What is the Foreign Currency Exchange Market

Post on: 5 Май, 2015 No Comment

What is the Foreign Currency Exchange Market

The forex market is the largest financial market in the world. More than $3 trillion in foreign currencies trade back and forth every day. Forex stands for the FOReign EXchange—the financial exchange on which governments, banks, international corporations, hedge funds and individual investors exchange foreign currencies.

When you fly to another country, one of the first things you do when you get off the plane is look for a place you can exchange your U.S. dollars for whatever currency is used in the country you are visiting—such as British pounds, Japanese yen or euros.

[VIDEO] What is the Foreign Currency Exchange Market

Why do you do this? Because you know the cab driver, the hotel clerk and the souvenir salesperson are all typically going to want you to pay them in their national currency, not U.S. dollars.

When you slide your U.S. dollars over to the teller and she slides back a stack of multi-colored bills (let’s face it, most currencies have more color than the greenback) you have just participated in the Forex market. You exchanged one currency for another.

Now, if you stop and think about all of the people who travel, all of the businesses that operate in multiple countries and all of the governments that are exchanging money, you can start to get an idea of how big the Forex market really is.

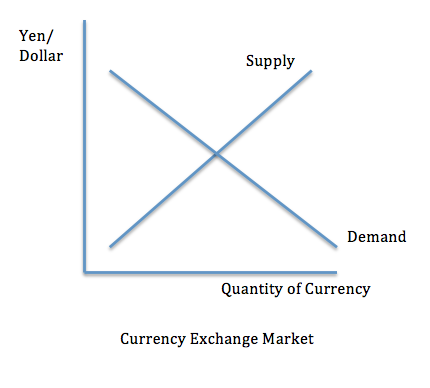

For those of you who travel abroad frequently, you have probably also noticed that the exchange rates at the currency counter at the airport never seem to be the same. They are constantly changing. It is those changes in exchange rates that enable you to make money in the forex market.

Know Your Forex Terms

Before we delve any deeper into the exciting possibilities that exist in the forex market, we need to get you up to speed on the lingo in the forex market. Now, don’t worry. As far as vocabulary lessons go, this one is quite a lot of fun. Honestly! It’s a very short lesson:

Pip: While some of you may recognize “Pip” as a character in Charles Dickens’ Great Expectations, we hope you will become more intimately acquainted with the pips in the forex market—because you will be using them to determine your profits and losses. A pip (percentage in point) or point, is the smallest unit of measurement in the forex market. Most currency pair quotes are carried out four decimal places—i.e. 1.4500. The last decimal place is called a pip. So if the exchange rate of a currency pair moved from 1.4500 to 1.4510, we would say that the price moved up 10 pips. You make money when the pips move your way in a trade.

There is an exception: Any exchange rate that contains the Japanese yen or the Thai baht as one of the currencies will only be carried out two decimal places. If you want to know why that is, you will have to take it up with the International Organization for Standardization (ISO). Honestly, there is such an organization. It is located in Geneva, Switzerland, and you would be amazed at the fields it impacts—from health care and electrical engineering to ship building and metallurgy. Anyway, they set the rules.

Currency Pair: We wouldn’t have a forex market if we weren’t able to compare the value of one currency against the value of another currency. It is this comparison that drives prices. Forex contracts are always quoted in pairs. The euro vs. the U.S. dollar (EUR/USD) is the most heavily traded currency pair. The U.S. dollar vs. the Japanese yen (USD/JPY) is another popular pair.

The following is a list of the most common currency pairs, their trading symbols and their nicknames:

“Euro” Euro vs. U.S. dollar (EUR/USD)

“Pound” Great Britian Pound vs. U.S. dollar (GBP/USD). Also known as the “Sterling,” or the “Cable.”

“Swissie” U.S. dollar vs. Swiss franc (USD/CHF)

“Yen” U.S. dollar vs. Japanese yen (USD/JPY)

“Loonie” U.S. dollar vs. Canadian dollar (USD/CAD), also known as the “Cad”

“Aussie” Australian dollar vs. U.S. dollar (AUD/USD)

“Kiwi” New Zealand dollar vs. U.S. dollar (NZD/USD)

Currencies are Grouped in Pairs for Trading

When you trade in the stock market, you buy or sell the stock of individual companies. When you trade in the forex market, you buy or sell currency pairs (two currencies put together).

Imagine each pairing as a tug-o-war with a single currency on each side of the rope. Ultimately, the stronger currency pulls the price of the weaker currency in its direction.

One thing causes currency pairs to become stronger or weaker: people (buyers and sellers). Remember that it is ultimately people who move this market.

The currency pairs forex traders refer to as “major pairs” are currency pairs that contain the U.S. dollar (USD) combined with another currency from a major global economy. The following is a list of the major currency pairs:

EUR/USD (Euro / U.S. dollar)

GBP/USD (British pound / U.S. dollar)

USD/CHF (U.S. dollar / Swiss franc)

USD/JPY (U.S. dollar / Japanese yen)

USD/CAD (U.S. dollar / Canadian dollar)

AUD/USD (Australian dollar / U.S. dollar)

NZD/USD (New Zealand dollar / U.S. dollar)

The currency pairs forex traders refer to as “the crosses” are currency pairs that do not contain the U.S. dollar (USD) combined within the pair. The following is a list of just a few of the crosses you may encounter in your trading:

GBP/JPY (British pound / Japanese yen)

EUR/GBP (Euro / British pound)

AUD/JPY (Australian dollar / Japanese yen)

EUR/CAD (Euro / Canadian dollar)

CAD/JPY (Canadian dollar / Japanese yen)

Exotic Pairs:

The currency pairs forex traders refer to as “exotic pairs” are currency pairs that contain the U.S. dollar (USD) combined with another currency from a smaller or emerging global economy. The following is a list of a few of the exotic currency pairs you may encounter in your trading:

USD/SEK (U.S. dollar / Swedish krone)

USD/NOK (U.S. dollar / Norwegian krone)

USD/DKK (U.S. dollar / Danish krone)

USD/HKD (U.S. dollar / Hong Kong dollar)

USD/ZAR (U.S. dollar / South African rand)

USD/THB (U.S. dollar / Thai baht)

USD/SGD (U.S. dollar / Singapore dollar)

USD/MXN (U.S. dollar / Mexican peso)

As you begin investing in the forex market, you should focus on the major pairs and some of the crosses. Spreads (the difference between the price you can buy and the price you can sell the currency for) on major pairs are tighter, liquidity is higher and information is more readily available for the major pairs—which makes it easier for you to be profitable trading them. As you progress, you can consider investing in some of the exotic pairs.

Understanding Forex Pricing

One distinction you do need to make when looking at a currency pair is which currency is the base currency and which currency is the quote currency. The base currency is the first currency listed in the pairing. For example, the base currency in the EUR/USD pair is the euro because it is listed first.

The base currency is important because it is the strength or weakness of this currency that is illustrated on the chart. For example, as the chart of the EUR/USD moves higher, it means the value of the euro is getting stronger as compared to the U.S. dollar.

Daily EUR/USD Chart—Base Currency Strengthening

As the chart of the EUR/USD moves lower, it means the value of the euro in relation to the U.S. dollar is getting weaker.

Daily EUR/USD Chart—Base Currency Weakening

The same principle applies to the USD/JPY pair or any other currency pair. The U.S. dollar is the base currency in the USD/JPY pair. So as the chart of the USD/JPY moves higher, it means the value of the U.S. dollar in relation to the Japanese yen is getting stronger. And as the chart of the USD/JPY moves lower, it means the value of the U.S. dollar in relation to the Japanese yen is getting weaker.

Daily EUR/USD Chart—Base Currency Strengthening

The quote currency is the second currency listed in the pairing. For example, the quote currency in the GBP/USD pair is the U.S. dollar because it is listed second. The quote currency is important because it is the currency in which the exchange rate is quoted.

To illustrate, when you say the exchange rate between the British Pound and the U.S. dollar is 1.7533, you are saying it costs $1.7533 to purchase £1. The same principle applies to the USD/CHF pair or any other currency pair. The Swiss franc is the quote currency in the USD/CHF pair. So when you say the exchange rate between the U.S. dollar and the Swiss franc is 1.2468, you are saying it costs 1.2468 Swiss francs to purchase $1.

Currencies Are Sold In Lots

In the stock market, when you want to buy something, you buy a share of stock, or a share of that company. In the forex market, when you want to buy something, you buy a contract, or a lot. There is no way to buy a share of the U.S. dollar like you would buy a share of Google in the stock market. When you trade in the forex market, you are trading lots or contracts.

Contracts are divided into three categories: full-size contracts, mini contracts and flexible contracts.

Full-size contracts control 100,000 units of whatever the base currency in the currency pair is. So for instance, if you were to buy one full-size contract on the EUR/USD, you would control €100,000 because the euro is the base currency in the pair.

Mini-contracts control 10,000 units of whatever the base currency in the currency pair is. As you can see, a mini contract is one-tenth the size of a full-size contract.

Flexible contracts allow you to choose the exact amount of a currency you would like to control. If you want to control 84,392 units or 2,755 units of the currency you are interested in, you can with a flexible contract.

Being able to choose among full-size, mini and flexible contracts allows you to tailor your investing to best meet your investment style and strategy.

Make sure to take the time to feel comfortable with the lingo of the forex market. If you have a solid foundation of knowledge, you’ll be much better off in your investing. So now that you’ve got the basics, let’s watch the video and take a look at what makes the forex market tick, how it came to be, and how you can use it to protect and multiply your money.