A Look at Leverage When You Spread Bet

Post on: 16 Март, 2015 No Comment

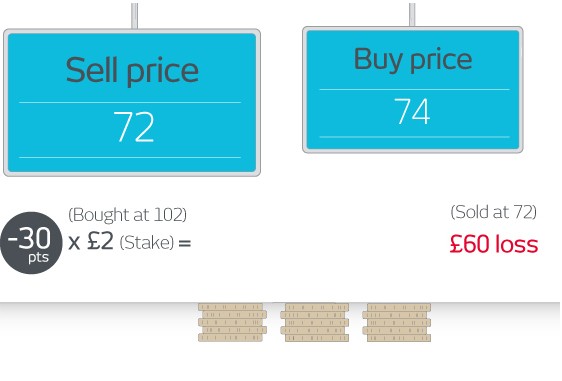

Spread betting is a convenient way to take advantage of opportunities available in the marketplace. It can also be a quick way to lose money, but why this is the case will be explained later.

When you spread bet. you are not physically dealing in the underlying asset that you are speculating on. For example, if you enter into a spread betting contract for Brent oil, you are not buying or selling oil; instead, you are effectively taking a bet that the price will go either up or down.

Let’s assume you are still interested in learning how to spread bet. To get started, all you have to do is to open an account with one of the various spread betting companies out there like IG Index and Spreadex. beware though that accounts are subject to status. Look for a spread betting company that receives good reviews for its customer service, which has been in the market for a number of years and is authorised and regulated by the Financial Services Authority. That way you can be fairly sure your deposits are safe.

Spread Betting Leverage

The good news is that, with spread betting, you do not need to possess the full amount that you are trading with. You only need to put down a small deposit, sometimes as little as 1% of the amount you are speculating on.

Let us say you believe the Barclays share price will increase in the near future, so you obviously want to buy the Barclays market. Let us further assume that you only want to deposit Ј100. Thanks to leverage, with a 100:1 bet you can ‘buy’, ie have exposure to, Ј10,000 of Barclays shares.

The double-edged sword comes in with the fact that you are then exposed to the full market fluctuation of that Ј10,000. If the shares were to increase in value by 1%, you would make a profit of Ј100 and would have doubled your initial deposit of Ј100. On the other hand, if the price of the shares were to fall by 1%, you would lose Ј100, which is the full amount that you initially invested, equating to a loss of 100%, if the share price fell by 2% you’d lose Ј200 etc.

Risk and Stop Loss Orders

If you only have Ј100 to trade with, you obviously do not want to lose everything on a single trade. Knowing how to spread bet successfully involves making proper use of a tool known as the ‘stop loss’. As an example, if you set your stop loss level to Ј50 at the start of the spread bet, that is the maximum you stand to lose. Although you should note that some stop losses are not guaranteed.

The tricky part is not to set your stop loss too close to the initial price, otherwise the market might go against you somewhat, and the stop loss would kick you out of the trade, before the market could turn around and go into a profit.

Setting the stop loss too wide could be even more dangerous, because the wider you set it the more you stand to lose if the bet goes against you.

Spread Betting Margin

Margin gives CFD trading and spread betting a key advantage over other forms of financial trading.

While most standard forms of financial speculating require a trader to pay for the full value of their position, CFDs and spread betting companies such as City Index allow you to trade with only a percentage of your position’s total value in your account.

Spread Betting — Trading on Margin Requirements

For example, if a trader buys Ј2,000 of shares in standard dealing, he or she has to pay the full Ј2,000 value to do so. In contrast, if you open a shares spread betting or CFD trading position worth Ј2,000 with City Index, you would only have to pay between 5% and 15% — or Ј100 to Ј300.

This deposit, required for each open trade on your account, is known as the ‘margin requirement’.

When you open a trade your spread betting account must hold enough funds to cover the margin requirement.

You must also maintain the margin requirement deposit level in line with any profits/losses going through your account. If your margin deposit level does not remain above the margin close-out level at all times, some or all of your positions may be closed.

Spread Betting Margin and Risk Management

A margin is there to help you trade responsibly, ensuring that you never overstretch your financial means. To avoid enforced closure of your trades, follow a considered trading strategy and always employ appropriate risk management measures.

Spread Betting & Leverage — edited by Maxine Price, 23 February 2015.

For related pages and articles see:

Financial spread betting solves a lot of problems and this is especially true when it comes to accessing the World markets and the simplification of tax* issues. There are some useful benefits, a key advantage is that spread betting offers read more

10 Reasons to Spread Bet. Spread betting offers a range of positive reasons for why you should consider spreads as part of your investment portfolio: 1)Tax Free Trading*, a well publicised aspect read more

In part 1, ‘Spread betting and the downside to day trading’, we discussed some of the negatives and pitfalls but what about the positives? What are the benefits for the day traders who like the read more

Spread Betting History — guide last updated: 10 March 2015

Want to know the history of spread betting? Sitting comfortably? Then let’s begin. It all began a long long time ago in a time period we now call the ‘1970s’ read more

Whilst there is no limit on your profits a limited risk account guarantees that every losing spread bet is closed at a pre-set level. Therefore, with a limited risk spread betting account an investor is read more

Narrow Spreads — guide last updated: 10 March 2015

A narrower spread means that the market does not have to move as far before you can make a profit, therefore we think this is better value. You can now get a narrow 1pt spread on the FTSE and DAX, plus only 2 points on Pound/Dollar with read more

Here we take a look at which companies have won the awards for best spread betting service, best platform, most popular platform etc. read more

Breadcrumbs for Spread Betting & Leverage — Spread betting is a convenient way to take advantage of opportunities available in the marketplace. The leverage means that you do not need to put the full amount that you are trading with in your account. However, the double-edged sword is that read from the start of the page