A tale of two Japan stocks ETFs; hedging makes a big difference

Post on: 3 Июнь, 2015 No Comment

A passerby is reflected in an electronic board showing Japan’s Nikkei average outside a brokerage in Tokyo April 4, 2013.

Analysis & Opinion

NEW YORK (Reuters) — U.S. investors in two big funds that track Japanese stocks got a good lesson in the importance of currency hedging on Thursday.

The Bank of Japan jolted markets, unleashing the world’s largest monetary stimulus, with a commitment to inject $1.4 trillion into the economy in less than two years.

The Nikkei-225 jumped more than two percent in Tokyo overnight, and expectations of further gains make it a good time for investors who own exchange-traded funds that track Japanese equities.

It was pretty clear throughout the day that investors were pleasantly surprised by the magnitude of the BoJ actions, said Andrew Wilkinson, chief economic strategist at Miller Tabak & Co.

But not all ETFs are created equal. The WisdomTree Japan Hedged Equity Fund soared more than 7 percent on Thursday, while the iShares MSCI Japan Index Fund climbed only 3.7 percent. Both ETFs outpaced Japan’s market, a sign U.S. investors expect more gains in Japan in coming days.

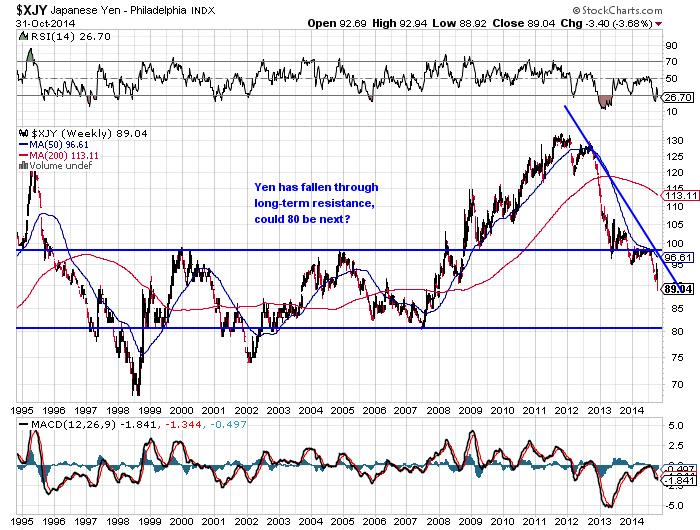

The big difference: The WisdomTree ETF hedges against exposure to the yen, and on a day when the Japanese currency fell more than 3 percent against the dollar for its worst day since 2008, that was crucial. The iShares fund, in contrast, has no such hedge and is purely an exposure to the Japanese equities market in yen.

It has been a similar picture since the yen started to weaken dramatically on September 27 last year. The WisdomTree fund gained 37 percent in that time, while the iShares fund, which has $7.2 billion in assets, has gained 17 percent in 2013.

The WisdomTree ETF has attracted $3.9 billion in funds in the first three months of 2013, more than almost every other U.S. ETF, according to Lipper data. Assets have grown ten-fold since November.

The iShares fund has also grown, pulling in $1.3 billion in inflows in 2013 through last week. This ETF buys Japanese companies, many of which are big exporters, who benefit as the currency weakens because it cheapens the goods they are selling. An iShares spokesman was not immediately available for comment.

Notably, through the five-and-a-half year bull market in yen that ended in January 2012, the iShares fund outperformed the WisdomTree fund by more than 7 percentage points.

Currency hedging in the equities markets — even for retail investors — has become more of a question given concerns that the massive stimulus being poured into the system by various central banks is creating the conditions for a currency war.

The dollar/yen rate is expected to hit 100 yen before long, up from 95.32 late on Thursday and 86.74 at the beginning of the year.

Net short yen positions have fallen from five-year peaks, but were still sizable at about $11.8 billion as of last week, data from the Commodity Futures Trading Commission show.

What the BoJ unleashed was a bazooka, and they got a weaker yen, which is what they really wanted, said Axel Merk, president and chief investment officer at Merk Investments in Palo Alto, California, who shorted the yen for the first time in his hard currency strategy, going as high as 40 percent of the portfolio. That’s the fund’s biggest position.

RETAIL INVESTORS

Retail investors directly investing in Japanese stocks, rather than through an ETF, could take a similar path as Merk — shorting the currency to offset the long exposure in the yen that comes from buying stocks. The cost of hedging yen exposure is low for a U.S. investor, fund managers say, because short-term interest rates are similar in the United States and Japan.

Had a U.S. investor hedged yen exposure by selling forward contracts every month beginning September, the drag from the yen would have been reduced to 1 percent, said Vassilis Dagioglu, head of asset allocation portfolio management at Mellon Capital in San Francisco, with $290 billion in assets.

Japanese stock markets tend to rise with a weaker yen given the heavy influence of Japan’s exporters in the index. The Topix index and yen, for instance, have a negative 10-year correlation of nearly 90 percent, based on Reuters data.

With $5.7 billion in assets, the WisdomTree DXJ ETF invests in about 300 Japanese companies, hedging exposure to the yen by selling the currency’s non-deliverable forwards, which is like selling the yen. That effectively neutralizes its yen exposure.

WisdomTree’s director of research Jeremy Schwarz said he expects Japanese stocks to continue their positive momentum.

If you believe the global economy is normalizing and we’re getting past the financial crisis, the Nikkei still has a long way to go to get to the level before the crisis started, Schwarz said.

ETFs that hedge against foreign currency risk also exist for other parts of the world. Wisdom Tree’s Europe Hedged Equity Fund takes the euro out of the European stock market by selling euro non-deliverable forward contracts. That fund is up 4.6 percent so far in 2013.

(Additional reporting by Doris Frankel in New York; Edited by Martin Howell and Tim Dobbyn)