3 Best Stocks to Invest in Health Insurance (ANTM CNC UNH)

Post on: 19 Май, 2015 No Comment

To say that America’s health insurance landscape has changed over the last year would be a major understatement. The launch of Obamacare opened up new realities for healthcare consumers, companies, and investors alike — and for the savviest shareholders, 2014 has offered a bounty of profits, as many of the top insurance stocks on the market have thrived.

But in a future with Obamacare and the steady aging of Western populations, which health insurers deserve your money? Let’s look at three top stocks in this market — WellPoint ( NYSE: ANTM ). Centene ( NYSE: CNC ). and UnitedHealth Group ( NYSE: UNH ) — to see why these hard-charging health insurers have investors loving the future.

Will Obamacare bring a boom for WellPoint?

WellPoint investors have had a whale of a year so far. The market’s second-largest health insurer by market cap has boomed by more than 30% since 2014 kicked off, capitalizing on Obamacare’s launch and lifting shareholder spirits with solid growth in its membership rolls. While increasing costs — an industrywide problem — took a bite out of WellPoint’s bottom line through the first half of the year, the insurer is setting up for a long-term win.

The state-by-state expansion of Medicaid under the Affordable Care Act has worked out well in WellPoint’s favor to date. Medicaid membership boomed by more than 8% year over year by the end of the second quarter. That’s no small feat: Last summer, the insurer’s CEO claimed the combination of Medicaid’s expansion and the growth of individual insurance coverage via federal and state health exchanges could add up to $20 billion in operating revenue by 2016. WellPoint thrived through the first year of the ACA’s exchanges, topping its own estimates by registering 769,000 new members during Obamacare’s first enrollment period.

Government-related insurance lifted the company’s operating performance in the second quarter, with its operating gain in the government segment jumping by more than 11% year over year even as operating gain shrank in its commercial and specialty business unit.

While costs have weighed down the company’s performance, WellPoint is investing in long-term fixes: The company in August teamed up with Blue Shield of California in funding an $80 million commitment to the first three years of the state’s health information exchange, the Cal Index. The company hopes to reduce costs in the long run by paying providers based on effective and quality care and, as The Wall Street Journal reported, the Cal Index offers the potential to reduce waste by tracking patient care more effectively. If such measures can reduce ballooning medical costs, WellPoint will be in prime position to boost its bottom line and margins in the long run — keeping both patients and investors happy.

Centene rolls the dice with Medicaid

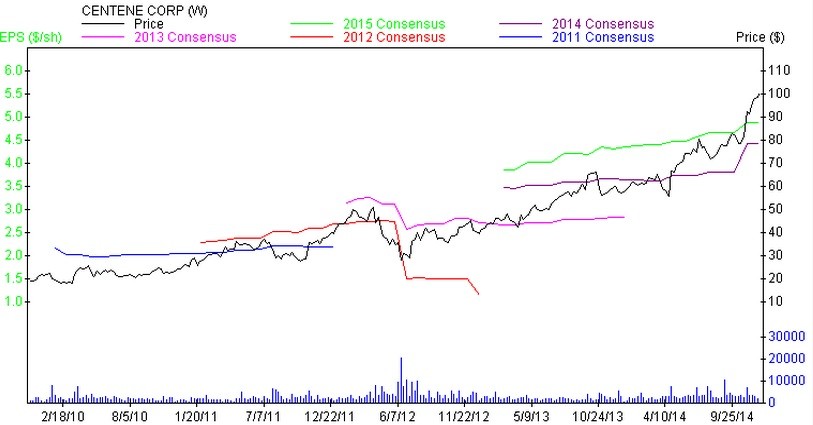

Medicaid is only a piece of the bigger puzzle for WellPoint, but for Centene — a company less than 15% WellPoint’s size by market cap — it’s a recipe for huge gains. More than 75% of Centene’s membership came from Medicaid as of the company’s second quarter, and the program’s growth has paid off in a big way: This stock has boomed by more than 36% so far in 2014, and Centene has had no problem shattering Wall Street’s expectations.

The company has kept premium growth in line with rises in medical costs, helping to boost its diluted earnings per share by more than 21% year over year through the first six months of 2014. Centene also capitalized by growing its overall subscriber rolls by more than 23% as of its most recent quarterly report and lifting its full-year revenue outlook.

Centene is pushing hard to expand its business across the country as cash-strapped states look to handle growing Medicaid costs by handing off to managed care groups. The company has moved intently into states such as Florida, where it grew membership by 45% in the second quarter, and has opened up business in California, counting more than 131,000 members in the Golden State as of June 30 after having no foothold there at the same time last year. With Centene looking to expand further in states such as Illinois, this company is ripe for additional growth in the coming few years as Medicaid business booms.

UnitedHealth’s growing foundation

While WellPoint and Centene have been a growth investor’s dream in 2014, UnitedHealth, the insurance industry’s top dog by market cap, hasn’t put on such a show. Still, the stock has jumped by more than 13% year to date. And for long-term investors, it’s hard to find a better insurance stock than this blue-chip giant.

UnitedHealth offers a 1.7% dividend yield, a rarity in an industry with few strong dividend payers. While the company has only been raising its dividend each year since 2010, when it switched from a yearly to a quarterly payout, its modest 22% dividend ratio means UnitedHealth has plenty of flexibility to continue those annual increases.

While this company is known more for its size than its growth — UnitedHealth boasts the most members among publicly traded insurance companies — its Optum group racked up 29% year-over-year revenue growth through the first six months of 2014. The insurer is working hard to keep that up, acquiring Texas-based healthcare provider MedSynergies last month to boost Optum’s presence in physician management and healthcare coordination between patients, doctors, and payers.

UnitedHealth has also made perhaps the best moves in the industry in expanding abroad. The company’s international division grew revenue by 10% year over year in its most recently reported quarter, and its 2012 acquisition of a majority stake in Amil, Brazil’s largest health insurer, should only help UnitedHealth diversify beyond the U.S. market. The company is also reportedly one of several suitors vying for Portuguese hospital business Espirito Santo Saude.

Not only will moves such as these open up new avenues of international growth for UnitedHealth, they also will help the company hedge against potential instability in the U.S. market should Obamacare hit a snag. In all, UnitedHealth is one of the safest — and strongest — long-term bets for any healthcare investor looking for a solid foundation stock to build around.

Looking at the long-term benefits

Health insurance has provided a windfall for investors in 2014, but shareholders WellPoint, Centene, and UnitedHeath could be looking at much more than just today’s rewards. With the opportunity to capitalize on Medicaid’s expansion and Obamacare’s ongoing rollout, and with UnitedHealth ‘s international growth and reliable dividend, these three companies are building toward strong futures for years to come.

Looking for more top long-term stocks? Don’t miss these high-yielding dividend kings

UnitedHealth Group’s dividend isn’t just a sweetener to this great stock: It’s a key investing reward for the long-term. The smartest investors know that dividend stocks simply crush their nondividend-paying counterparts over the long term. That’s beyond dispute. They also know that a well-constructed dividend portfolio creates wealth steadily, while still allowing you to sleep like a baby. Knowing how valuable such a portfolio might be, our top analysts put together a report on a group of high-yielding stocks that should be in any income investor’s portfolio. To see our free report on these stocks, just click here .