A Brief History Of Commodities Indexes

Post on: 1 Апрель, 2015 No Comment

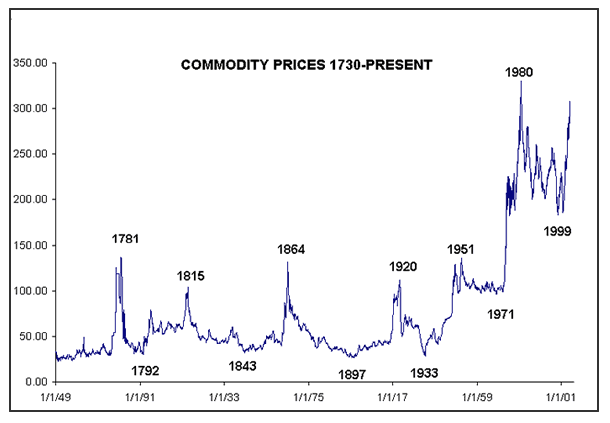

Commodities indexes have been around for a long time. The Economist’s Commodity-Price Index, for example, has been published for nearly 150 years, starting in 1864. However, this index, like many of the earlier indexes, tracks spot commodities prices and is therefore not investable.

First-Generation Indexes: Passive

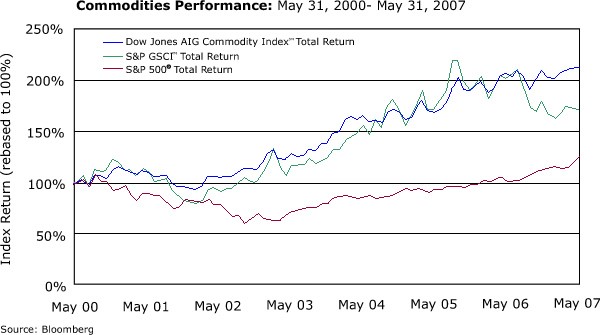

The era of investable commodities indexes is much shorter. It arguably began in 1991 with the creation of the S&P GSCI (originally the Goldman Sachs Commodity Index), an index comprising exchange-traded commodities futures. The Dow Jones-UBS Commodity Index (originally the Dow Jones-AIG Commodity Index) was launched in 1998. Although there are many other commodities indexes today, these two have become the industry-standard benchmarks for commodities investing.

While both the S&P GSCI and DJ-UBSCI have become popular with commodities investors, they were not originally designed to serve as the basis for investable products. Both indexes emphasize global production, liquidity, open interest and scalability as primary determinants for weighting individual commodities and sectors. As a result, the S&P GSCI is heavily weighted toward the energy sector. Although this index has five unique sectors, the energy sector regularly has a weighting of 60 to 70 percent of the overall index. Furthermore, of the 24 components that comprise the index, the eight smallest components collectively have an index weighting of less than 5 percent. This makes the S&P GSCI less attractive to investors looking for diversified exposure to the commodities markets.

The DJ-UBS Commodity Index was developed with sector constraints that compensate for the energy focus of the S&P GSCI. According to the rules of the DJ-UBSCI, no single sector of the commodities universe can account for more than one-third of the index. However, energy is usually at this limit and can even exceed this limit between annual rebalancings if the price of energy rises during the year. In addition, many of the DJ-UBSCI components have 4 percent or less weighting, and 10 of the 19 DJ-UBSCI components have a collective weight of less than 30 percent.

These indexes have other characteristics that may be of concern to investors. Chief among them is the fact that for any given commodity, the indexes invest only in a single futures contract that is close to expiration. As a result, they must frequently roll their futures position forward to the next contract, leading to significant trading costs for index replication with exchange-traded futures. 1 Also, from an investor perspective, the front of the curve may not be the most desirable area to hold a long futures position. Indeed, in recent years, steep contango at the front end of many commodities futures curves has been blamed for degrading the returns of various commodities investment products, including those based on the S&P GSCI and the DJ-UBSCI.

Ironically, some market participants and asset managers may find it helpful that the industry-standard benchmarks are not designed to maximize investor returns. When compensation and career advancement depend on outperforming a particular benchmark, it is better to have one that is easy to beat.