What is swing trading

Post on: 29 Август, 2015 No Comment

Swing trading is a style of trading in the foreign currency exchange market where traders hold positions for more than one day, but no more than a few weeks.

It might make more sense to define swing by trading by saying first what it is not.

Short term day trading

Scalping involves a strong daily commitment. Like a “most of the day” commitment. Many trades are placed within a scalper’s trading day. And, the rapid succession of trades are only held for seconds to minutes—sometimes hours, but never overnight.

Long term trend trading

Buy-and-hold investing is the polar opposite. Traders typically only dedicate a few hours a month to their trading. And, usually only a few trades a year are placed and subsequently held for many weeks to months.

So, this puts swing trading somewhere in between the fast-paced life of scalpers and the sometimes stagnant existence of trend traders.

Swing traders maintain a steady but casual trading life. They reserve a couple of hours each day for their trading. They hold their trades for a short period of time—anywhere between a few days but less than a few weeks.

Some even say swing trading has the plusses of both without the minuses, making it perfect for the novice trader.

Movement

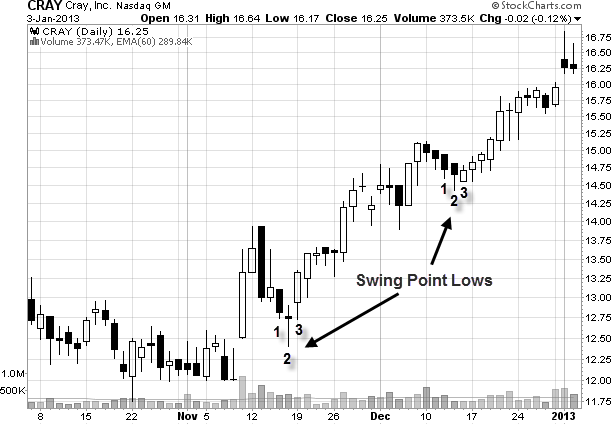

It’s been said that any market that goes up and down is ideal for a swing trader. The swing style of trading isn’t as linear as other forms of trading. For example, the stock market either moves up or down, however, swing trading allows trading whether the market is moving up, down or sideways. Sideways? Yes. Search the definition of ‘trading sideways’ and you’ll find that it is essentially when the market doesn’t make higher highs or lower lows, it just stays within the same trading range over any period of time. Traders swing from these highs and lows analyzing the charts for precise entry and exit points.

Analysis

It’s a fact. Analysis is important to any style of trading. Swing traders, however, are inclined to pay more attention to the technicals rather than fundamentals. This is mostly because swing trading happens a little too fast for fundamental analysis. Nevertheless, swing traders should remain aware of any and all fundamental announcements that could affect the market.

Newbies

Flanked by scalping and trend trading, the swing style of trading is idyllic for beginners. For obvious reasons, it’s far less complicated and time consuming than scalping yet more active and stimulating than trend trading.

And, the foreign exchange (forex) market is a perfect match for the swing style of trading—the movement, the leverage, the currencies and the market’s 24-hour time frame.

Education

Although this style and this market seem to be made for each other, education is essential—especially for the rookie.

Charting analysis, locating short-term trends, market movement, observing timeframes, and when to exit and why, and more. A learned understanding of these components—and how they work together—is crucial for the swing trader’s success.

Meet Our Expert Analysts specializing in swing trading: