An Introduction To Trading Eurodollar Futures Trading Tutorials

Post on: 30 Май, 2015 No Comment

Trading Eurodollar Futures

Trading Eurodollar Futures 5.00 / 5 (100.00%) 1 vote

In order to be successful as a trader, it is important to diversify your interests and investments in order to see a variety of different returns in the long run. Fortunately, working with binary options means having the chance to invest in several different commodities, all at your own comfortable pace. One of the most lucrative investments that can be made involve working eurodollar futures. A basic introduction to trading Eurodollar futures will identify them as time deposits that were denominated in U.S. dollars, but held in banks outside of the United States. Time deposits themselves are simple interest yielding bank deposits that work a specific maturity date.

Because eurodollars are outside of the Federal Reserves jurisdiction, they are subject to a lower type of regulation. They are not subject to any United States banking regulations, which means that the high level of risk these futures pose to investors is reflected in exceptionally high interest rates. The contract for eurodollar futures was originally launched in 1981, which marked it as the first cash settled contract for futures. On their expiration, the trader for cash settled futures would be able to transfer all of the associated cash positions instead of making deliveries with the underlying assets. This makes them interesting trading points for those who would like to work with the additional risk and are comfortable enough to explore the relevant indicators. These futures are now primarily traded electronically, though there are some locations that still provide live pit trading options.

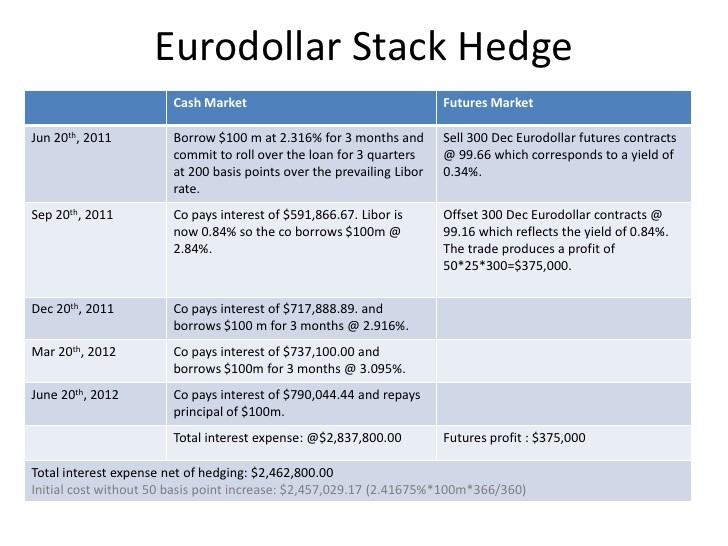

For the most part, eurodollar futures can provide a very effective way for banks and companies to secure their interest rates for money that they plan to work with in the future. A contract will be able to hedge against different yield curve changes over as far of a period as several years into the future. Groups will have the opportunity to work with these futures in a relatively fast paced environment, while looking into a variety of factors that would help them determine in what direction the value of each contract would go.

Speculating with the futures can be an interesting process to learn, one that can result in large profits as soon as a level of comfort has been reached by the investors. Because it is primarily an interest rate product, an introduction to trading eurodollar futures will stress the importance of United States Federal Reserve policy decisions in terms of the pricing. The market is noticeably most volatile when the Federal Open Market Committee makes announcements and general economic releases that would influence the policy as applied by the Federal Reserve. While changes to policies towards interest rates can usually take years to finalize, values are immediately and accordingly adjusted. While these options are typically overlooked by most retail traders, the truth is that they have excellent potential for long term investing, especially for those who have the patience to analyze all of the relevant indicators.