When a Central Bank Intervenes in the Currency Market

Post on: 16 Март, 2015 No Comment

by Stephan Smith on September 21, 2011

As a currency trader one must always be wary of central bank interventions in the currency market. Forgetting the fact that central banks have the power to significantly change the course of their currencys trading price against all other currencies in mere minutes, is something that can deal major blows to ones FX account. But before I continue to cover the dangers of central bank interventions in the currency market for currency traders, let me explain exactly what it means when a central bank intervenes in the FX market .

When a central bank intervenes in the currency market, it means that a central bank has purchased or sold a currency in an effort to strengthen or weaken that currency relative to other currencies. The currency that the central bank has authority over is usually involved in the intervention.

Heres an example. If the Federal Reserve System (the central bank of the United States of America) decided to intervene in the currency market by buying United States dollars and selling European euros, it would in effect be trying to strengthen the U.S. dollar relative to the euro. If the Federal Reserve were to do the opposite and sell United States dollars and buy the European euros it would be trying to weaken the U.S. dollar relative to the euro.

Central banks around the world can intervene in the Foreign Exchange market. It is my opinion that central bank intervention is one hundred percent currency manipulation. Since all central banks have intervened in the currency market at some point in history, all central banks in all countries/economic unions are currency manipulators. Now please be aware that I use the phrase all central banks loosely.

There may be some central banks out there that had never intervened in the currency market before. If there is, then hesitate to label them a currency manipulator. But please be aware that there is more than one way to manipulate the trading valuation of a currency. So Ill reserve judgement on those central banks that claim to have never intervened in the currency marketif there is one.

Why Would A Central Bank Intervene in the Currency Market

Now that you have some understanding of what it means when a central bank intervenes in the currency market, the question I wish to answer is why. Why would a central bank intervene in the currency market? Central banks claim to have the best interest of the country or economic union they have authority over in mind when conjuring monetary policy. Because the objective of most central banks is to promote economic growth along with maintaining price stability, a central bank main be provoked to intervene in the currency market if its currencys valuation is threatening economic growth.

Consider this example. Imagine there is an export based economy (an economy whose economic growth is heavily tied to exporting its goods and services ) and the economy is doing very well because its experiencing strong economic growth. That would suggest that the export based economy has a currency that is at an acceptable valuation relative to other currencies.

What happens if the export based economy uses a currency with a valuation that is too high? If its currency becomes too strong, other economies wont be able to buy as many goods and services from the export based economy because those goods and services will become too expensive.

If the currency of the export based economy does indeed become too greatly overvalued, then the export based economy will experience a decline in growth since less goods and services will be sold aboard due to higher prices (similar to inflation ). If growth is projected to decline too greatly due to a decline in export sales because of currency overvaluation, then the central bank will take steps to weaken its currency. One way for a central bank to quickly weaken its currency relative to other currencies is to intervene in the currency market.

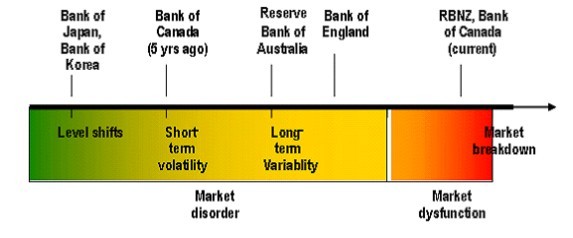

But can a central bank really take on the entire Foreign Exchange Market? Can one institution change the direction of a currencys trading price when the world has it going in a specific direction? The answer to that question is yes. A central bank has the power to change the direction of a currencys trading price. But just how hard of a time a central bank will have in changing the direction of its currencys trading price will depend on the global force that is being exerted.

If the global community isnt pushing a currencys trading price too heavily against the will of a central bank, then changing its trading direction shouldnt be too difficult. A single intervention should be all that is needed to convince the global market to push the currencys trading price in another direction. But if the global community is pushing a currencys trading price heavily against the will of a central bank, then changing its trading direction will be difficult and may be time consuming.

A central bank may intervene in the currency market to have an inverse effective on the trading price of a currency, but it will be temporary if market forces are strong. The global market, because it is heavily trading against the will of a central bank, will push the trading price right back to where it was prior to the intervention. If further intervention isnt done, then they global community will continue to push the currency trading price further against the will of the central bank.

More and more interventions will need to be preformed if a central bank is looking to change the trajectory of a currencys trading price. If interventions dont permanently change the currencys trading price trajectory, then other monetary policies will need to be implemented. However, sometimes monetary policy actions like interventions, interest rate changes and others will not be enough to change the trajectory of a currencys trading price. Thats where central banking teamwork comes into play.

Unilateral Vs. Multilateral Interventions

There are two ways a central bank can intervene in the currency market. One way is to intervene unilaterally and another is to intervene multilaterally. When a central bank intervenes in the currency market on its own without the coordination and cooperation of other central banks, then that is known as a unilateral intervention. Usually, unilateral interventions dont work at permanently changing the course of a currencys trading price.

Thought the likelihood of a unilateral intervention resulting in a permanent change in a currencys trading price trajectory is depressed, there are some benefits for a central to act on its own. One benefit a central bank can enjoy is ability to intervene quickly.

A central bank that wishes to intervene in the currency market unilaterally doesnt have to consume time by communicating with other cooperating central banks, create a plan of how the intervention will take place among the many different parties, working out the details and comprising. A central bank can simply act and do what it pleases. Though that course of action will save time and effort, the effectiveness of the a unilateral intervention will be questionable.

When a central bank coordinates will other central banks before it intervenes in the currency market, that is known as a multilateral intervention. These types of interventions are way more effective at changing the trajectory of a currencys trading price because many central banks are working in unison to make it happen. However, the down side of multilateral inventions is a lack flexibility and timely action. There is many more processes and steps that must be taken in order to execute.

Central Bank Interventions and Why It Can Be Dangerous for Currency Traders

Central bank interventions can really do some damage to a currency traders trade. Typically, central banks dont announce to the public that they are going to intervene in the currency markets beforehand. Because of that fact, if a central bank intervenes and causes a currency pair to suddenly and rapidly move in the opposite direction it was originally headed, it can cause currency traders around the world to lose profit or even lose principle (Read my article Capital Preservation and the Break Even Stoploss ).

In an effort to help you avoid losing profits and or principle due to central bank interventions in the currency market, I want to share this with you.

Beware of currency pairs at or close to

all time highs or all time lows

When a currency pair is too close to record territory, a central bank may be looking to intervene.

This is Stephan Smith and Ill talk to you later.

You also may be interested in: