Why RSI the Relative Strength Indicator Surpasses All Other Momentum Indicators

Post on: 10 Июнь, 2015 No Comment

Whether you are a seasoned trader, or a brand new trader, learning the key concepts of the RSI, Relative Strength Index, is perhaps the most important thing you can do to advance your trading career.

The concepts are simple to learn but not readily available. Instead, the mythically incorrect concepts of RSI are perpetuated on nearly every site. These are:

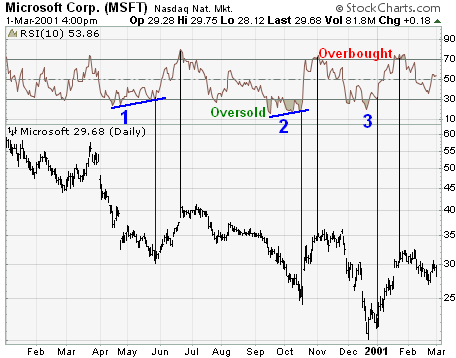

1. Sell when RSI reaches 70 because price is overbought.

2. Buy when RSI reaches 30 because price is oversold.

3. When price crosses 50 RSI, this can be a good entry point.

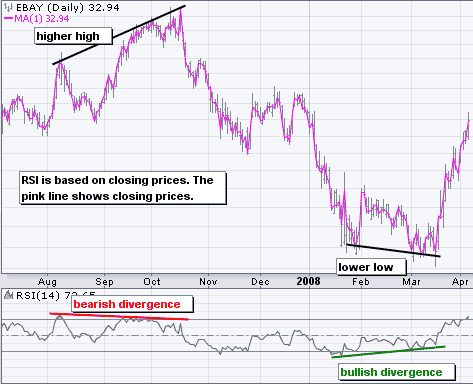

4. And divergences are good trading signals.

It is easy to provide statistical data that shows that this information is incorrect.

There are reasons however that RSI can be a great tool to add to a current trading system or to act as a standalone trading system.

Here are three of the strongest reasons however, there are many, many more.

1. Because RSI takes into consideration time, price and momentum.

2. RSI has 4 signals that create profits.

3. Understanding the location of divergences and reversals on RSI will give you deep insight into the current market condition regardless of time frame or currency pair.

Traders who focus just on price do not take momentum into consideration. Because RSI is a leading indicator it can predict with accuracy where price is going. No indicator will be right all the time however, RSI will give you telltale signs that will tell you about the strength of a trend and the possibility of trend changes. Traders who make consistent profits take into consideration the aspect of time, price and momentum and understanding RSI is crucial to that end.

The second point above is one of the most important points any trader should know. If a trader understands the 4 trading signals on RSI they will elevate their trading game to the highest levels. There are two kinds of divergences and two kinds of reversals. Knowing all four and how they interact is crucial to reading any currency trading chart.

The 4 signals are: Positive and Negative Divergences and Positive and Negative Reversals. Divergences statistically are known by most traders but reversals are not. Reversals are the most powerful of the two signals and best for entering, exiting and re-entering trending markets. Divergences are best of retracements and predicting coming reversal points.

There is strong statistical data available that shows which signals should be traded in down trends and which should be traded in up trends. Knowing the difference can be the difference between profit and loss.

The last point is by knowing the location of these divergences and reversals in context with one another one can begin to read the market. For example, the current EURUSD hourly chart has created in less than 72 hours of trading; 3 negative divergences and 4 positive reversals. This indicates that the market is moving up and gives the traders specific points of entry.

In addition, because of the specificity of entry, stop losses and take profits can be reliably placed making risk and reward calculations much easier.

Traders who learn the proper concepts of RSI which are not typically found on most Forex websites and in most Forex trading courses will be well on their way to understanding the markets and putting money in their pockets.

www.youlearnforex.com

This article was published on 17 Jul 2010 and has been viewed 1165 times