AbsoluteReturn Funds Low Risk Low Return

Post on: 26 Апрель, 2015 No Comment

Daisy Maxey

Updated Oct. 29, 2010 12:01 a.m. ET

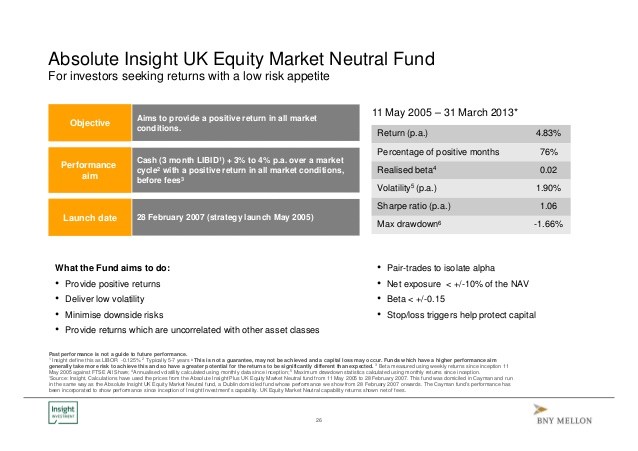

Investors seeking safety in absolute-return funds may be surprised to learn that such funds tend to minimize risk but aren’t likely to consistently deliver positive returns.

Absolute-return funds generally seek to produce at least moderate returns in any market by balancing long positions in stocks with nontraditional strategies and investments, such as arbitrage, short selling, derivatives, futures, leverage or options.

The results, while hard to precisely quantify because such funds’ strategies vary widely, aren’t the stuff market-beating portfolios are made of.

Because the Standard & Poor’s 500 index fell 37% in 2008 and was up 26.5% in 2009, that two-year period is a good one in which to evaluate the funds’ behavior, said Veerendra Virkar, a research analyst at Boston-based financial-services consulting firm Financial Research Corp.

ENLARGE

Investment-research firm Morningstar Inc. doesn’t have an absolute-return fund category, but it now tracks 24 funds with absolute return in their names, up from just eight in 2006.

Of those 24, only 11 existed in 2008, and most of those performed better than the S&P 500 index that year, according to Morningstar. In 2009, most of those funds notched positive returns, but many were lackluster in comparison with the index returns and just two funds outpaced the S&P 500’s gains.

When I look at absolute return, the most important thing I look at is the return because that is exactly what the fund is promising, Mr. Virkar said. If I am an investor, at the end of these two years if I can get some positive return on my fund I am happier, rather than just beating the S&P.

Fund Goals and Management

Because absolute-return funds define their strategies differently, investors should be sure they understand the manager’s goals. Indeed, investors may find it confusing to determine whether a fund is pursuing an absolute-return strategy, especially since some absolute-return funds include the term in their names and others don’t.

Putnam Absolute Return 100 (trading symbol PARTX), for example, seeks a positive return that exceeds the rate of Treasury bills by 1% over a reasonable period of time, regardless of market conditions.

It’s more like a real-return fund, Mr. Virkar said. If you try to put it in the absolute-return category, that means it has a very low aim.

Matthew Tuttle, chief executive of Tuttle Wealth Management LLC, a White Plains, N.Y. registered investment adviser, notes that the fund has a short track record and lagged badly in 2009.

Another fund, Ivy Asset Strategy (trading symbol WASAX), seeks to provide high total return over the long term with a high degree of safety in uncertain times. This is a true go-anywhere, do-anything fund, Mr. Tuttle said.

Mr. Virkar noted that the fund performed well in the 2008/2009 period, though there were funds that did better.

Risks and Costs

Though investors may like the idea of gaining access to hedge-fund-like strategies, making such strategies work in the mutual-fund world can be challenging because hedge-fund and mutual-fund investors may behave differently. Also, many of today’s absolute-return funds don’t have long track records, so investors should carefully examine the background of a fund’s manager.

Geoff Bobroff, a mutual-fund industry consultant in East Greenwich, R.I. says his greatest concern is that many of the existing funds haven’t yet gone through a market cycle, so it is difficult for investors to judge their managers.

You’re taking an institutional concept where money is relatively static, and putting it into the retail market where it’s not, and where money tends to come and go at the most inopportune times for the manager, Mr. Bobroff said. Still, he said he applauds the mutual-fund industry for being innovative.

Investors should also keep in mind that these funds aren’t for those who want to embrace risk in a hunt for outsized gains. Because the funds seek to minimize risks, their returns in bull markets can be muted.

T. Rowe Price Group warns, for example, that the T. Rowe Price Capital Appreciation Fund may not keep pace in a rapidly rising market due to its fixed-income and cash holdings.

The fund (trading symbol PRWCX), which has gained nearly 5.5% annually for the past five years, outpacing its moderate allocation peers, isn’t a true absolute-return fund, Mr. Tuttle said. Its emphasis on value stocks helped it protect its assets during the bear market from 2000 through 2002, but it lost 27% in 2008, he says.

It is important, too, to keep a wary eye on costs when choosing among the funds. They typically charge more than an average mutual fund because they employ more sophisticated strategies, but investors will want to be sure they’re getting decent long-term performance and protection for the cost.

It’s the hot thing now, Mr. Tuttle said, so there will be a lot of absolute-return funds coming out that will be what I call ‘no-return funds.’ You’re going to want to see that the manager is going to be able to deliver on the promise.