An Introduction to Exchange Traded Funds (ETF s)

Post on: 28 Май, 2015 No Comment

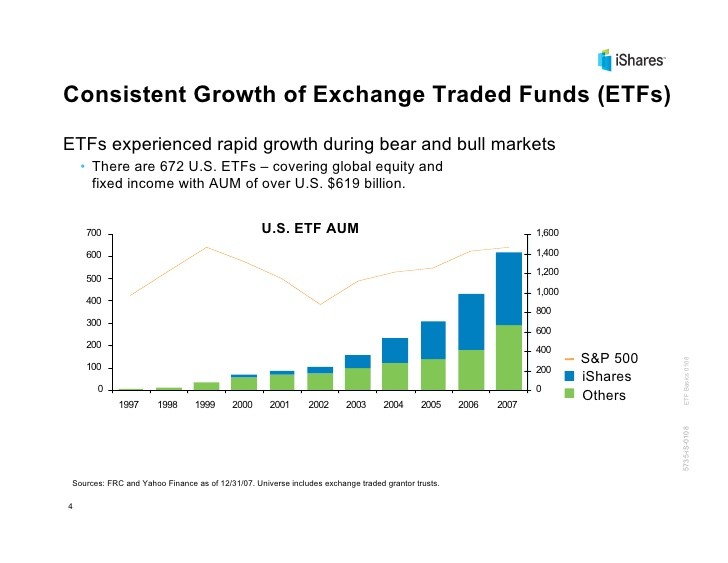

An exchange-traded fund, or ETF, is a basket of securities ( forming a fund ) that trades like shares on major stock exchanges. The securities that make up an ETF can be varied and may include such things as stocks, bonds, commodities, or currencies. An ETF may track the performance of a broad index, like the S&P 500, or it may track a specific country’s index or sector.

Trading the underlying commodity via an ETF may be ‘purer’ than trading a resource stock if you want exposure to the movement of that specific commodity .

In practical terms, this gives the trader the opportunity to better meet their own investment purpose with exposure with relative ease to markets and vehicles which may be otherwise difficult or complicated to trade.

ETFs give the trader a relatively easier opportunity to trade vehicles and markets which may be otherwise difficult or more complex to trade .

The tradable value of the fund i.e. what you can buy or sell for, is defined as with any asset class by the market. In this case the pricing of an ETF reflects the total value of assets held within the fund and will alter during market hours as the value of its component parts changes. There are over 20 companies who offer ETFs.

As part of the responsibility of the issuing company, the composition of the ETF must be defined as part of the requirements of the fund. Some funds are made up of a basket of shares, but it is important to note that this may not necessarily be the case.

One of the major benefits of ETFs is the ability to trade options of the underlying ETF.

Other ETFs may have exposure to futures contracts, or currencies. This can be seen as an advantage, as the movement of a particular commodity future e.g. Oil, is often thought of as being ‘Purer’ than oil or gold stocks which are of course exposed to different forces as well as the underlying commodity.

Although ETF trading decisions in terms of entry and exit can be made from a technical perspective, it is essential that the trader does the appropriate due diligence in 3 key areas. Logically, it would be fair to say these are the first 3 golden rules of investing in ETFs and are to:

- Know the component parts that make up the fund.

- Ensure a good correlation exists with the particular index or vehicle for which the trader wants exposure.

- Develop an understanding of the factors influencing a particular asset class for relevant funds e.g. commodities or currency ETF’s.

While an ETF as an investment vehicle may be similar to a mutual or managed fund, there are differences which make these particularly attractive to traders who wish to retain more control over their investing than would be standard with a mutual/managed fund.

The first and perhaps key difference is that an ETF trades during market hours like an individual stock and can be bought and sold continuously until market close.

ETFs can also be sold short ( dependent on your broker) unlike funds, but of major interest to many traders is that many ( but not all) ETF’s are ‘Optionable’ ( i.e. you have the capability to trade options strategies in that particular ETF ). This provides the options savvy trader with the chance to use strategies they are already familiar with to access markets and vehicles that otherwise would require much in additional learning, account set-up and complexity.

ETFs can be actively or passively managed dependent on the specific management objectives of the fund. In the former of course, the component parts of the fund may change more readily than that of its passive counterpart.

Checking the sampling technique of the index fund will assist in deciding whether this ETF is the most suitable.

Types of ETF

There are many different types of ETFs. As previously stated, this key advantage to the trader in terms of opportunities to trade markets that would otherwise be more difficult provides an exciting array of strategies dependent on the individual trader purpose. There are various ways of classifying the types of ETF. Some may be articulated perhaps a little differently than in other things you may have read. This does not really matter, however it is essential that you adhere to the first of the 3 golden rules that were outlined earlier.

As the name suggests, the most common of ETF, the index ETF, tracks the specific chosen index of the fund to attempt to replicate the performance of that index. The index fund either holds the contents of the index or a representative sample of the securities in the index in its portfolio. An example of an index ETF would be ( QQQQ ). which tracks the NASDAQ 100 index. Some index ETFs invest 100% of their assets proportionately in the securities underlying an index, termed replication. Other index ETFs use representative sampling, investing 80% to 95% of their assets in the securities of an underlying index and investing the remaining 5% to 20% of their assets in other related asset classes, such as futures, option and swap contracts, and securities not in the underlying index. The final method occasionally used by a fund manager would be so called aggressive sampling where investment is in only a small number of the underlying securities. This would be used for index ETFs that invest in indexes with thousands of underlying securities. See also leveraged, bear/short ETFs and sizerelated ETFs in the later section for common variations particularly ( though not exclusively ) regarding the index ETF type.

Examples:

Dow Jones – DIA

S&P500 – SPY

NASQAQ QQQQ

Commodity ETFs invest in commodities, such as actual or futures in precious and non-precious metals and other commonly traded commodities. Commodity ETFs generally are viewed as index funds, but track nonsecurities indexes.

Checking the correlation between a commodity ETF/ETC and the actual underlying commodity is essential prior to making your investment decision.

Exchange Traded Commodities ( ETCs) which operate in exactly the same way as far as the trader is concerned as an ETF, are investment vehicles that track the performance of a single underlying commodity index, including total return indices based on a single commodity. ETCs trade just like shares, are simple and efficient and provide exposure to an ever-increasing range of commodities and commodity indices, including energy, metals, soft commodities and agriculture.

Although there is usually a good correlation between a commodity ETF/ETC and the underlying commodity, it is important for a trader to recognise that there are often other factors that may affect the price of a commodity ETF that might not be immediately obvious. In the case of many commodity funds, they simply roll front-month futures contracts from month to month which may add additional expense in the rollover process. Having said this, there is little doubt that in the majority of situations the ETF will track the underlying commodity much closer than that of a commoditybased stock.

Examples:

Oil – USO

Gold – GLD

Agriculture – DBA

SLV – Silver

Exchange-traded funds that invest in U.S. Government bonds are known as bond ETFs. There are specific points in an economic cycle where exposure to bond ETFs may be advantageous. They tend to do particularly well historically during uncertain economic times because traders pull their money out of the stock market and into U.S. Treasuries. Additionally, there may be benefits in terms of alternative asset exposure within a selfmanaged superannuation fund, again with relative ease. The use of options with bond ETFs may therefore offer opportunities irrespective of economic conditions.

Examples:

10 year bonds – TLT

High yield bonds – JNK

Trading options on currency ETFs gives you exposure to movements in currency without having to learn how to trade Forex.

A currency ETF provides traders the ability to track the performance of various currencies throughout the world, such as the U.S. dollar, Japanese yen, British pound, or Euro. Also, there are some funds which expose the trader to a basket of currencies V the US dollar.

There are many variations on this theme, including the ability to access long or short currency funds. As well as for general investment purposes, there may be distinct advantages to those involved in import/export or exposed to overseas investments as a hedge against adverse local currency movement.

Examples:

UUP – Dollar index ( bullish )

FXA – AUS/USD

FXE – EUR/USD

A sector ETF holding represents a segment of an economic market. Common sectors include Basic Materials, Consumer Goods, Financial, Government, Health Care, Industrial Goods, Services, Technology, and Utilities. Commonly these are stocks representative of that sector. Again, investing in these may give you easy access to a recognised sector without the exposure to specific company risk.

Materials – XLB

A country-specific ETF tracks the performance of the economies of an individual country. As the ETF availability grows, more countries are being added as well as grouping of countries e.g. emerging markets.

Additionally, there are ETFs whose securities track a specific region such as Europe. The obvious advantages to traders are the exposure to countries which may otherwise be difficult to access ( e.g. China ). and of course many countries do not have exchange traded options available over their stocks, and so offers this opportunity also to the ETF trader.

Brazil – EWZ

Emerging markets EEM

There are three other variations on the ETF theme that are worth mentioning. These are size-specific, leveraged and short/bear market ETFs. They are commonly utilised, though not specifically, with some index ETFs.

A size-specific ETF is defined by the market capitalization of the individual holdings within the fund. There are 4 standard types of “market cap” classification, though these differ from country to country. In relation to the US markets the following is a common distinction:

a. Large-cap ( larger than $10 billion )

b. Mid-cap ( a range of $2 billion to $10 billion )

c. Small-cap ( a range between $300 million and $2 billion )

d. Micro-cap ( a range between $50 million to $300 million )

This type of ETF provides traders with the prospect of amplifying their returns when the market responds in a specific direction. Traders must note that should that direction be against the desired one, the result will be magnified losses instead of gains.

Again this provides some justification for looking at options, as the risk of such an adverse move is capped with many options strategies.

As with any leveraged market vehicle, leveraged ETFs can magnify losses as well as profits.

iii. Short or bear market ETFs

A short or bear market ETF is becoming a popular way for many traders to hedge their portfolio for downside risk in the markets, and returns the inverse or opposite of an underlying index. So in essence this may be useful in down trending markets that a specific fund is exposed to. Having said this are two reasons why a decision not to enter these may be taken. Firstly, there is a risk to the upside should the movement in the fund components occur. Secondly, the opportunity to enter options positions to either hedge or profit from downturn through the use of a Put Option, for example, may make these less popular and seen as unnecessary with some traders.

Trading short or bear ETFs may be less necessary if you are an options trader with the ability to trade Put Options.

Using ETF Options

A few key points about the options capabilities of ETFs:

- Not all ETFs are optionable.

- As with any traded option strategy, liquidity of the option NOT the liquidity of the underlying asset ( in this case the ETF ) is a vital consideration whether such is suitable to trade or not.

- Defining trader purpose should be your primary guide in selection of option strategy over your chosen ETF.

- The rules of any trading game are to have a plan, trade your plan and review your plan often.

- Covered Call options may be sold over an ETF in the same way as with holding stock. Delivery of the underlying ETF is required should the call be exercised.

- As with many options strategies most positions will be closed prior to expiry or exercise unless it is desired and it is likely that they will expire worthless.

- Option expiry is the same as for security options in most countries.

- Some care must be taken in ETFs with asset classes that trade over the 24 hour period e.g. forex, commodities as ETFs may only be traded in US market hours. In reality however, this is no different really to having some exposure to a resource stock where the underlying commodity over the 24 hour period may move whilst the resource stock is not tradable. Nevertheless it is an important consideration.

Trader Requirements

What you need:

- The required knowledge so that you have a good understanding of how equity markets work, ETFs and options over ETFs.

- Trading software with relevant ETF codes as it is these that will assist you in your entry and exit decision-making.

- Broker accounts that not only allow ETF trading in the originating country but also the capability to trade options over the ETF. It is an advantage if trading across time-zones to have the ability to place conditional orders.

- A trading plan for every ETF option strategy you are choosing to trade.

Summary

ETFs offer the trader an incredible opportunity to invest in alternative trading ideas with ease of access and the same trading plan you would use for shares. Those who are able to trade options are presented with an awesome array of potential investment opportunities to not only profit from any market direction, but also to hedge a portfolio easily, or even a business or property portfolio. So the question is surely not why would you look at ETFs, but why wouldn’t you??