Yen Carry Trade

Post on: 9 Июль, 2015 No Comment

The carry trade is when investors borrow in a currency with low interest rates and invest in a currency that pays high rates. Photo: Artifacts Images/Photodisc/Getty Images

Definition: The carry trade is when investors use a currency with a low interest rate to buy currency of a country with a high interest rate. This automatically creates a profit when they receive high interest on the money invested, but pay low interest on the money borrowed. The broker pays the difference into the account each day the trade is open.

Traders often borrow money in the low-interest currency to purchase a larger amount in the high-interest currency. They therefore get interest on the total amount borrowed. This works great as long as the currencies remain stable.

If enough investors do this, it boosts demand for the high-interest rate bonds. The investors can sell these bonds at profit on the secondary market. This can happen because t he forex market is the largest in the world, trading $5.3 trillion a day.

As demand for the high-interest rate bonds increases, so does demand for the currency. This boosts the value of the currency, adding more profit for holders of the high-yield bond.

Yen Carry Trade Today

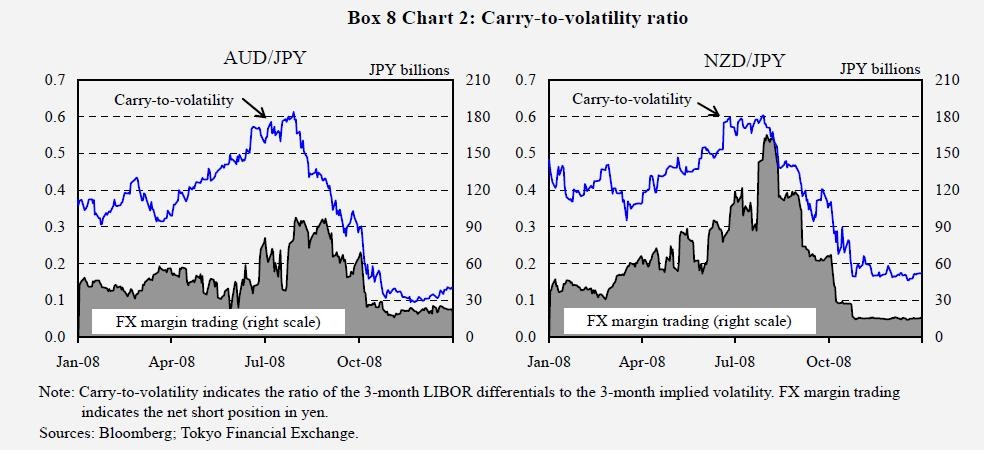

The yen carry trade is alive and well in 2013. Many experts believe that the global liquidity before the 2008 financial crisis was thanks to the carry trade in yen, which had close to a zero interest rate cost.

The yen carry trade with the dollar ended in 2008 when the Federal Reserve dropped the Fed funds rate to near zero. It continued with high-yield currencies such as the Brazilian real, Australian dollar, and Turkish lira. For example, many forex traders borrow near-zero yen to buy Australian dollars which have a 4.5% return.

However, trading in the yen began to pick up in October 2012, when Shinzo Abe was elected as Prime Minister. He promised to boost economic growth by increasing government spending, lowering interest rates, and opening up trade. He accomplished the first two, but had less progress on the third. Between 2010 and April 2013, the yen carry trade rose by 70% in this period. As a result, the yen expanded its share, becoming responsible for 23% in global forex trading in 2013

However, when Abe raised consumption taxes in 2013, the economy went back into recession. The Bank of Japan responded with more Quantitative Easing, sending the yen to a 7-year low in October 2014. (Source: Boby Michael, Yen Plummets to 7-Year Low on BOJ Easing , International Business Times. October 31, 2014) Article updated January 30, 2015.