AND NOW THE WEATHER PART I AN INTRODUCTION TO WEATHER DERIVATIVES

Post on: 30 Май, 2015 No Comment

Since the summer of 1997, when the first weather derivatives transaction was recorded, we have witnessed the development of a new derivatives market in the United States, which is gradually expanding across the globe.

INTRODUCTION:

Since the summer of 1997, when the first weather derivatives transaction was recorded, we have witnessed the development of a new derivatives market in the United States, which is gradually expanding across the globe.

The U.S. Energy Department estimates that USD1 trillion of the U.S. economy is exposed to weather risk. So far, the notional size of weather derivatives traded is around USD3.5 billion, which represents a small amount compared with the size of the exposure. The trend towards hedging weather risk is clearly gaining acceptance, as firms whose earnings are directly related to weather are starting to realize that not hedging weather is equivalent to speculating.

This article outlines major aspects of the developing weather derivatives market. We begin by discussing the weather measures often used in financial instruments. The second article describes the types of structures most commonly traded. In the third we describe several approaches to pricing weather derivative contracts, the major types of players and current market developments.

WEATHER MEASURES

Just as an option on a commodity has as its underlying asset the price of a futures contract, a weather derivative has as its underlying asset a weather measure. The type of measure depends on the specifics of the contract. Most weather derivatives are based on Heating Degree Days (HDD) or Cooling Degree Days (CDD). Other contracts are based on precipitation, measured by the amount of rain over a given time period, or snowfall, measured by the amount of snow (including sleet) in a given time period. However, it is estimated that 98-99% of the derivatives now traded are based on temperature.

HDD AND CDD

Intuitively, HDDs and CDDs measure the heating and cooling demands that arise by departures of average daily temperatures from a base level.

An HDD is the number of degrees by which the day’s average temperature is below a base temperature, while a CDD is the number of degrees by which the day’s average temperature is above a base temperature.

HDDs and CDDs are calculated as follows:

Daily HDD = Max (0, base temperature — daily average temperature)

Daily CDD = Max (0, daily average temperature — base temperature)

Base temperature is the pre-specified base temperature (usually 65 degrees Fahrenheit, sometimes 75 in warmer climates), and daily average temperature is measured as the average between the daily high and low.

HDDs and CDDs are usually accumulated over a period of time. The most common structures are based on the cumulative HDDs or CDDs for one month or one season (November to March). To calculate the HDD (CDD) over a period of days, we simply add up the daily HDDs (CDDs) for the period.

where HDDt|T (CDDt|T ) are the cumulative heating (cooling) degree days for the period beginning on day t and ending on day T.

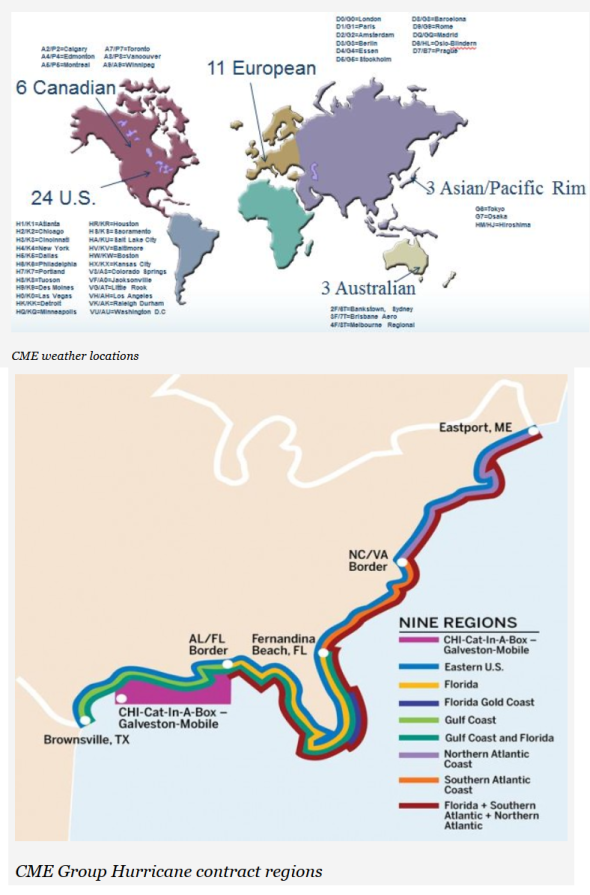

Weather derivatives are referenced to a weather station with a particular WBAN (Weather Bureau Air Force Navy) code. In the following table we can see the measuring stations and ticker symbols of the futures contracts traded in the Chicago Mercantile Exchange .

This week’s Learning Curve was written by Mark Garman , president for Financial Engineering Associates , Carlos Blanco , manager of global support and educational services for FEA , and Robert Erickson , senior financial engineer for FEA.

- 15 Nov 1999