Agriculture ETFs

Post on: 16 Август, 2015 No Comment

Investment case

The investment case for Agriculture is both a demand and supply story.

Strong Demand Drivers

World population is growing and the world needs to eat. At the same time, the diets of the emerging middle class in China and India are evolving to inlcude more protein and processed foods.

A relatively new factor on the demand side is BioFuels. The US is looking for energy indepedence and sees BioFuels as part of the answer.

The Energy Independence and Security of Act of 2007 calls for production of Corn-Based Ethanol to grow from 9 billion gallons in 2008 to 15 billion by 2016. The same act calls for the expansion of advanced biofuels from near zero today to over 20 billion gallons by the year 2022.

Together, these factors create a strong case for demand growth in the agriculture sector.

Long Term Supply -Yield Enhancement

To close the gap between supply and demand, agricultural productivity must improve and the most likely source is yield enhancement. A good example is the production of corn.

The US is the world leader in corn productivity at 151 bushels per acre. India, Mexico and Brazil produce 36 or less. Agribusiness giant Monsanto points out that if these 3 countries alone boosted their yield-per-acre to 100, then they could produce nearly 4 billion additional bushels per year or more than total world corn exports in 2007.

Short Term Supply — Farm Equipment and Fertilizer

Adoption of yield technology will not take hold over night. In the mean time, strong commodity prices means that farmers will plant more acres, deploy more fertilizer and buy more tractors. Strong demand for farm inputs means a positive outlook for the producers and manufacturers.

Near Term Outlook — Rising Commodity Prices

While farmers and agribusiness play catch up on the supply side, the growing demand for food and biofuels will continue to drive up prices for grains and other agricutural commodities.

Overview

Investors can gain exposure to agriculture through several ETFs that differ by asset class and concentration levels.

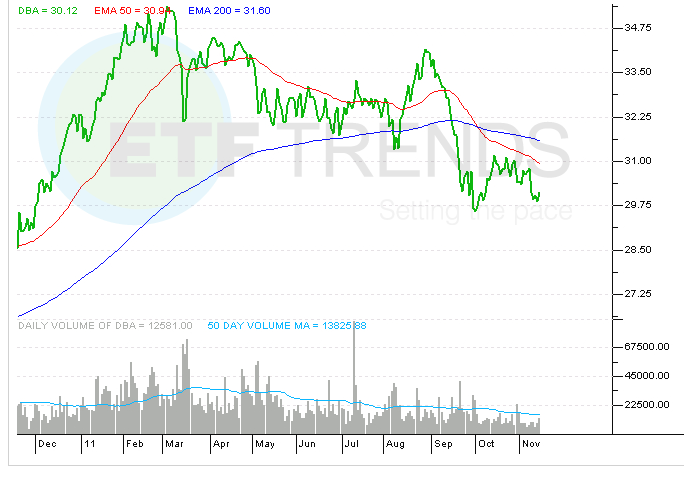

Agricuture commodity choices include one ETF from PowerShares and two ETNs from iPath. The PowerShares DB Agriculture Fund (DBA ) tracks a rules-based index of futures contracts on corn, wheat, soy beans and sugar.

The Dow Jones-AIG Grains Total Return Sub-Index ETN (JJG ) provides exposure in grain commodities. The Dow Jones-AIG Agriculture Total Return Sub-Index ETN (JJA ) offers investors exposure in agricultural commodities including soybeans, corn, wheat, coffee, sugar, cotton.

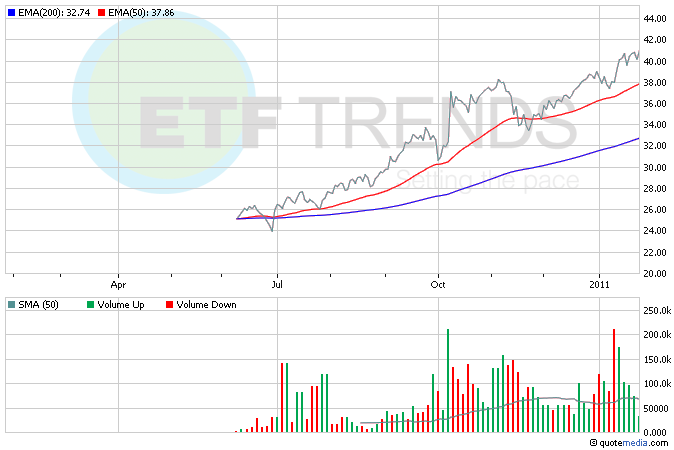

For equity investors, a pure play Agribusiness ETF is Van Eck Global’s Agribusiness ETF (MOO ) which tracks a glboal index of companies involved in the agriculture business across five major sub-sectors, including agriproduct and livestock operations, agricultural chemicals and equipment and ethanol/biodiesel. Top holdings include Swiss crop-yield giant Syngenta. fertilizer producer Potash. Deere. Monsanto. and phosphate and potash producer Mosaic .

For a more diversified approach, use a sector ETF. The industrial sector ETFs such as Vanguard Industrials (VIS) and Industrial Select Sector SPDR Fund (XLI) have 2%+ positions in tractor maker Deere. The materials sector ETFs, including the Materials Select Sector SPDR Fund (XLB). Vanguard Materials ETF (VAW) and Dow Jones U.S. Basic Materials Sector Index Fund (IYM) have 10%+ positions in seed supplier Monsanto.