What is Dollar Cost Averaging Good Strategy or Myth

Post on: 16 Март, 2015 No Comment

Are there real benefits to dollar cost averaging or is it a myth? Confused yet?

Are you into dollar cost averaging?

Chances are you may already be doing it. Especially if you contribute regularly to a retirement account at your workplace.

In this post Ill attempt to tackle this basic tenant of investing. Im not a pro at this material, but Ive researched it and hopefully I can give you some every man perspective.

Dollar cost averaging is the act of investing your money on a set schedule, with a fixed amount or percentage, regardless of market conditions. For instance, you decide that you are going to invest in a stock, mutual fund. other other investment each month with a contribution of $100 until you reach some goal or pre-determined date.

Using this method, your $100 buys more or less depending on the current value of your investment.

The way I see it, is its not so much of an intentional strategy as it is a resulting strategy. Most people dont intend to participate in this strategy. They dont seek it out, per se. They just start investing and its what naturally happens.

If dollar cost averaging sounds a lot like what you already do with your company 401K, you would be right. Most people already take part in this strategy. Although, some choose to call it regular contributions .

It aligns perfectly with the goals of the long-term, buy-and-hold investor, who is only able to invest a certain amount each month.

In contrast, does dollar cost averaging make sense for a person with a lump sum of $10,000 sitting around? I not so sure that it does. If you have $10,000 sitting in a bank account that you want to invest, you should just go invest itnow. Right?

If you are buying into a single stock. and you have no idea about the true value of the stock, then it might be wise to hedge your bets and spread out your purchases.

However, if you are buying into a diverse set of investments with your $10,000 (like every wise buy-and-hold investor should do), then you are already reducing much of your risk, right? Im not so sure about this part, but it seems logical. If you have an opinion, let me know in the comments below.

One thing is for sure, most people dont have $10,000 lying around to have to make this choice. As I said above, most people participate in this strategy just because. Still, lets look at the benefits.

What I Like About Dollar Cost Averaging

It fits into most financial lifestyles. Most people earn money on a periodic basis through employment. Its natural to take a portion of these earnings and invest them for the future. Most successful investors will even apply some type of automation to this process to be sure it gets done.

Also, most people arent sophisiticated enough to guess when the market will rise and fall. Last time I checked, not too many people can get that right over the long haul. So this strategy makes a lot of sense for your average investor who just wants a solid return with little risk over the long-term.

It takes the emotion out of your investing. Investing in U.S. companies via the stock market is not without its risks. The market is constantly moving, and even if your investments are well diversified, the market as a whole can see huge ups and downs from time to time.

By investing on a schedule, you are intentionally ignoring day-to-day market prices, and putting trust into the idea that over time (a long time), a diversified portfolio will win more than it loses. The person investing with this strategy doesnt panic when he/she sees a down market, they just enjoy the fact that they can now buy more with their money.

Note: it could be argued that those first two points are really just benefits of buy-and-hold investing. The real, supposed benefit to dollar cost averaging comes from reduced risk. Heres where I start talking out of my ars a little bit.

Reduces the risk that youll pay too much for investments. I would argue that if were talking about a single investment made by a short-term investor (less than 5 years), then dollar cost averaging (over a 1 or 2 year period) reduces the risk that youll buy too high. However, you and I arent into single investments for the short-term. Many studies have shown that dollar cost averaging doesnt reduce risk for the typical investor.

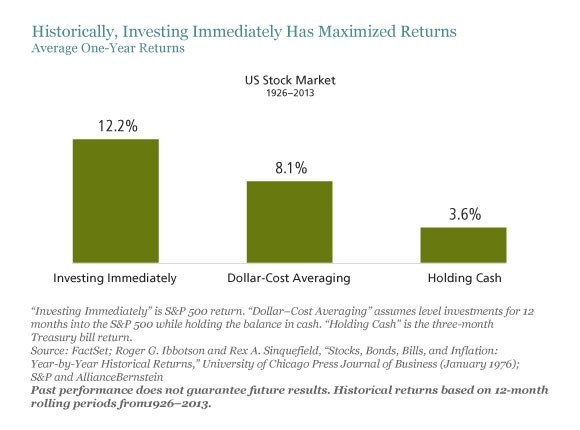

Does dollar cost averaging mean a better return on your investment? No. But it does mean youll be paying less than the average price for your shares across a set period of time. See this handy-dandy chart: