confused with these strategies, but remember the point of this section. It is to show how the calls, puts and underlying are related. The price of any one cannot move very far without the others adjusting as well.

Put-Call Parity and Box Spreads

In addition to their relationship with the underlying asset, the price of each option is also related to the price of all the other options. The value of the puts and calls are related by means of an important theory in options pricing called Put/Call Parity. This theory says that the value of a call option implies a certain fair value for the corresponding put, and visa versa.

Naturally, there are arbitrage strategies that are designed to profit if these relationships get out of line as well. I won’t go into the theory of Put/Call Parity here, since there are already other articles here on DiscoverOptions.com that go into this subject in detail.

You may have already guessed that the previously discussed conversions and reversals are two arbitrage strategies that could be used to take advantage of any mispricing in the relationship between puts and calls. But you can also do both of them! When you do a reversal at one strike price and a conversion at another (all options in the same expiration month), the long and short positions in the underlying cancel out, and you are left with what is called a Box, an arbitrage strategy that uses four different options.

It is probably easiest to think of a box as doing both a bull spread and a bear spread. One spread is established using put options, and the other is established using call options. The spreads may both be debit spreads (a bull call spread vs. a bear put bear spread) or both credit spreads (a bear call spread vs. a bull put spread). Below is an example of one using the options in our hypothetical XYZ Corporation again.

As you can see, the options are fairly valued and the only result of placing this particular trade would be to make you poorer by $140 (and your broker a little richer). The risk graph is simply a horizontal line, just as all truly risk-free pure arbitrage trades would be.

page 4

Inter-Month Relationships and Jelly Rolls

The previous arbitrage strategies all used options within the same expiration month, and we have seen how the underlying and these options are related in one way or another. What about options from one expiration month to the next? Are there relationships between these as well? Yes, there are.

Under normal circumstances, the implied volatility of the options in the farther-out months is a little higher than the front month. When that relationship is backwards, it may seem like a great trading opportunity. When traders see this happen they tend to think about placing calendar spreads that involve selling front month options and buying the farther-out options. The idea is to sell higher implied volatility and buy lower implied volatility, and then make money when the volatilities reverse themselves.

But there can be a problem with taking this route. Calendar spreads are typically market-neutral strategies that make money only if the stock stays in a narrow trading range. But keep in mind that implied volatility is the market’s expectation of the magnitude of future stock price changes, and implied volatility that is higher in the front month than the back months is usually telling you something.

When you see implied volatility higher in the front month, there is almost always a reason for it. For example, it could be an upcoming earnings announcement, uncertainty regarding a particular sector, or an upcoming news item such as an FDA announcement. In those situations, the stock price could move up or down a great deal, depending on how the marketplace interprets the news or announcement.

When a stock moves around a lot, market neutral trades are not necessarily going to be profitable, even if you sold high implied volatility and bought low implied volatility. So when you see situations where the front month volatility is much higher than a farther out month, do some research before you enter any trade. You will probably find the reason why others are predicting wide short-term swings in the price of the stock.

With that word of warning out of the way, let’s show how the options of different months are related using an arbitrage strategy call a jelly roll, sometimes simply called a roll. To do this, we will again start with the conversion and reversal strategies. Consider the following reversal using our hypothetical XYZ Corporation:

Short 100 shares of the underlying stock at $75 a share.

Long the August $75.00 call option

Short the August $75.00 put option; and

Now, a conversion:

Long 100 shares of the underlying stock at $75 a share.

Short the December $75.00 call option

Long the December$75.00 put option; and

If we place both positions simultaneously, the two underlying positions cancel out, leaving you with the following position:

August options December options

Long $75 call Short $75 call

Short $75 put Long $75 put

This is a jelly roll. It may be easier for you to think about this in the synthetic sense. You have a synthetic long stock position in the August options and a synthetic short stock position in the December options. You are just spreading one month versus the other.

If you are dealing with futures options, where these option months would be based on different futures month, then you are essentially just trading one month’s value versus another. But when you are looking at a stock, this opens up some interesting issues.

Think about what this position actually is. Once you reach the August expiration, you will be left with a long position in the stock. Why? If the stock price moves up, the call option will be in-the-money and you would exercise it. If the stock price falls, the put will be in-the-money and you will be assigned. Either way, you will be long the stock.

The December position is just the oppositeyou would be short the stock after expiration. Once you reach this date, the short position would, of course, cancel out the long position. In a way you could say the jelly roll is a position where you arrange to be long the underlying at some point in the future and then hold it for a short period only.

Now we need to think about how the position should be priced. It all has to do with carrying costs and dividends. Carrying costs refers to the cost of holding the stock for the four-month period from August to December. With the current risk-free interest rate at about 1.75% and the stock at $75, the cost of carry for four months is:

$75.00 x 3/12 x 1.75% = 2.625

This is what the jelly roll should be priced at without dividends. If it is less there would be an arbitrage opportunity. In fact, placing this exact trade would cost 7 or a net debit of $70, so no arbitrage opportunity currently exists in this situation.

You can see how a change in just one of the component options would provide the smart traders out there with an opportunity. As they began to take advantage of it, they would drive prices back in line. So any deviation from fair value would not last very long. Keep in mind that the reason we are looking at this strategy is not for you to turn around and trade it. It is to simply understand how the option prices are related.

page 5

Transaction Costs and Dividends

In all the above examples, I have only touched on the effects that transaction costs and dividends can have on option pricing. It is easy to see the effect transaction costs can have. You simply need to make sure that the profit from any of these strategies is greater than your transaction costs. Since is worthwhile to do the trade only if you can at least cover your transaction costs, options prices can thus be out of line (and stay that way even in the long term) by the amount of those transaction costs.

Dividends are a little more complicated, but still pretty easy to factor in. Let’s look at an example of a reversal on a stock that pays dividends. You would need to reinvest the proceeds from the short sale of stock at a sufficiently high interest rate to cover any dividends, and still have more than enough to pay the strike price on the expiration date of your synthetic long position. Thus you need to pay a bit less for your calls and sell your puts for a little higher price.

For the jelly roll, if the stock pays a dividend during the holding period (August to December in the above example) it would change the relative value of the position in each expiration month. The impact would be to lower the fair value of the jelly roll by the amount of the dividend. Increasing dividends will boost the value of the front month options and reduce the value of the back month options, reducing the cost of the roll.

I would also like to mention again the importance of correct dividend information when modeling these arbitrage strategies on a stock that pays dividends. Many of the candidates you will if you scan for put/call differentials can be explained by incorrect dividend information. After researching and inputting the correct upcoming dividends, those apparent opportunities will disappear.

I have tried to demonstrate all the relationships between the various securities the underlying stock, the call options and the put options, as well as the different expiration months using various arbitrage strategies to explain the fundamental relationships that underlie their pricing.

If you are not on the trading floor, the probability of finding one of these arbitrage trades is very small. Off-floor traders can look for undervalued opportunities, but with electronic trading there are thousands of other traders, often using specialized computer software applications, watching market quotes for bargains. That has reduced the life of a mispriced quote to just seconds, often less than one second.

The short life of these opportunities means that if you find one you need to jump on it immediately. That can be dangerous because it doesn’t leave you time to do the thorough research you should to see what is causing g those mispriced options. Chances are you will find many apparent opportunities are simply due to a stale or incorrect quote. Keep in mind the danger of incorrect data (such as dividends) and how incomplete information can make a fairly valued situation look like a risk-free opportunity.

When trading options, the average retail trader should be content with just making sure that the options they are trading are fairly valued. It is important that the retail trader have a firm grasp of the fundamental principals that underlie the pricing of each option, and know that if these relationships get out of whack an arbitrage opportunity exists. Compared to someone that does not know about arbitrage relationships you will have a much better understanding of what an option really is.