A Word Of Caution For Soybean And Crush Spread Traders

Post on: 26 Июнь, 2015 No Comment

Virgil began his classical epic poem The Aeneid. I sing of arms and of a man. In that grand tradition and in homage to the Mediterranean diet, I will sing of beans and the crush — specifically November 2014 soybeans and the spread between soymeal and beanoil.

With the exception of the Asian market and a few places in the US where people do more than pretend they care about healthy food, the economic value of soybeans lies not in the whole bean but rather in the myriad products made from either soymeal or beanoil.

That is the simple version of things. The more complex version includes the relationship between the soy complex and other edible oils such as canola and palm oil, the biodiesel market, the arbitrage between corn, high-protein feed wheat, fish meal and corn for the livestock market, and all of the seasonal volatility created by the different Northern and Southern Hemisphere crop cycles. I should add a form of dietary laws as strict as kashrut or helal have arisen around genetically modified organisms, much to the consternation of firms like Monsanto (NYSE:MON ) that invested heavily in GMO development.

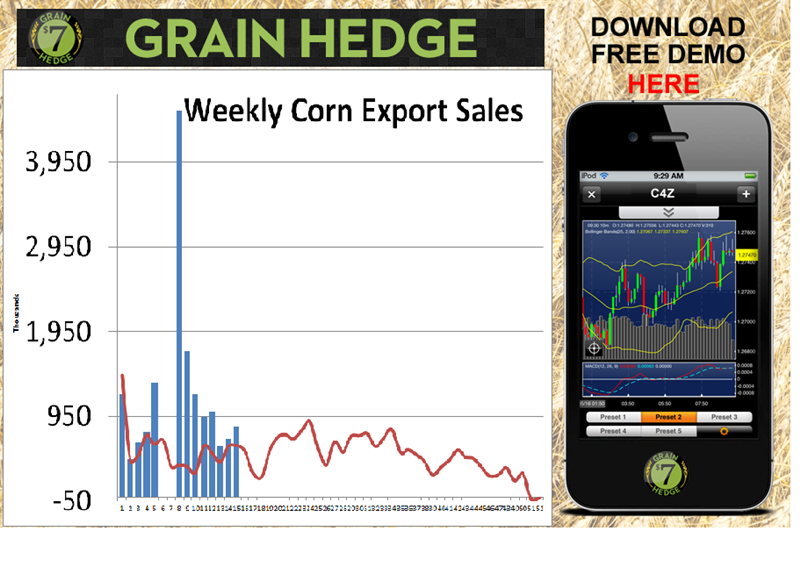

Right now new-crop soybeans are under a little bit of pressure, but you should pay attention to that about as much as a basketball score in the first quarter. Grain traders usually find one or two periods a year when, OMG, it gets hot and dry in growing regions and it pushes the price higher. Then it rains over the weekend and anyone long gets soaked along with the crop.

The crush spread often moves in the opposite direction of soybean prices as higher bean costs can erode process margins and vice versa. This is not the case at present, though. The new-crop crush spread started rising before the first USDA planting intentions report in January and has been tracking soybeans closely. This tells us there is not a lot of room for crush margin expansion if soybeans continue lower. Is this negative for crushers such as Bunge (NYSE:BG ) and Archer Daniels Midland (NYSE:ADM )?

If we map the relative performance of Bunge and ADM against the new-crop crush spread, we see no pattern whatsoever, other than ADM’s ability to outperform the Russell 1000 Index ( INDEXRUSSELL:RUI) over most of the post-June 2013 period and Bunge’s general underperformance with crush margins under $0.73 per bushel.

This is not as much of an accident as it may appear. Many commodity processors such as Koch Industries and Cargill are privately held for the simple reason that public investors might not be able to tolerate their volatility. Others, such as Bunge and ADM, are highly diversified across a portfolio of commodity operations in hopes of dampening the volatility.

The moral of the story is simple: If you want to trade soybeans or the crush spread, do so in the futures market. Efforts to do it in the stock market will fail.