2000S commodities boom Wikipedia the free encyclopedia

Post on: 18 Апрель, 2015 No Comment

The 2000s commodities boom or the commodities super cycle [ 1 ] was the rise in many physical commodity prices (such as those of food stuffs, oil, metals, chemicals. fuels and the like) which occurred during the decade of the 2000s (2000–2009), following the Great Commodities Depression of the 1980s and 1990s. The boom was largely due to the rising demand from emerging markets such as the BRIC countries and the former Yugoslavia. as well as the result of concerns over long-term supply availability. [ citation needed ] There was a sharp down-turn in prices during 2008 and early 2009 as a result of the credit crunch and sovereign debt crisis. but prices began to rise as demand recovered from late 2009 to mid-2010. [ citation needed ] Oil began to slip downwards after mid-2010, but peaked at $101.80 on 30 and 31 January 2011, as then Egyptian political crisis and rioting broke out, leading to concerns over both the safe use of the Suez Canal and over all security in Arabia itself. On 3 March, Libya’s National Oil Corp said that output had halved due to the departure of foreign workers. As this happened, Brent Crude surged to a new high of above $116.00 a barrel as supply disruptions and potential for more unrest in the Middle East and North Africa continued to worry investors. [ 2 ] Thus the price of oil kept rising into the 2010s. The commodities super-cycle peaked in 2011, [ notes 1 ] driven by a combination of strong demand from emerging nations and low supply growth. [ 1 ] [ notes 2 ] Prior to 2002, only 5 to 10 per cent of trading in the commodities market was attributable to investors. [ 1 ] Since 2002 30 per cent of trading is attributable to investors in the commodities market which has caused higher price volatility. [ 1 ] [ notes 3 ]

Contents

Background of depressed prices [ edit ]

The prices of raw materials were depressed and declining from, roughly, 1982 until 1998. From the mid-1980s to September 2003, the inflation-adjusted price [ citation needed ] of a barrel of crude oil on NYMEX was generally under $25/barrel. Since 1968 the price of gold has ranged widely, from a high of $850/oz ($27,300/kg) on 21 January 1980, to a low of $252.90/oz ($8,131/kg) on 21 June 1999 (London Gold Fixing). [ 3 ]

The analysis of this period is based on the work of Robert Solow and is rooted in macroeconomic theories of trade including the Mundell–Fleming model. [ 4 ] One opinion stated that

The volatility and interest rates found its way into commodity inputs and all sectors of the world economy. [ 5 ]

Hence, in the case of an economic crisis commodities prices follow the trends in exchange rate (coupled) and its prices decrease in case there are downward trends of diminishing Money Supply. [ 4 ]

Foreign exchange impacts commodities prices and so does money supply: the advent of a crisis will pull commodities prices down. [ 4 ]

Boom [ edit ]

A commodity price bubble, known as the 2000s commodities boom. was created following the collapse in the mid-2000s housing bubble. Commodities were seen as a safe bet after the bubble economy surrounding housing prices had gone from boom to bust in several western nations, including the UK, USA, Ireland, Greece and Spain. [ citation needed ]

The renewed interest in coal by China ‘s and Taiwan ‘s energy companies and the rise of alternative power sources like wind farms helped modify coal prices over the 2000s. [ citation needed ]

Chlorine price steadily increased throughout 2007 and early 2008 as demand for P.V.C. and some metals like copper, Neodymium and Tantalum rose due to the increased growth of the BRIC countries’ demand for electrical goods. Russia increased production, but the US offset this with production cuts in the late 1990s and mid-2000s. [ citation needed ]

Phosphorus. rhodium. molybdenum. manganese. vanadium and palladium are used in high grade steels, oil based lubricants, automotive catalytic converters, chemical plants’ catalysts, electronics, TV screens and in radio isotopes. [ 6 ] Demand for these metals appeared to be increasing as computers and mobile phones became more popular in the mid to late 2000s. Thulium is used in x-ray tubes and Neodymium is used in high strength/high grade magnets. [ citation needed ]

Sulfuric acid (an important chemical commodity used in processes such as steel processing. copper production and bioethanol production ) increased in price 3.5-fold in less than 1 year while producers of sodium hydroxide have declared force majeure due to flooding, precipitating similarly steep price increases. [ 13 ] [ 14 ]

Food [ edit ]

Corn, wheat, rice, cocoa and Soya beans [ edit ]

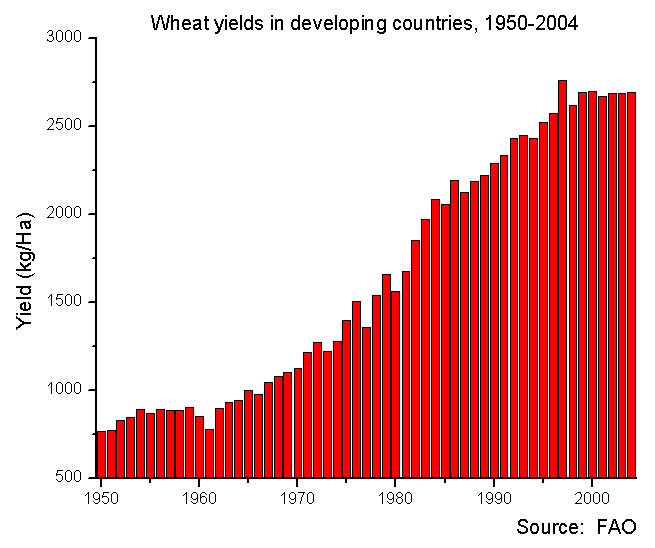

The growth in food production has been greater than population growth. [ citation needed ] Food per person increased during the 1961–2005 period. [ citation needed ] It has now begun to shrink slightly due to rapidly rising populations in countries like India. Iran, the DRC and Nigeria. [ citation needed ]

Both a rising global population and a sharp decline in food crop production in favour of a sharp rise in biofuel crops helped cause a sharp rise in basic food stock prices. [ 15 ] Ethiopia also saw a drought threaten its already frail farm lands in 2007. [ 16 ] Cocoa was also affected by a bad crop in 2008, due to disease and unusually heavy rain in parts of West Africa. [ citation needed ]

Rising demand in both India and Egypt helped to ramp up demand for American wheat during the bull market during August 2007. [ 17 ] Discounted wheat sold at about £11–£15/t. August 2007, with non discounted wheat at slightly higher price. The November 2007 wheat futures market was trading at nearly £165/t, with November 2008 contracts at £128.50. [ 17 ] The market became rather bearish as non-futures prices froze and stagnated in December 2007. [ 18 ] The price of wheat reached record highs after Kazakhstan began to limit supplies being sold overseas in early 2008, but had slowed down by late 2008. Food riots hit Egypt on 12 April 2008, as national bread prices rose rapidly in March and April 2008. [ 19 ]

In late April 2008 rice prices hit 24 cents (U.S.) per U.S. pound, more than doubling the price in just seven months. The price of wheat had risen from an already high £88 per tonne to £91 from January to March 2010, due to the bullish market and currency concerns. [ 20 ] This led to food riots in places such as Haiti. Indonesia, Côte d’Ivoire. Uzbekistan, Egypt [ 21 ] [ 22 ] and Ethiopia. [ 16 ] The market remains fairly bullish. [ citation needed ]

On 31 July, leading economists predicted that food prices, especially wheat will rise in Chad as Russia end exports due to a domestic drought destroying their wheat and barley harvests. [ 23 ] By 3 August, wheat prices stood at $7.11 per bushel [ 24 ] due to the Russian export ban.

Paper [ edit ]

The price of recycled paper has varied greatly over the last 30 or so years. [ 25 ] [ 26 ] [ 27 ] [ 28 ] [ 29 ] [ 30 ] [ 31 ] The German price of €100/£49 per tonne was typical for the year 2003 [ 28 ] and it steadily rose over the years. By the September 2008 saw the American price of $235 per ton, which had fallen to just $120 per ton, [ 25 ] and in the January 2009, the UK’s fell six weeks from about £70.00 per ton, to only £ 10.00 per ton. [ 26 ] [ 29 ] The slump was probably due to the economic down turn in East Asia leading to market for waste paper drying up in China. [ 29 ] 2010 averaged at $120.32 over the start of the year, but saw a rapid rise global prices in May 2010, [ 27 ] with the June 2010 resting $217.11 per ton in the USA as China’s paper market began to reopen. [ 27 ]