Why Scalping Is the Hardest Way to Trade Forex

Post on: 3 Июнь, 2015 No Comment

by Simit Patel on September 26, 2013

Scalping is a popular way to trade forex, and is often recommended by the various businesses in the trading industry that profit from customers who trade with a high degree of frequency. However, scalping is not an appropriate style of trading for many; in fact, it can be the hardest way to trade. Here’s why:

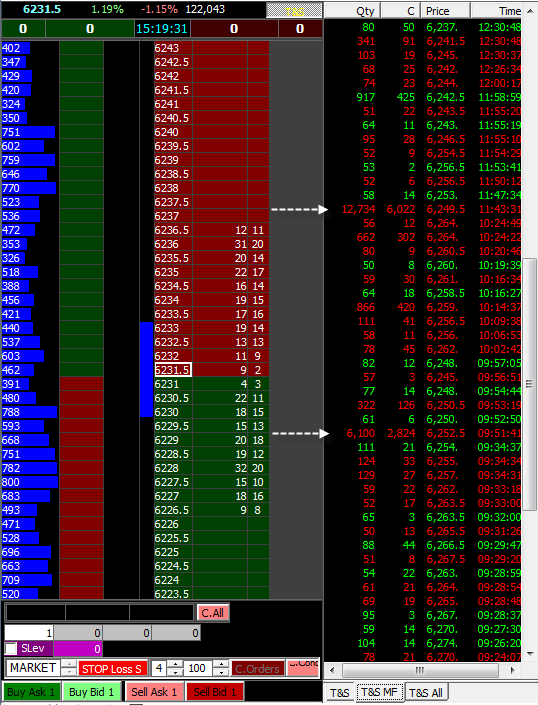

Precision. Scalping requires traders to be extremely fast and precise to get into and out of positions quickly. This takes supreme focus. Also, one cannot analyze as many markets intraday, at least not deeply, when focusing on trading with this type of precision.

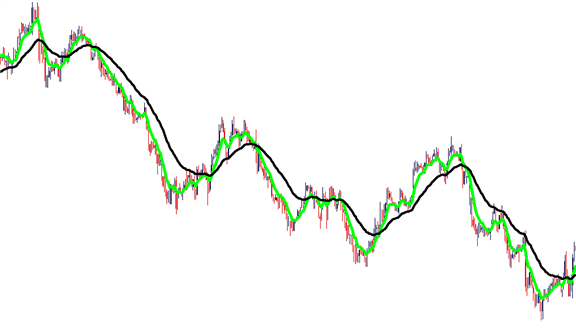

Noise. The smaller your time frame, the more noise you are introducing to your chart.

Risk/Reward. Generally, in most scalping strategies, you sacrifice risk/reward for accuracy. The strategy generally calls for catching more moves correctly but there are far less big winners. This puts a lot of pressure on the trader to be right more often. Yes, your exposure is less per trade, but your margin for error is often much less. If you are hitting 50% of trades at 1.5 to 1 and I am hitting 50% of trades 4 to 1 – I am probably living large while you are eating cat food out of a can.

Fees/spreads. You are trading in a market which regularly has 100 to 200 pip moves. I would much rather catch a few big trades a month than a bunch of little trades. Your fees will be 10x mine even if we are taking the same number of pips out of the market.

Stress. For most people stress is accumulative. One or two bad trades will lead to more with no time between to reset. Slowing down and taking less trades will help most people trade better with less stress.

Scalping can be done and you can make a lot of money doing it. Many traders want to scalp because of the thrill; it seemed exciting to make 10-30 trades a day. I thought I would make more consistent profits and be less bored. I’ve found that personally slowing down improved my trading. With 15 minute bars I have some time to consider options and to stay ahead of the market. I can look at higher time frames and come up with a few what-if scenarios. I’ve been profiting on around 60% of my trades and all of my trades have at least a 3 to 1 r/r ratio.

The number 1 priority of any new trader should be protecting his capital. You need to have money to keep trading and keep learning. Exposure is only one aspect of protection. Will this be offset by churning your account?

This article was drafted by InformedTrades member YertleTurtle (with minimal editing). Check out theInformedTrades Forex Scalping Course for more on how to scalp.

%img src=http://feeds.feedburner.com/

r/Fxtimes-ForexNewsCommentariesTechnicalAnaylsisEducationLiveEventsAndMore/