What are Your Chances of Success as a Trader » Learn To Trade

Post on: 24 Июнь, 2015 No Comment

What Are Your Chances of Success as a Forex Trader?

Most traders have heard or read that 95% of people who try their hand in the markets fail to make money; this is a very common myth that is widely circulated around the internet and elsewhere. However, this myth is not based on any solid evidence or statistics, rather it is a general statement that is factually incorrect and usually based on broad assumptions and flawed logic. Unfortunately, this myth also inhibits many traders from reaching their full potential and instills misplaced fear into their minds from the very start of their trading career.

A Quick Note: When you have finished this article, please press the facebook like button and leave a nice comment at the bottom of this post. Remember to Share it around with others :).

So, what are your chances of succeeding as a Forex trader?? This is a very important question that deserves some logic-based discussion, rather than the vague general statements that we so often read on the internet. Let’s tackle this question head-on with some supporting evidence and logical thought, this will hopefully give you some confidence and eliminate some of the “I’m just another doomed trader” thoughts that you no doubt have had or are currently having.

What Percentage of Traders Make Money but are not “Professional”?

This is a very important question with far-reaching implications. Basically, there are always people making money in the markets; in theory, for every loser there is a winner. However, consistently making money is a different story, so over the long-term there are going to be fewer traders who have made money than who have lost money. But, while 95% of traders may not be professional or full-time traders, this DOES NOT mean that 95% of traders don’t make money over the long-term. Let me explain…

As traders, we don’t need to aim to be “professional” right out of the gate, in fact, having such unrealistic expectations is often what causes beginning traders to over-trade and over-leverage their accounts. Your goal as a Forex trader should initially be to turn a profit each month, if you can do this for an extended period of time, you are a profitable trader, not “professional” yet, but profitable. Thus, by just aiming to make a profit each month, your statistical chances of “trading success” will jump incredibly. As you learn and become a more skilled trader, you can shift your goal up from profiting each month to profiting each week, and then eventually to pro-trading; over-time you will see your trading improve and your trading account grow. But, for now it is important to understand the distinction between “professional” or full-time trading and simply being a profitable trader or part-time Forex trading .

Thus, it stands to reason that traders who aim to just make money and become good traders, rather than aiming to become a “professional” trader right away, will have a far greater chance at succeeding in the markets over the long-term. There are reasons why this is so, I alluded to some of these in the previous paragraph, but it’s worth explaining them in more detail…

The primary reason why you are more likely to experience success in the markets if you dial-down your expectations of “professional” trading right out of the gate, is because it puts you at a much more advantageous emotional point than expecting to be a pro the first month you start trading. When your expectations are more in-line with the reality of trading, you will have less desire to over-trade, and you will feel less desire to trade large position sizes as well. Since you are just aiming to make some profit each month, your temptation to over-trade and over-leverage is far less than what it would be if you felt “forced” or compelled to make a living from your trading as soon as possible, which is unfortunately what most beginning traders feel they need to do.

Since you feel no pressure to rely on your trading exclusively for income, you release most, if not all of the emotional attachment to your trades and to the money you have at risk. This is a very important point that has far-reaching implications on your success as a trader. Releasing your emotional attachment from the market as much as you can is the easiest and quickest way to experience success in the markets, and it is done by having realistic expectations, meaning not expecting to be a full-time trader right away, in other words, Forex trading success comes from within. So, given the fact that you can trade profitably as a part-time trader, the statistics of people who trade and actually make some money each month are probably closer to 20 to 30%, maybe even more, this is far higher than the 5-10% we so often hear about.

So what are your Chances of ACTUALLY Making Money as a Forex Trader?

Ok, now let’s get down to some actual facts and figures, so that you can see for yourself what your approximate chances are of making money as a Forex trader with an effective Forex trading strategy vs. a trader without any strategy at all.

I am going to approach this in terms of risk reward, basically the risk reward ratios will be the “control group” and the trading strategy or entry method will be the “variable group”, for all of you science freaks out there.

So, let’s first look at what it takes to be a break-even trader in terms of risk reward.

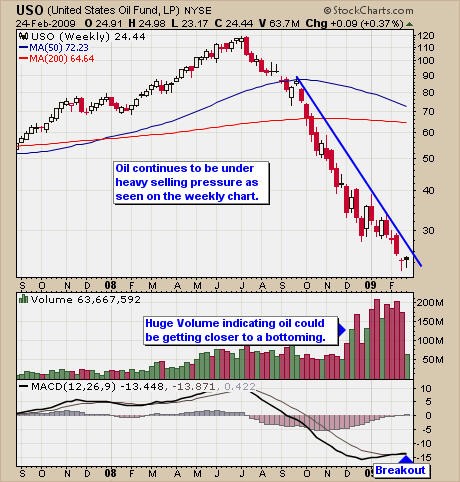

As you can see in the chart below, with a risk reward of 1:1 you have to win 50% of your trades to breakeven. As your risk reward moves up you can win less of your trades and still breakeven; a risk reward of 1:2 requires only winning about 33% of your trades to get to breakeven, and a risk reward of 1:3 requires you only to win about 25% of your trades to breakeven, take a look at the chart:

If you want to be a trader who simply makes 1 times risk on each trade, you have to win 66% of time with a risk reward of 1:1, 50% of the time with a 1:2 risk reward, and with a 1:3 risk reward your winning percentage can be as low as 33% to make a 1R profit.

I often discuss the power of risk reward in Forex trading. and for good reason, it is a concept every trader must understand and it is the best way to see how letting your winners out-pace your losers makes successful trading easer to achieve.

However, risk reward is not the only thing that makes a trader profitable over the long term. You also need a high-probability trading edge like price action. This will greatly increase your overall odds of making money on a regular basis in the markets, as we will see below.

The chart below on the left displays how many winners are required to breakeven with no particular trading edge, basically, over a long-series of trades, you will breakeven by winning 50% of the time on a 1:1 risk reward ratio, 33% of the time on a 1:2 risk reward ratio, and 25% of the time on a 1:3 risk ratio. With only random entry and risk reward in Forex trading. you are likely to just perform around breakeven over the long-run.

Now compare this random entry risk reward model with the chart on the right; it shows your approximate chances of winning using a high-probability trading edge like price action trading strategies in conjunction with the power of risk reward…

Note that your chances of winning actually decrease as the risk reward ratio increases, this is because your target is further away and your stop loss stays the same distance, thus the percentage of your stop getting hit increases as your target increases, so we need to stack the odds in our favor as much as possible by using a high-probability entry method like price action.

By analyzing the images above we can clearly see that the an educated trader who has a solid Forex trading plan and who knows exactly what their edge is in the market, has a much higher probability of making money than a non-educated trader who is essentially entering randomly. The reason why the majority of traders lose money is because they number 1; don’t understand risk reward and forex money management. and number 2; they have not truly mastered a highly-effective trading strategy like price action. So, your first priority as a trader should be to master these two things.

Making money in Forex is NOT unattainable…

The odds of you becoming a profitable trader are very good if you do this, notice I did not say “professional trader”. The reason I didn’t say “professional trader” is because as we stated above, your aim at first should be to become a profitable trader each month. This is a much more attainable goal right out of the gate. Doing this will lift your chances of success dramatically because it will give you a REALISTIC GOAL and will allow you to avoid the common mistakes so many traders make due to the fact that they try to rush into being a pro right away. Start out with a plan to trade part-time successfully, you’re attitude should be to trade less and profit more / set and forget .

In closing, I would just like to say that I get feedback from my member’s all the time; emails and testimonials from people who truly are turning the corner in their trading, not because they are professional full-time traders, but because they have stopped the bleeding and are starting to see the power of effective money management and price action trading in combination with one another. Simply having a solid education in an effective trading strategy and truly “mastering” it greatly increases your chances of making money consistently in the markets.

As a Forex trading coach it is my aim to push traders onto the correct path that gives them the best chance at success in the Forex market. So, it gives me great satisfaction to know that I have helped so many traders through the quality content that I offer and the repetition of the concepts I teach, because this gives traders a far better chance at making money consistently than if they have no formal Forex trading education or no effective trading method.