An Introduction to Managed Futures

Post on: 7 Апрель, 2015 No Comment

extramiletrading.com

The power of group investing is best shown in a managed futures fund. The fact is that a managed futures fund is more attractive than a traditional stock portfolio, which underscores the volatility of it.

Futures within itself are a risky proposition because of the short term life expectancy of its products. Most people are not full time traders, so they don’t know the current trends that futures investments exhibit. Enter the commodity trading advisors and their role in a managed futures fund.

These professionals have taken on the vocation of overseeing futures accounts for the benefit of the investor. The advantage of having a managed futures fund from a qualified advisor is that it offers diversity in various commodity products represented by the fund. A significant amount of money needs to be invested within these type funds in order to reap any type of significant profit. The use of managed futures funds has been attractive to institutional trading in recent years because of the profit potential adhered to it. Access to these type funds are also available to the average investor, but the buyer beware caveat must be employed and proper research done before committing any funds to it.

Selecting a managed futures fund requires a self-analysis of the trader to see if the risk is worth the reward. There are wild fluctuations within any type of futures contract. With a managed futures fund, there are many selections that are contained within it. For that reason alone, a proper historical research needs to be done on the fund manager.

Knowing what type of historical drawdowns one can expect, is certainly a fact that needs to be known. Knowing what a certain portfolio contains and what funds can be used to invest needs to be defined. Knowing how much drawdown can be expected should be researched and dealt with before it happens.

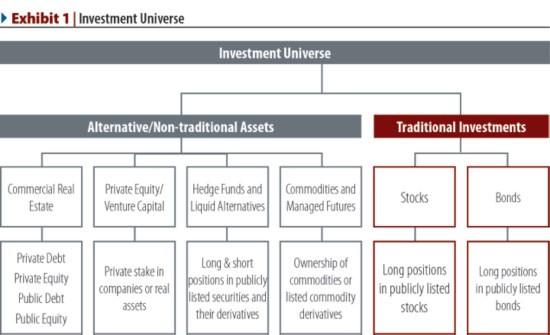

The attraction to a managed futures fund is the diversity and the liquidity of the markets themselves. Profit potential can be identified whether it’s a bull or bear market. Traditional stock trading profits, where a bull market is positive and a bear market is not profitable, do not apply to futures contracts. Futures fund profit, if positioned for a bull or bear market, can be an exciting endeavor for the investor. Selling short, bear markets, can be just as profitable as an up trending or bull market.

With that type of structure in place, volatility must be taken into account. Making sure that the initial investment money involved can be used for positions that end up against it. Making sure that discretionary income is used for futures funds is an absolute necessity in order to head off the potential of losing any necessary funds.

Insuring that successful commodity trading advisors represents a profitable managed futures fund can be an exciting addition to anyone’s trading portfolio. The success can be there for the taking if the proper precautions are met. Being a conservative investor in this type or arena requires diligence and persistence, but it can be done.