Algorithms Replacing Wall Street Analysts Investors

Post on: 22 Май, 2015 No Comment

Getty Images

Computerized algorithms are quickly replacing single-stock analysts and investors, leading to big changes in the way the stock market will value companies and increasing the chance that software glitches or hack attacks will jeopardize market stability.

Technological forces—including high-frequency trading, an explosion in exchange-traded funds and the proliferation of free information via social media—are behind this seismic shift, according to Nicholas Colas of ConvergEx Group.

The changes that started with high-frequency and algorithmic trading are just the first step to an entirely different process of determining stock prices, Colas wrote in a sweeping note to clients Monday. Will an equity market running on algorithmic autopilot serve to tie the managers of capital (senior executives) to the ultimate owners (shareholders) as robustly as one dominated by flesh-and-blood money managers? It seems a stretch to think so.

In other words, we’ve come a long way from the days of the Buttonwood tree and Benjamin Graham.

Computers and decimalization have chipped away at the ranks of human traders in the past decade. Now, smarter machines are taking aim at the very people who analyze a company’s merits and who make buying and selling decisions based on that analysis.

I spoke with a high-ranking member of the trading community this weekend, said Michael Murphy of Rosecliff Capital, a fundamentally geared hedge fund. His large firm sees an end of stock-picking. They see passive, ETF-style investing as the new normal.

Exchange-traded funds, which blindly buy whole groups of securities or futures as easy as single stock, have garnered $65 billion of inflows this year alone, while traditional equity mutual funds haven’t seen a three-month period of inflows in years, Colas said.

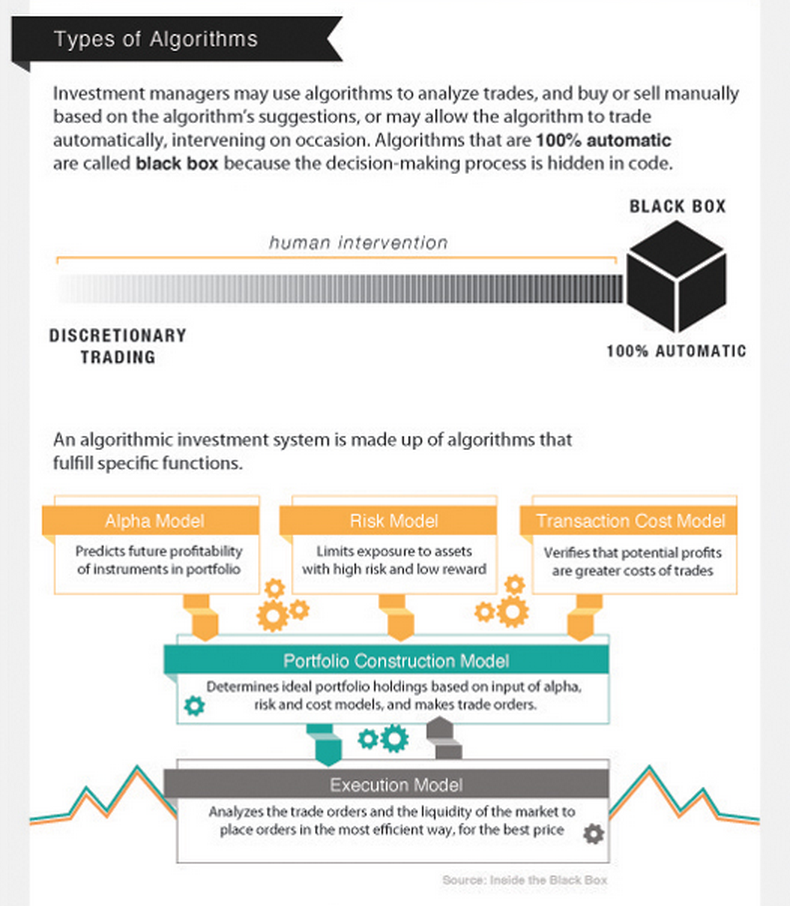

On top of that, layer algorithms executing trades in milliseconds based on complicated fundamental and technical models, and simply front-running people before the human eye can read company or government news releases.

This kind of trading accounts for up to 70 percent of volume on some days with the full support of exchanges, which allow the purveyors of this trading to have their servers to be located right next to theirs so the high speed action can take place.

It depends on your time horizon for investment, said Tony Wible, a media stock analyst for research firm Janney Montgomery Scott. I think the number of permutations gets harder for machines the longer out one goes.

Some investors are already throwing up their hands at what they see as a market that is so detached from fundamentals and simply based on computers owned by hedge funds pinging each other back and forth.

There’s just no new names, no new energy, no new opportunities, and that’s a problem, said Mark Cuban, an avid trader, entrepreneur and owner of the Dallas Mavericks. That’s a reflection of the lack of trust, the fact that we don’t know what business the markets are in, and there’s so much algorithmic trading and technology-driven trading it’s created downstream problems.

Earlier this month, The Associated Press’ Twitter account was hacked. The anonymous group sent a message styled like a headline that there had been two explosions at the White House. It sent markets reeling for four minutes as some traders say algorithms picked up on the tweet first, or at the very least they started to instantly sell when the market ticked lower.

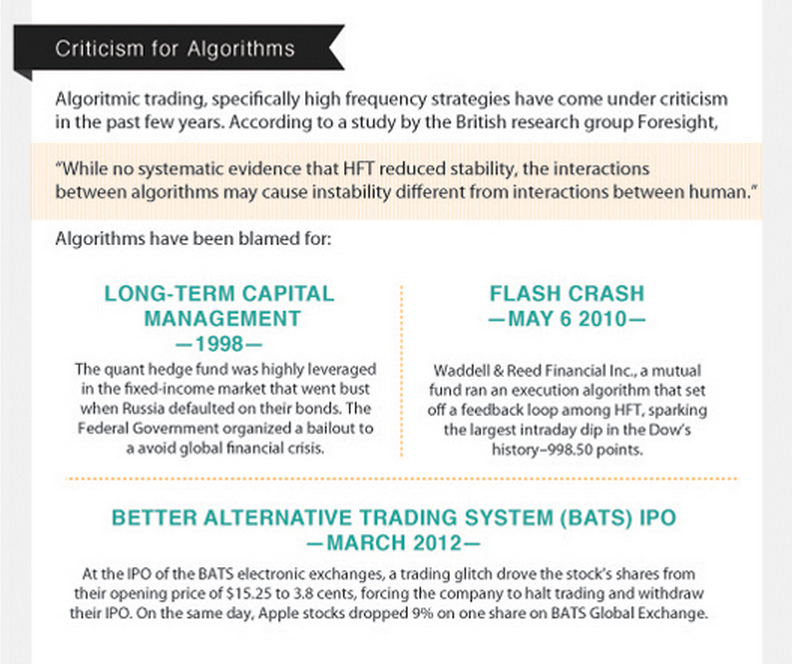

This follows the so-called flash crash in May 2010 that sent the Dow Jones Industrial Average down 1,000 points in a matter of moments. The cause of that event is still not totally known, but high-frequency trading certainly played a part, most say.

It isn’t just machines killing the analyst star. Social media has made keeping information behind a paywall for investment banks virtually impossible. It’s also created a community of analysts on Twitter and other social networks (many of them former professionals) giving away their analysis for free.

People that want to be tapped in now follow the right people on Twitter and obviously other networks like Stocktwits which offer communication, context and community, wrote Howard Lindzon, the founder of StockTwits.com, in a blog post. Everyone is connected, not just the people ‘in the know.’ Of course with everyone ‘holding hands’ in this new world, the reactions like the AP hacking will be more volatile and the recoveries that we saw after, just as fast.

That could be the happy ending to this story. After a rough transition period, social media eventually reinvigorates fundamental analysis amongst the people, allowing anyone with a computer to capture big followings and become the Peter Lynch of tomorrow.

Under this scenario, capital will be guided to its most efficient place through the ultimate free marketplace where the information playing field is level between participants.

But this assumes there will be enough homegrown analysts and retail traders to outweigh the incredible boom in electronic trading on Wall Street. This could be an optimistic view.

Can anything change this glide path to an ever more technology-based system of stock analysis? Colas asked in his note. I can only think of one: a very large system failure that causes a recession in the U.S.

For the best market insight, catch Fast Money at 5 p.m. ET, and the Halftime Report at 12 noon ET each weekday on CNBC. Follow @CNBCMelloy on Twitter.