Why Forex Traders Lose Money

Post on: 17 Август, 2015 No Comment

A MASSIVE STUDY BY FXCM.COM REVEALS THE SURPRISING

REASON WHY MOST OF THEIR CUSTOMERS LOSE MONEY.

Dear Forex Trader:

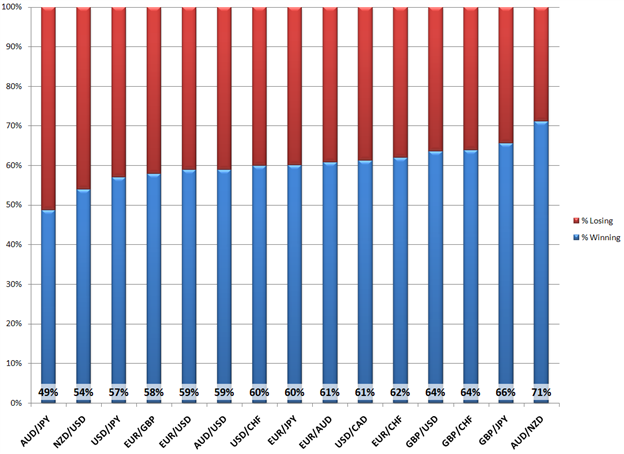

A recent article by FXCM.com, the U.S.’s 2nd largest online forex broker, revealed the results of their review of over 12 million of their customers’ forex trades made during 2009 and 2010. The biggest surprise, according to FXCM, is that almost 60% of these trades were profitable. while the vast majority of their customers still lost money!

How is that possible, you might be thinking? Well, it’s easy to lose money when your losing trades equal roughly $2.13 for every $1.00 you make on your winning trades. That’s exactly what FXCM’s customers did, and that performance is no doubt typical of the majority of all forex traders. IN SPITE OF THE FACT FEW ARE FINDING THEM, THERE ARE SPECIFIC REASONS FOR THIS POOR PERFORMANCE, and our 7-currency-pair forex trading system is developed with specific AND EFFECTIVE solutions to each one of the problems that cause traders to lose money year after year.

OUR FOREX TRADING MODEL ADDRESSES ALL 5 OF

THE CRITICAL TRADING PARAMETERS THAT FORM THE

FOUNDATION OF PROFITABLE FOREX TRADING

TODAY 80% TO 90% OF ALL RETAIL FOREX TRADERS LOSE MONEY rather consistently. just as they did 25 years ago. Why are the same mistakes still being made? Perhaps the most important reasons are that most trading systems are either 1.) internally inconsistent, or 2.) they are designed to perform in a range of market conditions that no longer prevail, or possibly 3.) they are too focused on the big moves and take too many risks to chase them.

For example, a system using wide stops will keep you in a strong trend allowing you to profit from it. In a choppy market environment with few trends, however, these same wide stops that made you money in strongly trending markets, will eat you up in losses when those trends aren’t there. Also, many traders set their stops based on their entry price, but this usually doesn’t work. the market doesn’t care where you get it!

A fair number of trading gurus and system designers more or less relegate stops to an afterthought: “Set your stops outside the noise so they don’t interfere with your strategy” is often the advice. This is unlikely to work either. STOPS ARE NOT AN AFTER-THOUGHT. THEY ARE THE CENTERPIECE OF YOUR TRADING STRATEGY! Balancing stops with both entry and exit prices is the real “Magic Formula” that leads to profitable trading, and our model does this for you!

Our forex trading model solves this “stop” problem by using a modified, and we think improved, version of Welles Wilder’s Volatility System. Our system generates stop levels flexible enough for ANY market environment. Good stops, though, are not quite enough: setting good stops won’t save you if you don’t estimate your entry and exit prices consistently with those stops. Our trading model takes a consistent approach to generating market entry points, stop levels, and position exit targets. The result is one of BALANCE: With tighter stops you will make a bit less in strongly trending markets, but the lower dollar losses per losing trade that result when using our system should save you far more than you give up!

Our model rarely buys breakouts; instead, it buys (and sells) on price pullbacks. And by requiring a price pullback before entering a trade, you will lower the distance between your entry price and your stop — while at the same time increasing the distance between your entry price and your exit price. It’s not rocket science, it’s BALANCE . Balance is the key, and our forex trading model balances the answers to all five of the key currency trading questions (Buy or sell? Entry price? Stop level? Exit points? and How many contracts should I trade?) What this does is allow you to overcome the forex market’s seemingly random. (and sometimes pernicious) behavior.

I FEEL I MUST APOLOGIZE THAT OUR MODEL ONLY AVERAGES

A SIMPLE RETURN OF 175%+ PER YEAR, NOT INCLUDING COMPOUNDING,

OVER A 5 YEAR IN-SAMPLE PERIOD.

I must emphasize, once again, that our approach is not one of “get rich quick,” which many traders seem to be looking for. We’ve all seen the ads: “secret system returns 200% per month!”. “45 profitable trades in a row!” I suppose these things are technically possible, but I defy you to actually achieve them without shoving your entire trading account into the center of the table and spinning the wheel! And what is the maximum drawdown over the past 5 years that would have resulted from using one of these systems? They never tell you that! One word of caution you are probably already aware of: it is common knowledge that the in-sample returns a model achieves are almost always better than its actual, real-time returns, because the model coefficients are fitted to the historical period. With that in mind, we are expecting (but cannot be sure of) 100%+ returns per year in real-time trading.

Of course I could DOUBLE the average % return our model offers you. but I would also be doubling the maximum drawdown of your account: from the model’s current expectation of a Max DD of roughly –25% to somewhere near –50%! I won’t trade with this degree of risk, so I won’t ask you to. And this expected return our model offers you puts, on average, only 5% of your capital at risk at any one time with occasional spikes to just over 16% when we have a few carryovers! (This assumes, of course, that your stops actually get you out when the market goes against you!)

I’ve found that it never makes any sense to speak of return apart from, or ignoring, RISK. Offering you an acceptable risk profile — which our trading model does with the precision of a well-oiled machine — PRECLUDES US FROM OFFERING YOU OUTRAGEOUS RETURNS. Our model asks the question “How Does This Affect My Risk?” at every trading decision point. This is how our model will give you the edge in trading, NOT A SECRET FORMULA!

Risk levels in our model are set by you as you see fit. In my trading I typically set risk levels to no more than 1%, on entry, for each of the 7 currency pairs the model trades. (These are the default risks used in the model.) In addition, the model will carry over up to 3% of capital in markets that are trending. Our trading system gives you a return-to-risk ratio that you will find difficult to improve upon !

The number of contracts you should trade — based on your account size and the risk preference you program into the model — is calculated for you for every trade in every market the model includes. This, too, is a key ingredient in what I mean by balance in a trading system. Our system balances risk and return to consistently give you a GOOD chance to experience a VERY GOOD gain. in return for taking a REASONABLE risk.

This is all I can offer you, but I’ve learned from bitter experience that it is the hallmark of consistent, profitable trading.

Click here to get pricing information or to Purchase a copy of the full, 7-Currency Model.

Click here to see the innovative strategy we use to boost returns and lower risk.

Best regards,

James A McCune

James A. McCune

Founder & President,