Why does the average forex trading strategy lose money

Post on: 4 Июль, 2015 No Comment

Forex question

Why does the average forex trading strategy lose money?

David Rodriguez, FXCM

Extreme forex market volatility and major headlines has made forex trading more popular than ever, but the lightning-quick influx of new traders has been matched by a similarly dramatic outflow of existing traders. Market conditions remain as challenging as ever, and many novice forex speculators have found it very difficult to preserve capital — much less turn profits. But why do many strategies fail in current markets?

Why does the Average Forex Trading Strategy Lose Money?

Both anecdotally and empirically, we have seen that many new forex traders are unable to profit due to poor money management techniques. Many speculators come from other traded markets, and their technical and fundamental analysis skills are quite good. Yet the most common reason for failure comes down to one simple point: poor money management. The most successful traders do not necessarily have an analytical edge. Many unprofitable traders have excellent analytic and forecasting skills, but going from analysis to live trades is often a limiting factor.

What is good money management? Letting your profits run and cutting your losses short. A countless number of trading books advise traders to do exactly this. In theory, this is a simple exercise: make profit targets larger than maximum loss thresholds. In practice, however, we see clear evidence that most traders do a poor job of putting these strategies in to action.

Measuring the Cold Hard Facts about Forex Trading

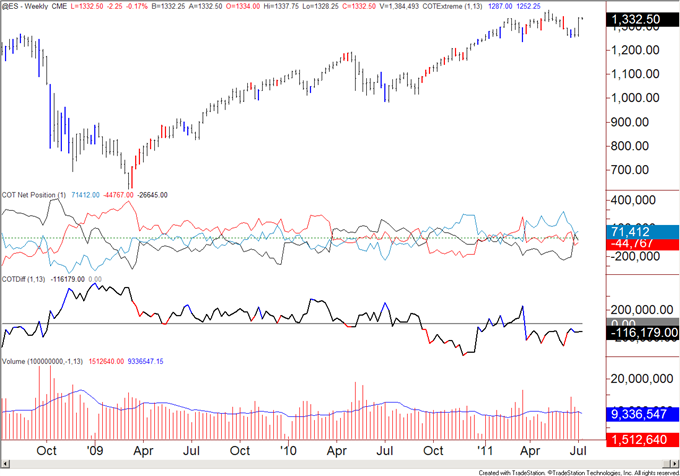

Using our execution desk data, we can examine general tendencies across a wide range of forex traders. Our data is completely anonymous, and we cannot identify any individual trader. Yet it is still useful to look at common themes across a broad swath of forex traders. A quick look at the histogram above tells us several different important facts about tendencies in trader profits and losses. One of the most immediately visible facts about daily P/L changes is that the overall distribution is skewed towards sizeable losses. That is to say, there are a greater number of days in which traders post unusually large losses than similarly large gains. The maximum single-day average gain was approximately 130 pips, while the worst single-day loss was a substantial 180 point drop.

Such a fact overshadows that traders actually turned a profit on an impressive 54 percent of all trading days in our three-year sample period. Despite generating gains on most days, the average trader lost money because of particularly sizeable losses on individual days of trading.

What do successful and unsuccessful trading strategies look like?

We can classify traders into many different groups, but it is useful to go through two simple examples of successful and unsuccessful trading strategies in recent market conditions. Using two very simple strategies we can identify some of the pitfalls across forex markets today.

The first trader often boasts that he is profitable in almost 60 percent of all tradesrarely taking a loss. Unfortunately, his style leaves him exposed to outsized losses when he least expects it. In fact, his max single-trade loss in more than four times his maximum gainexposing clear flaws in his money management techniques. Given that his average winner generates 90 pips in gains, that 1620 point loss erases his winnings from 18 successful trades.

The second trader is far less concerned with the consistency of his returns than his profits and losses at the end of every trading month. Though the majority of his trades actually generate losses, his average win is far larger than his average loser. In fact, this best winner generated more than two times what he lost in his worst trade. This style is clearly not for the faint of heart; the trader knows he will lose more often than he will win, and he has to keep his most profitable trades open for the maximum period of time to generate profits.

What is the moral of the story?

In our examples we saw key flaws in simple trading strategies that help us understand why many forex traders fail. Money management techniques really make the difference between profitable and unprofitable trading strategies.

The RSI range trading strategy is actually the higher-probability winner than the moving averages system. Yet it becomes all too clear that it requires much stricter money management because several outsized losses can completely erase profits. The moving average strategy is naturally a high-risk/higher-reward style of trading, and it will tend to outperform many range trading strategies over the longer-term. Of course, this does not mean that the strategy is without its flaws; our example shows that it was unprofitable for a whopping four years before strongly breaking higher in 2008.

Clearly both of these strategies could benefit from fine-tuned money management. Indeed, sound money management is a critical part of successful forex trading.

David Rodriguez, Quantitative Analyst, FXCM

Disclaimer: This article was written for informational purposes only, and is not intended to be used as advise. Trading is risky with or without the use of this information