About your tax forms

Post on: 30 Июнь, 2015 No Comment

Find detailed information about Forms 1099 * and other investment-related tax forms for Vanguard mutual fund and Vanguard Brokerage Services** accounts.

Form 1099-B

You receive separate Forms 1099-B for your Vanguard mutual fund accounts and your Vanguard Brokerage Services** accounts.

Looking for your forms?

Many Vanguard tax forms for 2014 will be available online beginning in mid-January.

Log on and view your personal tax forms

To view your forms, you’ll need Adobe Reader installed on your computer.

Important information for all investors: Beginning with the 2012 tax year, you’ll no longer receive a separate Average Cost Summary. Cost basis information for both mutual fund and brokerage clients will be included on the applicable Form 1099-B.

You’ll need this form to determine investment capital gains or losses. For mutual fund accounts, Form 1099-B reports all sales, exchanges, and redemptions (including checkwriting activity) from most nonretirement accounts. For brokerage accounts, this form reports sales, mergers, bond maturities, and aggregate profits or losses on regulated futures contracts.

Form 1099-B is not provided for the following:

- Redemptions or exchanges from money market funds.

- Transfers between nonretirement accounts within the same fund.

- Conversions from Vanguard Investor Shares to Vanguard Admiral Shares.

- Distributions from a retirement plan, including an IRA (see Form 1099-R information below).

- Accounts registered to a nonresident alien.

Many brokerage transactions are not reported to the IRS on a Form 1099 but appear in the nonreportable section of your Form 1099-B. These types of transactions include:

- Purchases.

- Partnership distributions.

- Certain trust distributions.

- Equity option trades.

Form 1099-DIV*

You receive separate Forms 1099-DIV for your Vanguard mutual fund accounts and your Vanguard Brokerage Services** accounts.

For both mutual fund and brokerage accounts, this form reports dividends (ordinary and qualified) and capital gains distributions from taxable accounts, foreign tax paid in nonretirement accounts, and interest dividends (including specified private-activity bond interest) from tax-exempt bond funds and money market funds.

Form 1099-DIV is not provided for the following types of accounts:

- IRAs and other tax-deferred retirement accounts.

- Accounts registered to nonresident aliens. (Nonresident aliens will receive Form 1042-S; see Form 1042-S information below.)

- Exempt registrations such as corporations, money purchase pension plans, profit-sharing plans, certain types of trusts, and charities.

Form 1099-INT*

Important change for mutual fund clients: Beginning with the 2012 tax year, you’ll no longer receive Form 1099-INT. Interest dividends (including specified private-activity bond interest) from tax-exempt bond funds will be reported on Form 1099-DIV.

For brokerage accounts, Form 1099-INT will still report taxable and tax-exempt interest income from individual bonds and other interest-bearing investments.

Form 1099-MISC*

Applies to Vanguard Brokerage Services** accounts only. Form 1099-MISC reports substitute payments in lieu of dividends for securities held in nonretirement margin accounts.

Form 1099-OID*

Applies to Vanguard Brokerage Services** accounts only. Form 1099-OID reports original issue discount (OID) from certain debt obligations. Although you may not have received a cash payment from the obligation during the year, if the obligation was originally issued at a discount, Vanguard is required to report a portion of that OID each year it is held in your account.

Note to owners of U.S Treasury Inflation-Protected Securities (TIPS): There are two components to TIPS reporting, one of which is reported as OID.

- First, the principal value on these securities fluctuates according to changes in the Consumer Price Index. These adjustments are reported as OID on IRS Form 1099-OID.

- Second, the coupon payments from these securities are reported as interest on Form 1099-INT. Coupon payments are calculated by multiplying the coupon rate (which does not change over the life of the security) by the adjusted principal amount.

For more details about OID reporting, see IRS Publications 550 (Investment Income and Expenses) and 1212 (Guide to Original Issue Discount Instruments).

Form 1099-Q

You receive separate Forms 1099-Q for your Vanguard mutual fund accounts and your Vanguard Brokerage Services** accounts. This form reports distributions, including asset transfers to another financial institution, for education savings accounts (ESAs) and the Vanguard 529 College Savings Plan. For ESAs, the form also reports the investment fair market value as of the end of the tax year.

Form 1099-R*

You receive separate Forms 1099-R for your Vanguard mutual fund accounts and your Vanguard Brokerage Services** accounts. This form report transactions from retirement accounts (including IRAs and employer-sponsored plans) such as distributions, removal of excess contributions, Roth conversions, IRA recharacterizations or rollovers, and federal and state tax withholding.

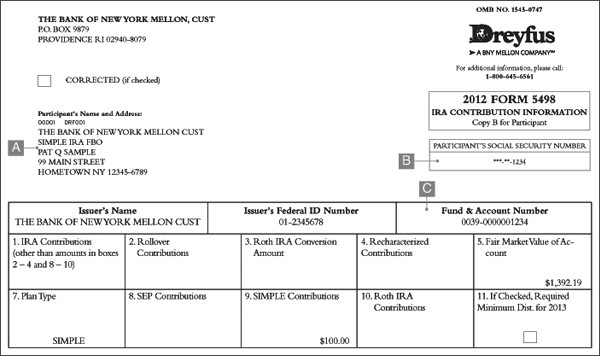

Form 5498

You receive separate Forms 5498 for your Vanguard mutual fund accounts and your Vanguard Brokerage Services accounts. Generally, this form is not necessary for the preparation of your tax return.

This form reports the following information for traditional IRAs, Roth IRAs, Simplified Employee Pension (SEP) IRAs, and Savings Incentive Match Plan for Employees (SIMPLE) IRAs:

- Contributions.

- Catch-up contributions.

- Conversions.

- Rollovers.

- Recharacterizations.

- Fair market value (December 31 year-end balance).

It also indicates whether an individual must take a required minimum distribution (RMD) in the following year. (Note: RMDs may be required even if not indicated on the form. See Publication 590 for more information, or consult a tax advisor.)

Note:  Since IRA contributions can be made until April 15 of the year following the previous tax year, this form is mailed to you in May.

Form 5498-ESA

You receive separate Forms 5498-ESA for your Vanguard mutual fund accounts and your Vanguard Brokerage Services accounts. This form reports contribution information, including asset transfers from another institution, for education savings accounts (ESAs).

Form 1042-S

You receive separate Forms 1042-S for your Vanguard mutual fund accounts and your Vanguard Brokerage Services accounts. This form is only mailed to nonresident alien investors. It reports dividends and short- and long-term capital gains for nonretirement accounts, and distributions from retirement accounts, including IRAs. The form also reports federal income tax withheld, referred to as nonresident alien withholding.

Depending on account activity, nonresident alien shareholders could receive Form 1099-B or 1099-DIV for a nonretirement account if they fail to provide Form W-8BEN to certify their foreign status.

* Note on IRS reporting of investment income on tax forms: Most tax forms are required to be provided only for amounts of $10 or more, or if taxes have been previously withheld. However, you must report any investment income or distributions you receive to the IRS. All investment income or distributions during the year are reported on your year-end mutual fund or brokerage account statement.

** In an effort to reduce the number of revised tax forms resulting from income reclassifications by security issuers, the IRS has permitted the mailing of Forms 1099 related to Vanguard Brokerage Services accounts through the end of February.