Another VIX ETF Long

Post on: 26 Май, 2015 No Comment

UBS became the latest issuer to introduce a product linked to a VIX-related index on Wednesday, launching the E-TRACS Daily Long-Short VIX ETN (XVIX ). The new exchange-traded note, which is linked to the S&P 500 VIX Futures Term-Structure Index Excess Return. is the first U.S.-listed ETP to offer investors exposure to a strategy that includes both long and short exposure to VIX benchmarks. The underlying index is a composite that measures the return from taking a long 100% position in the S&P 500 VIX Mid-Term Futures Index Excess Return with a short 50% position in the S&P 500 VIX Short-Term Futures Index Excess Return. The positions are rebalanced on a daily basis.

The CBOE Market Market Volatility Index, better known as the VIX, is a widely followed indication of the markets expectation for volatility in U.S. equities over the next 30 days. Because the index is computed based on prices for a variety of put and call options on the S&P 500, it isnt possible for investors to establish exposure directly to the VIX. But over the last several years options and futures linked to the VIX have begun trading, and in early 2009 iPath rolled out the first ETNs linked to VIX-related indexes. The first products included notes linked to the Total Return versions of the S&P 500 VIX Short-Term Futures Index (VXX ) and S&P 500 VIX Mid-Term Futures Index (VXZ ). The short-term VIX index offers exposure to a daily rolling long position in the first and second month VIX futures contracts, while the mid-term index offers exposure to a daily rolling long position in the fourth, fifth, sixth and seventh month VIX futures contracts.

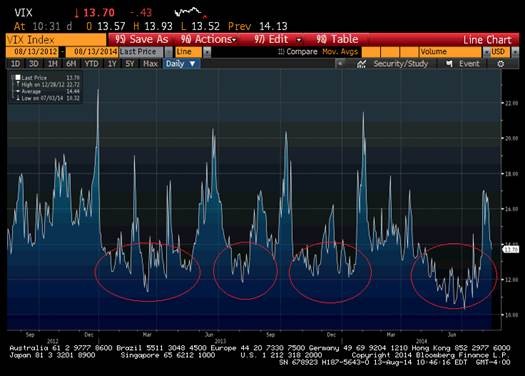

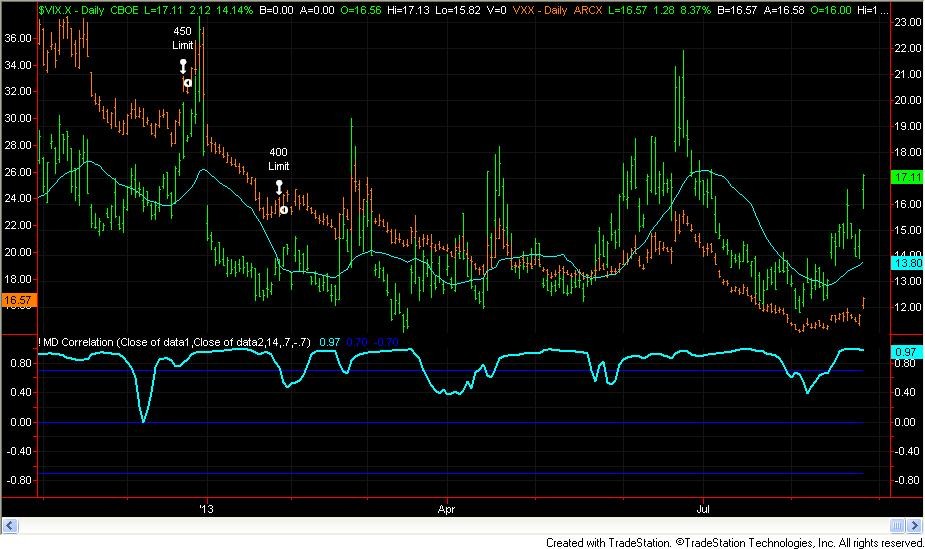

The VIX futures curve is generally in steep contango, meaning that longer-dated contracts are more expensive than those approaching expiration. For products that replicate futures-based strategies that means that the cost of rolling exposure can become significant, causing a material disconnect between the return delivered and the hypothetical return on spot VIX. And because contango is often steeper in the near-term than in the far term, the difference in performance between a short-term strategy and long-term strategy can become significant as well. Since inception, both VXX and VXZ have declined significantly, but the short-term VIX note has faced much stiffer contango-related headwinds:

The investment thesis behind XVIX focuses on the systematically high risk premium for near-term VIX futures relative to mid-term contracts. By maintaining long exposure to mid-term contractsthose that are between four and seven months from expirationand short exposure to those contracts nearing expiration, XVIX presents an opportunity to capture some of that risk premium regardless of whether equity market volatility is increasing or decreasing. Of course there is risk in XVIX, but the strategy to which the fund is linked has historically exhibited lower volatility than a long-only play on either the short-term or mid-term index.

So the new ETN from UBS will offer investors an opportunity to establish exposure to stock market volatility while eliminating some of the often adverse impact of contango in VIX futures markets. The underlying strategy is appealing because it offers returns that have historically been uncorrelated to the markets while also presenting an opportunity to capitalize on the outsized impact of contango on short-term strategies relative to mid-term strategies.

Flurry Of Activity

Recent weeks have seen the introduction of a number of volatility-related ETPs. Citi recently rolled out an ETN linked to its own volatility benchmark, the C-Tracks Citi Volatility Index ETN (CVOL ). iPath has also doubled its VIX-related offerings recently, adding an inverse VIX (XXV ) and leveraged VIX (VZZ ) to its lineup. And industry newcomer VelocityShares rolled out six ETNs linked to both short-term and mid-term VIX futures indexes, including inverse and leveraged products.

The new UBS ETN will charge an expense ratio of 0.85%, well below the average for the Volatility ETFdb Category of 1.11%.

[Read more about XVIX on the fund fact sheet. For updates on all new ETFs, sign up for our free ETF newsletter ]

Disclosure: No positions at time of writing.