Alternative Assets

Post on: 23 Май, 2015 No Comment

Member Search

Introduction

Most retirement account custodians allow investments in traditional investments public stocks, bonds, mutual funds, money markets, government securities and cash. There is a segment of custodians, including many of the firms which are members of the Retirement Industry Trust Association (RITA), that allow self-directed IRA owners to hold certain types of private equity investments and alternative investments. The term alternative investment includes a vast array of investment products, which include but are not limited to: private (closely-held) Stocks, Limited Partnerships, Limited Liability Companies, Promissory Notes, Real Estate, Real Estate Investment Trust (REITs), Precious Metals, Tax Liens, Hedge Funds, Futures/Commodities, Life Settlements and other investments.

Internal Revenue Code 408 prohibits certain types of investments in IRA accounts, including life insurance and collectibles such as artwork, gemstones, numismatic coins. Beyond this limitation, each IRA custodian determines what types of investments it will or will not hold. For example, some IRA custodians may not permit single-member limited liability companies, general partnerships, limited liability partnerships, working interests or foreign corporations.

Neither RITA nor its member firms recommend or provide any advice with regards to any particular investment or asset category. Member firms do not perform due diligence or determine the suitability of any investment or asset category for investors. Investors are urged to seek tax, investment and/or legal advice from professionals before making any investment decisions.

What are Alternative Investments?

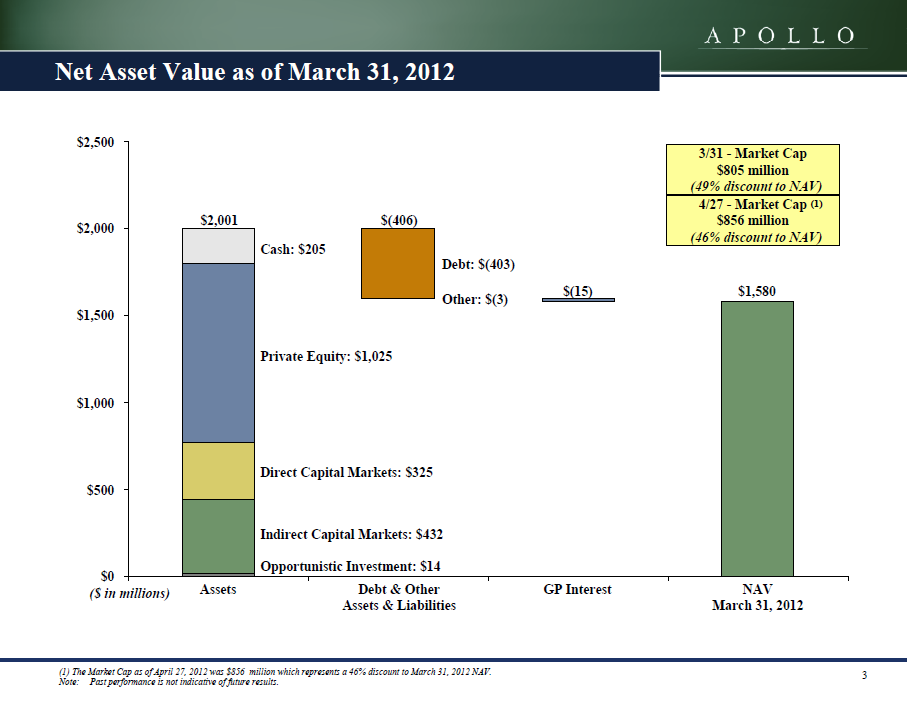

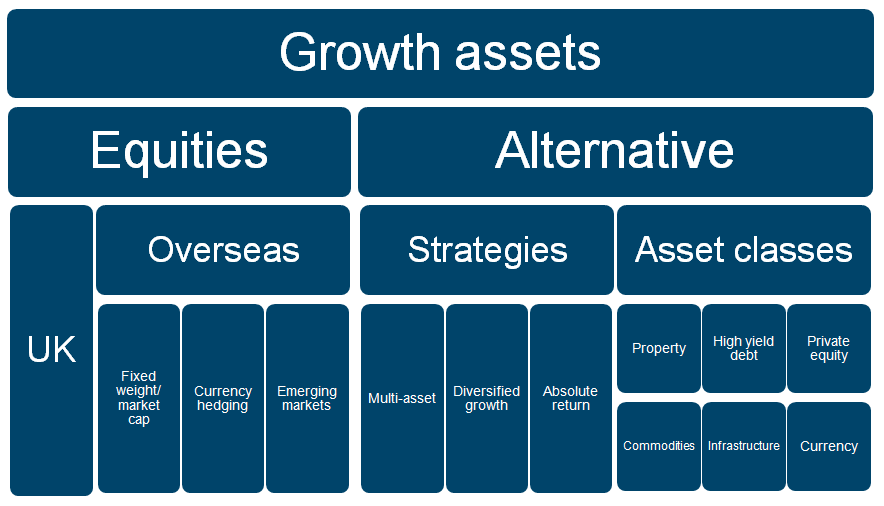

This term encompasses any non-traditional asset class, and covers investments that do not trade publicly on an organized exchange. This includes any investment outside of public stocks, bonds, money markets or cash. These assets may also be called special, sundry or hard to value assets. Alternative investments may be structured as private equity, such as stock, general partnerships, joint ventures, limited partnerships, and limited liability companies. Alternative investments may also be structured as debt investments such as promissory notes (secured or unsecured), real estate or corporate debt offerings.

Generally speaking, alternative investments are typically complex, illiquid, and more difficult to value than traditional assets. They usually offer the opportunity to earn investment returns in excess of those generally available in the traditional financial markets. However, there is typically a higher degree of risk associated with these investments which makes them potentially more suitable for high-net-worth individuals or institutions. These types of investors may be more resilient to higher risks, increased volatility and potential losses in investment value.

Alternative investments are generally categorized as either private placement investments or marketable alternative investments. These investments often focus on natural resources, energy, power, real estate, commodities and hedge funds. The investment proceeds may provide funding for: (1) a new business startup (often referred to as seed capital or venture funding), (2) expanding an existing business, (3) a leveraged buyout transaction or (4) a special situation need such as when a company is in financial distress.

Retirement plan investments can be very diverse as investors seek to spread their risk over different types of assets classes. There are risks and rewards for those investors who seek alternative assets but they must be aware of the many tax laws affecting retirement plans. Individuals considering any alternative investment should consult with their tax advisor or financial planner on the best course of action. Before deciding whether an investment is appropriate for a retirement account, the risks must be balanced with the financial rewards.

RITA does not recommend any particular investment or asset category. Individuals are urged to speak with a tax or investment advisor before investing Self-directed retirement account funds